Time for Tapering: What QE Has Done, and Why It’s Time for the Fed to Stop

As the market debates whether the Fed should “taper” the pace of QE asset purchases, an uncomfortable truth is beginning to face market participants. With the majority of QE benefits already having been felt, the tapering of QE is inevitable at this point and the market’s reaction, when it occurs, will not be pleasant. We will look at what the market is pricing in, how QE has impacted the economy thus far, and why it’s time for the Fed to stop incremental purchases.

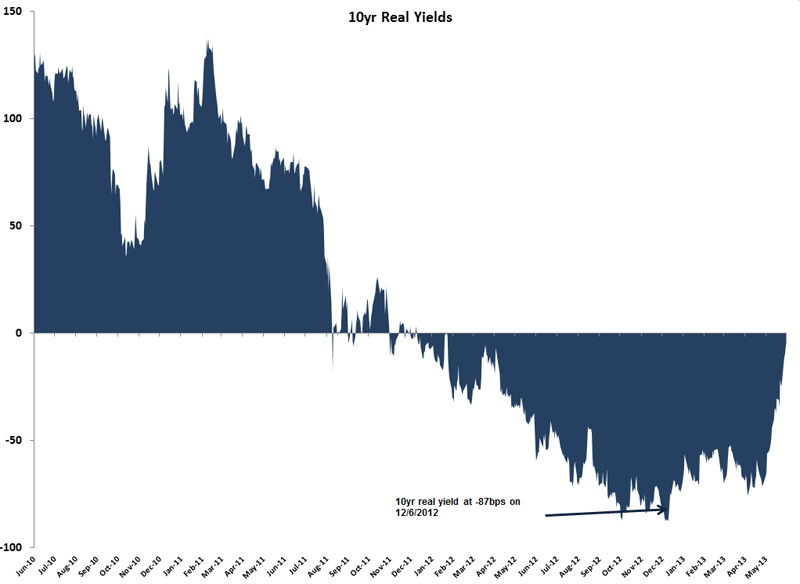

1. Tapering of QE is being priced in. One of the major goals of the Fed when implementing QE was to reduce “real interest rates.” Market participants observe real interest rates through the TIPS market. Each given interest rate is made up of the nominal rate less the breakeven rate. The breakeven rate tells us how much inflation is being built in. For much of QE, real rates have been negative past the 10-year tenor. Negative real rates imply you’ll get a negative return from holding a UST bond after factoring in inflation. The Fed wants the prospect of a negative inflation-adjusted return to entice investors into riskier asset classes. Given the rising stock market and well-documented chase for yield, pushing real yields to very negative levels has arguably worked. The problem? Real yields have spiked and are now almost positive at the 10-year tenor. Real yields bottomed at –88 bps on 6 December and briefly hit positive 1 bp on 31 May.

2. The vast majority of QE benefits to the real economy have already been realized. The data support that QE isn’t merely psychological but has made a strong impact through these channels:

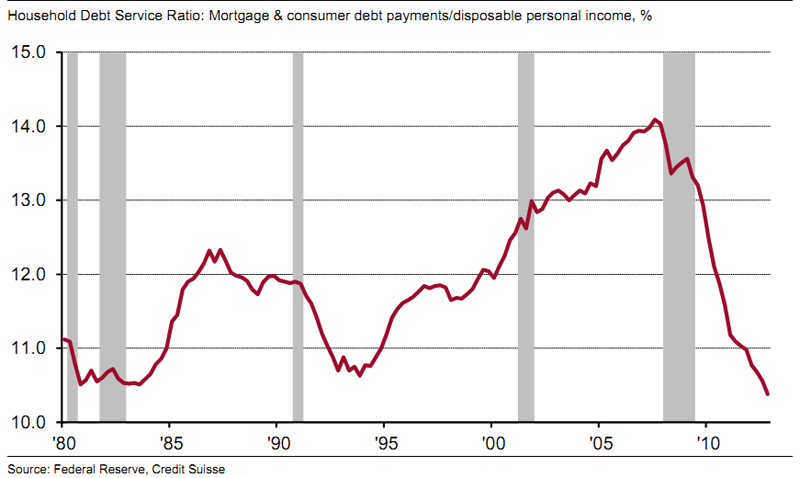

- Home Refinancings: The Fed has leaned hard on the yield curve and has been very successful at pushing down not only UST rates but also mortgage rates through the purchase of agency MBS. In December 2008, the effective rate of interest on outstanding mortgage debt was 6.08%. At the end of the first quarter of 2013, that rate stood at 4.80%. This has been a major stimulant for homeowners because their disposable income has risen through lower interest payments. The household debt service ratio (mortgage and consumer debt payments/disposable personal income) has plummeted to levels not seen since the early 1990s. Specialized programs such as HARP (Home Affordable Refinance Program) have been successful at refinancing underwater homeowners into market rates. One could argue that it’s necessary to keep HARP in place; however, the lion’s share of HARP-eligible borrowers have already refinanced.

- Lower Corporate Borrowing Costs: The second way QE has stimulated the economy is through lowering corporate borrowing costs. Both the investment grade and high yield segments of the corporate bond market have seen robust amounts of new issuance and refinancing as borrowers have rushed to lock in record-low borrowing costs. The chase for yield perpetuated by the Fed purchasing USTs and agency MBS led investors into incrementally riskier asset classes, such as corporate bonds. This chase for yield provided corporations a market with insatiable demand for yield and, therefore, very favorable issuance conditions and record-low borrowing costs. Corporations (such as Apple) with no need for cash took advantage of these conditions by issuing long-term debt to lock in these low funding costs.

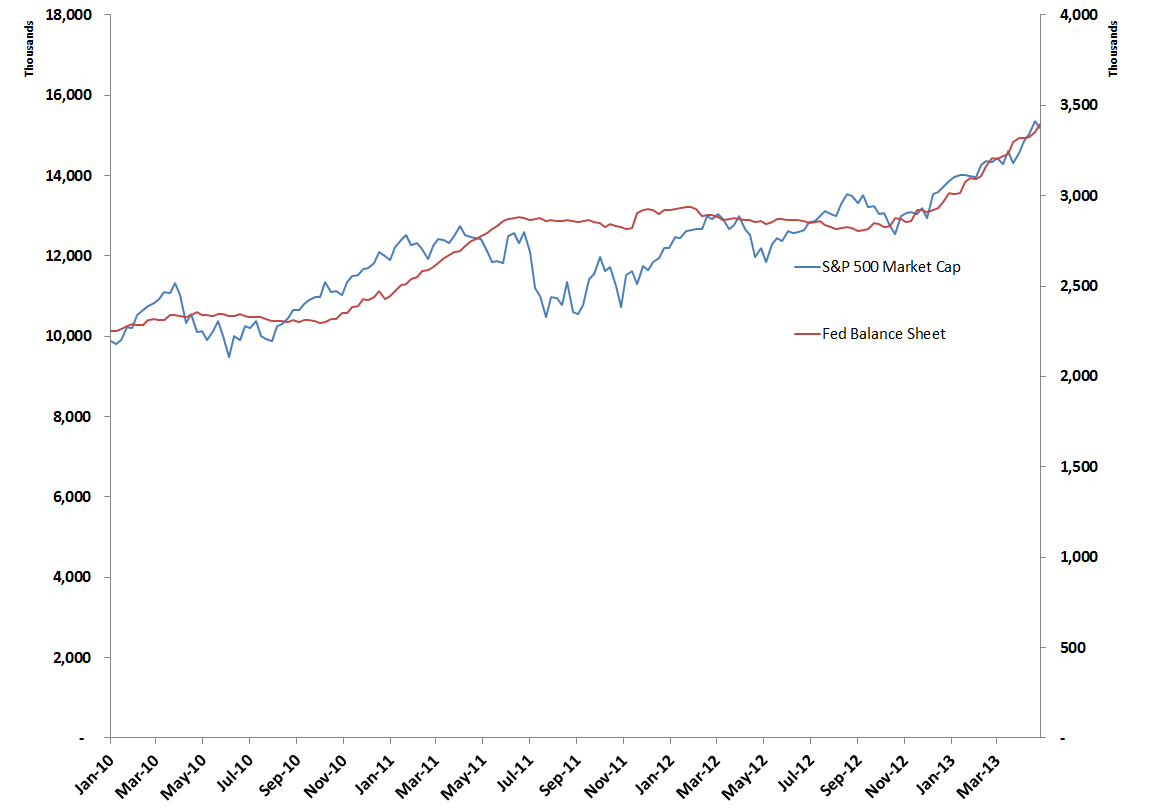

- Wealth Effect: The third way that QE has had a real impact on the economy is through Chairman Bernanke’s famous “wealth effect.” It is my opinion that QE has driven up not only UST and MBS prices but also the equity markets. At a minimum, we can assess the impact by looking at the incremental benefit to the S&P 500 Index’s bottom line through lower interest expense. BAML strategist Dan Suzuki estimates that lower interest expense for S&P 500 non-financial companies has contributed 0.7% to 2012 net margins when compared with 1995–2004 net margins. This is a direct and quantifiable impact to S&P earnings and, therefore, index price.

- Wealth Effect Creating Greater Inequality: Although there are data to suggest that consumption increases are based on wealth gains, there are also some less talked above drawbacks, namely that QE has benefitted the population in an extremely disproportionate way. As Credit Suisse’s Neal Soss recently noted: “Riskier investment assets have appreciated since the Fed’s quantitative easing strategies began in late 2008. But ownership of these assets is highly concentrated — in 2010 the top 10% of households by wealth owned about 91% of outstanding stocks and mutual funds. Growing wealth inequality also contributes to the shrinking wealth effect that we have discussed in past studies….Of the total recovery of $14.7 trillion between the first quarter of 2009 and the fourth quarter of 2012, $9.1 trillion, or 62%, of the gain was due to higher stock-market wealth. Stock wealth is unevenly held, with the vast majority of stocks owned by a relatively small number of wealthy families. Thus, most families have recovered much less than the average amount.”

3. Asset comparisons to UST yields is flawed: Taken further, we can surmise that QE has had a larger impact because it painted equities in the most favorable light with its dividend yields being compared against artificially high fixed-income prices (low yields). The Financial Times’ Dan Crum and Robin Harding hit on this point yesterday: “Modern finance is built on the concept of using the cost of government debt as a yardstick for value, particularly the super-safe debt of the US government. A change in its price affects what people are willing to pay for everything from stocks and bonds to office buildings and homes.”

This relative comparison is, in my opinion, not only intellectually lacking; it has caused various investors to assume safety based on yield. Income seekers have turned to leveraged vehicles, such as mortgage REITs, which sport tantalizing yields but contain embedded risk that the average investor may not realize. Defensive equities like utilities and consumer staples have been bid up to historically rich P/E multiples as investors justify the purchases as alternatives to fixed income because of a high dividend yield.

This is just the tip of the iceberg as the giant game of musical chairs commonly known as QE has left investors making investments not based on absolute valuation but based on comparisons to Fed-effected government bond yields. With the S&P hitting new record highs this year, it’s fair to ask how long the “wealth effect” aspect of QE can be justified. What is the arbitrary level that makes people feel “wealthy” enough?

4. The Fed risks becoming too market focused. The market is now obsessed with watching inflation and the unemployment rate — the two thresholds the Fed has provided as a gauge to potential changes in policy. The market’s seemingly pervasive belief that QE is inflationary is not only not supported by data, but also very solid arguments can be made that it’s actually deflationary at the margin. Remember, although newly created reserves are injected into the system, bonds are removed, creating an asset swap that leaves the market with more reserves and less bonds. Analyses by Lacy Hunt and Frances Coppola discuss the issue of QE being arguably deflationary.

The other threshold of the Fed is a 6.5% unemployment rate. As I argued earlier, while I do believe that QE has made a material impact in the real economy, I now believe that most of those benefits have been exhausted. Both individuals and corporations have already refinanced into lower-cost debt, and equity markets have hit new highs. Continuing on with a blunt instrument such as QE will not meaningfully impact the unemployment rate at this point.

So, if QE is NOT causing inflation and its real economic impact is becoming even more muted, then why does the balance sheet continue to be expanded? I think the answer to that is somewhat evident; the Fed is extremely concerned about the market’s reaction to tapering and/or ending incremental purchases. Former St. Louis Fed President William Poole recently commented to Bloomberg news that he believe the Fed minutes are omitting a debate about how a stronger economy will complicate the ending of QE as to “not spook the markets.”

Worst Case Scenario? Even more troublesome, in my opinion, is the prospect that the Fed could increase asset purchases after an initial tapering. Chairman Bernanke mentioned this is a possibility in his recent speech, but I believe it would set a terrible precedent. One could conclude that the Fed may increase asset purchases in response to a strong selloff in the bond and/or equity markets, which would cause its policy of making asset purchases to be viewed primarily as a tool to impact asset prices. If the Fed were to send this message, would it be forced into a hold of always intensifying purchases if the market faltered?

It’s Not a Matter of if, but When. The recent behavior in fixed income and interest rate sensitive equities should give market participants great pause when thinking about what will happen when the Fed actually slows down purchases. The impacts of such a move would be felt in markets far beyond just USTs and agency MBS, including dividend stocks, REITs, etc. The QE program has not been ideal, but it has provided stimulus (albeit not equally spread) to a number of areas of the economy. However, the benefits of large-scale asset purchases have largely been felt, and it’s time for the Fed to cease any further balance sheet expansion and let the market decide for itself where asset prices should reside. The big question is whether the Fed is willing to reduce its purchase program in the face of falling asset prices. If not, we may see the Fed set a dangerous precedent by increasing stimulus at the first sign of market weakness.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

No can do. As unperfect as it may be, it’s all we’ve got left. If the stock market takes a tumble, everything will seize up. The Fed knows it which is why it is desperately trying to float the market. It needs a 10% per year return going forward and the only way to get it is QE. ZIRP is permanent.