Investment Strategy: What Portfolio Withdrawal Rate Can You Live With?

If you’re contemplating retirement, chances are you’re trying to calculate how much money you can afford to pull out of your retirement nest egg each year. The key here is what withdrawal rate is sustainable: Naturally, you want to avoid exhausting your savings while you are still alive. Financial planners call this longevity risk, and it’s a growing problem as people are living longer. Here, we will discuss withdrawal rates, along with the related issue of how to generate that annual income (hint: it’s helpful to distinguish the need for cash from the need for yield).

An appropriate withdrawal rate will obviously differ for someone who is 65 years old versus someone who is 80 and will depend on health and other issues specific to each individual. While determining a withdrawal rate is not an exact science, we thought it would be helpful to apply some numbers to the scenario of a balanced portfolio to try to determine what a reasonable figure would be for investors to use as a starting point.

To examine a hypothetical investor’s experience under different withdrawal rate scenarios, we looked at a 50/40/10 portfolio — 50% of the portfolio invested in domestic stocks (as represented by the S&P 500 Index), 40% in intermediate-term U.S. bonds, and 10% cash reserves — as an approximation of what a portfolio might look like (we typically recommend that investors keep the equivalent of approximately two years of living expenses in reserve for unexpected shortfalls or unusual expenses). It’s also important to note that in estimating the amount of income needed from a portfolio, investors should calculate what they need after accounting for other income sources, such as Social Security, pensions, and annuities.

We made the following assumptions for our study:

- The investor retires with $1,000,000 in his portfolio and expects the portfolio to fund his living expenses for 35 years (in combination with what he is receiving from other sources).

- The investor withdraws a fixed percentage of the initial portfolio value (in this case $1,000,000) every year, with withdrawals taken at the end of each month. In the first year, for example, $40,000 is taken out in monthly withdrawals of $3,333 ($40,000/12= $3,333). These monthly withdrawals are adjusted at the start of every year based upon the actual rate of annual inflation for the preceding 12 months.

- We consider five time periods ending in each of the past five years: 1973–2007, 1974–2008, 1975–2009, 1976–2010, and 1977–2011.

- Withdrawal rates range from 4% to 8%.

- The portfolio is in a tax-free retirement account, and taxes are not considered in our analysis.

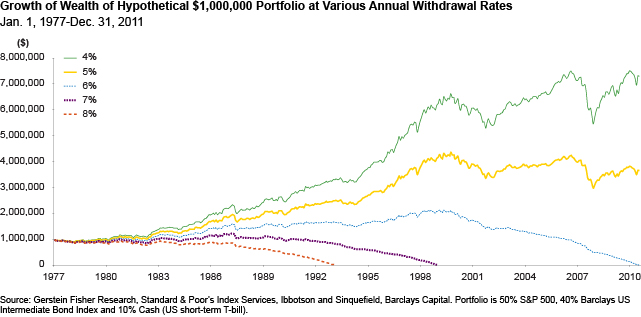

The chart below shows the $1,000,000 portfolio on 1 January 1977 and its value over the next 35 years (through the most recent calendar year end). The five colored lines in the graph represent the growth of portfolio wealth at the different withdrawal rates we analyzed. For the time period from 1977 to 2011, the investor’s portfolio would have survived at withdrawal rates of 4%, 5%, and (barely) 6%.

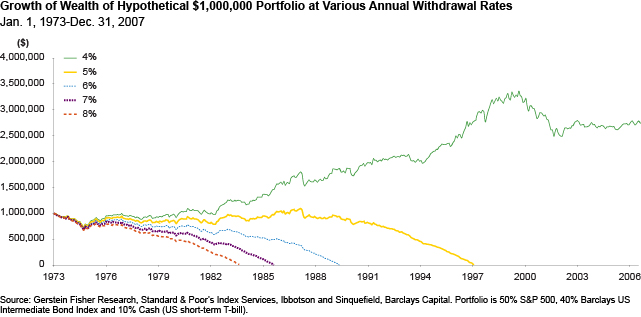

Now look at the next chart, which evaluates our earliest 35-year time period, between 1973 and 2007. Over this investment horizon (which began only four years earlier than the one we looked at in Exhibit 1), because of lower investment returns, we observe that only the 4% withdrawal rate holds. At 5%, the portfolio would have been exhausted by January 1998.

In fact, for all five periods we studied, the 4% rate was the only withdrawal rate at which none of the portfolios was depleted by the end of the investor’s 35-year time horizon. This finding is consistent with academic research on the topic of withdrawal rates, including that of Bengen (1994) and what is commonly called the “Trinity study” of Cooley, Hubbard, and Walz (1998), each of which also arrived at a sustainable 4% rate for an investor with a “moderate” allocation.

As noted earlier, there is no magic number that is right for everyone. Depending on factors like portfolio size/value, lifestyle and spending requirements, age, and health considerations, sustainable withdrawal rates can range from 3% of a portfolio (for conservative investors with long time horizons) to 8% — all with a high probability of not exhausting assets during the specified time horizons.

Total Return versus Income Only

So how, as an investor, do you get to that 4% figure in this low interest rate environment? Many investors are taking the approach of reaching for yield in other, riskier investment instruments — for example, high-yield bonds, high-dividend-yielding stocks, and preferred stocks. But this practice has its own risks.

For instance, during the market crash of 2007–2009, the prices of REITs and preferred stocks (80% of which are financials) collapsed along with those of common stocks. When a company decides to cut a rich dividend, investors not only lose out on that income but also in all likelihood see the value of its share price tumble. In our view, reaching for yield equates to reaching for risk — and not the kind that reliably rewards investors in the form of return.

It’s not uncommon for investors to try to meet their withdrawal needs solely through income-oriented investments. Not only is this particularly challenging to do (given the current yield environment) without incurring excessive amounts of risk, as just discussed, but also a pure-income strategy leaves a portfolio vulnerable to inflation, which is generally the greatest risk to investors over decades of retirement. Especially since we are living longer and longer, investors often underestimate the corrosive long-term effects of inflation.

In contrast with bonds, equities have historically done a good job keeping pace with inflation. For instance, from 1 January 1926 to 31 October 2012, the S&P 500 Index returned 9.85% annualized, compared with 2.99% consumer inflation over the same period. An investor who reduces his exposure to equities in favor of bonds is, in effect, making a trade: acquiring higher current income in exchange for a higher risk to his future income. Indeed, a decision to move entirely into bonds significantly decreases a portfolio’s ability to sustain the desired level of spending over the long run.

Rather than attempting to alter their portfolios by overweighting bonds, increasing bond duration, or loading up on income-oriented stocks, investors would be better served by employing a total-return approach, which allows for spending both from portfolio cash flows and from the potential increase in the portfolio value.

Using this strategy, income generated by the portfolio’s investments is the first source tapped to meet spending needs, and only when this source is insufficient does the investor liquidate some holdings to make up the shortfall. This can be done in conjunction with periodic portfolio rebalancing. In situations when the total portfolio cash flow is more than the annual spending requirement, the total-return approach is equivalent to the income approach.

Returning to our 4% withdrawal rate, investors may be surprised to learn that, in fact, for the majority of years from 1926 through 2011, the yield on a 50/50 stock/fixed-income portfolio either approached or exceeded 4%. Another noteworthy observation is that typically, when yields are less than 4%, the market has done well and thus the price-to-yield ratio is high. Therefore, liquidating some of the portfolio’s equity holdings for cash to meet the total income shortfall should not be too difficult.

Conclusion

Determining the appropriate withdrawal rate from a portfolio to cover a retiree’s living expenses (the amount needed in addition to what he or she receives in pension, Social Security, or other benefit payments) is a challenging but important exercise. Research by Gerstein Fisher and others points to 4% as being a reasonable starting point for a withdrawal rate. Investors should also consider age, health, and other individual-specific issues in determining whether their own withdrawal rate should in fact be lower than this, or possibly higher. While investors may be tempted, particularly in the current low interest rate environment, to reach for yield in high-dividend-yielding stocks or high-yield bonds, this approach entails excessive risk for most investors. When it comes to structuring a portfolio for retirement, a total-return strategy may be a sounder alternative to an income-only approach.

References

Bengen, William P. 1994. “Determining Withdrawal Rates Using Historical Data.” Journal of Financial Planning, vol. 7, no. 4 (October):171–180.

Cooley, Philip L., Carl M. Hubbard, and Daniel T. Walz. 1998. “Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable.” American Association of Individual Investors Journal, vol. 20, no. 2 (February):16–21.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Photo credit: alashi