The Cheapest Bonds in the United States

Value in the fixed-income markets, as in other asset classes, is driven in large part by fear and greed. The easy monetary policy communicated to the market through “QE infinity” in fall 2012 fueled a chase for yield that was already strong. Leveraging high-yielding assets with the US Federal Reserve promising to keep short-term interest rates low for “as long as the eye can see” caused a large buildup of leverage in certain segments of the bond markets. When Fed Chairman Ben Bernanke mentioned that a tapering of purchases was a possibility in May 2013, the market began to reprice QE infinity, and as a result, the levered trade had to come off. The carnage of the deleveraging of the carry trade combined with a 100+ bp rise in US Treasury yields encompassed a wide range of fixed income, including mortgage-backed securities (MBSs), munis, high yield, and emerging market debt.

Hindsight is always 20/20, and what’s been more of interest to me is what various bond fund managers are buying in the aftermath of this selloff. One such manager whose holdings I closely review is DoubleLine’s Jeffrey Gundlach. DoubleLine’s flagship total return fund has beaten 97% of peers over a three-year horizon, with a 6.8% annual return as of 30 September. Whereas some fixed-income managers feel this is just the start of the rate selloff, Gundlach appears to have a very contrarian view that rates have risen too far, and he has been aggressively buying longer-duration bonds. Because not all bonds and duration are created equally, DoubleLine, as MBS experts, has found an unique sector of the MBS market in which to express these views.

In other words, Gundlach has been looking to profit from rates dropping.

The largest holding in DoubleLine’s Opportunistic Credit fund (ticker: DBL) is a bond called FHR 4217 CS. This is an agency collateralized mortgage obligation (CMO) that is backed by 30-year 3.5% Freddie Mac pools. In the MBS industry, this bond is called an “inverse support.” It’s considered “inverse” because the coupon is inversely tied to one-month LIBOR. The specific coupon formula is 5.28% − 1.2 × one-month LIBOR. Because one-month LIBOR is only ~0.17% today, the coupon is projected to be 5.28% − (1.2 × 0.17), or 5.28% − 0.20% = 5.08%. As one can easily surmise, the bondholder will receive a higher coupon if one-month LIBOR stays low.

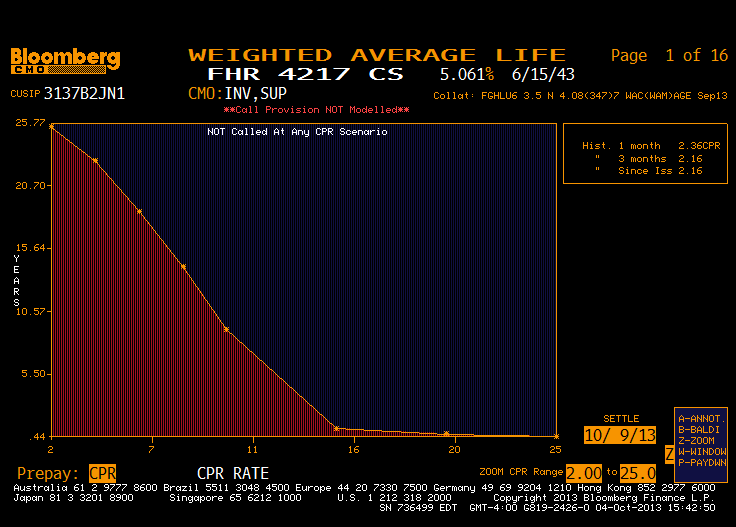

The chart below shows the weighted average life of this bond across different prepayment scenarios. Prepayments are shown as conditional prepayment rates (CPRs), which means the annual rate at which mortgage holders repay. A CPR of 20 would roughly imply that 20% of principal is repaid annually. As a refresher, the average life tells you the time in years in which an investor would get back half the principal owed. As the chart below shows, this bond has a very long average life if prepayments remain low. Conversely, if prepayments speed up, the bond could actually be very short.

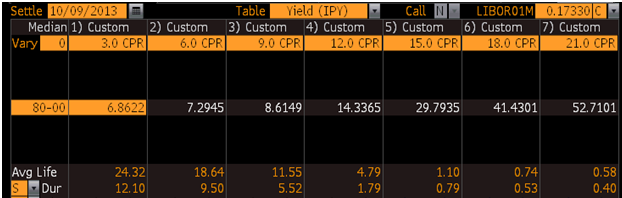

DoubleLine valued this bond as of 31 July at a price of 80 cents on the dollar. The table below shows the yield to maturity of this bond at different prepayment rates, assuming that one-month LIBOR stays at 0.17% for the life of the bond. At 3 CPR, the bond will yield 6.86% with an average life of 24 years. If prepayments sped up to 15 CPR, the bond would yield 29.7% with an average life of only 1.1 years.

A skeptic would respond that it’s very unrealistic to assume that one-month LIBOR will stay at only .17% for the next 25 years, and that person would be correct. As such, we need to look at the scenarios if LIBOR is at higher rates. Below, we show the outcomes assuming a static LIBOR rate of 2% throughout the life, or 1.83% above today’s one-month LIBOR.

Although the yields are still very high, you can obviously tell that the returns are lower as the coupon is reduced. Remember this particular bond’s coupon is inversely related to one-month LIBOR. In an e-mail to me, Gundlach commented that “inverse supports are the cheapest bonds in the US bond market.”

A bond such as this in May or June would have traded at nearly par versus the 80 cents on the dollar that DoubleLine priced it at as of 31 July. I think DoubleLine is very adept at finding out-of-favor sectors in the mortgage-backed market that appear to have very good risk–return attributes. Although this particular bond has a very long duration, and thus a lot of market value risk, DoubleLine is able to incorporate these in a well-diversified portfolio. Panic in the fixed-income market created dislocations such as this and an opportunity to add very attractive high-yielding government mortgage bonds. In the event that rates went back to levels seen in spring 2013, these bonds could have enormous upside. As of 31 August 2013, agency inverse floaters made up 1.2% of the DoubleLine total return fund and 20.2% of the more aggressive opportunistic credit fund. Although some bond managers have pared duration and become more defensive, Gundlach has taken advantage of this selloff and added duration. Whether this proves to be the right move, it’s clear to me that Gundlach is unafraid to buy some of the most out-of-favor assets. It’s certainly not for everyone, but as a bond manager myself, it’s a risk/reward that I find very attractive as well.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Interesting analysis, thanks David….I think this is too complicated for even CFA folks but buying into DoubleLine’s funds is a good way to get exposure to Gundlach’s expertise.

Fantastic analysis of yield with CPR and Avg life.

Nice article. POs (principal only CMOs) should also be cheap.

Very informative. Thanks for clarifying the relationship between CPR and yields on these.

The analysis might be correct dead on. It just needs full understanding to be of good use. This is actually trying to tell us something.