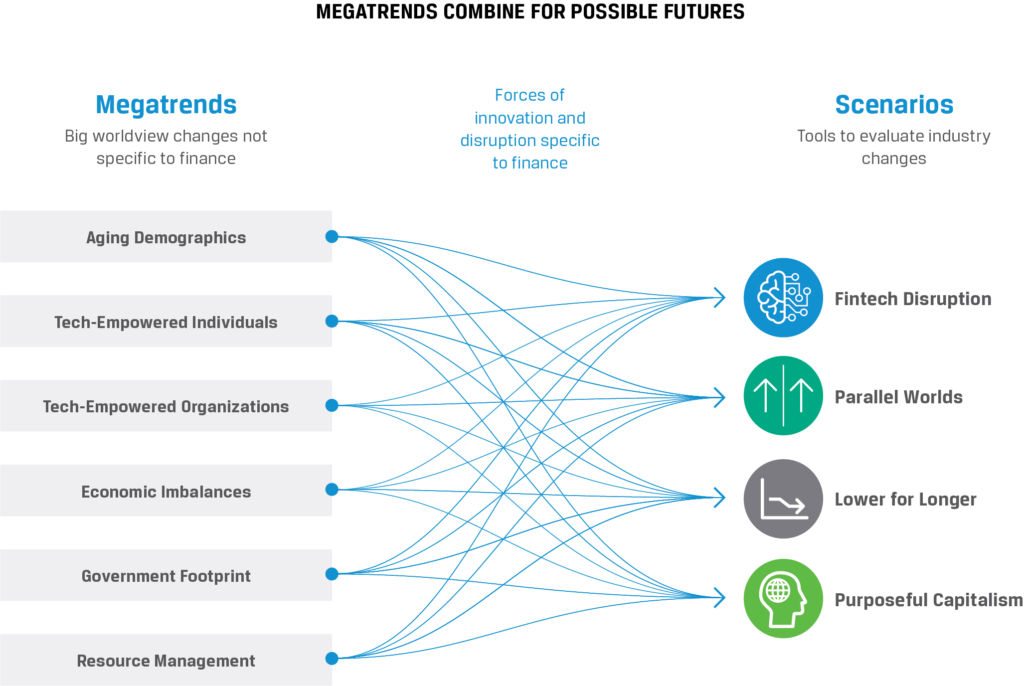

Future State of the Investment Profession: Preparing Now for a Different Future

The future of the investment industry is important for the functioning of the global economy, for the approximately 2 million workers it employs, and for the clients and end investors that depend on it to manage around $100 trillion in assets. But there are major shifts afoot that will likely result in significant change, and leaders need a better way to think through the implications of these shifts in various combinations — for their clients, the health of the industry overall, and the ongoing sustainability of their own firms. CFA Institute recently published the Future State of the Investment Profession , which examines these issues, and we hope it will be of use to both new firms and those with decades — or even centuries — of experience.

Four Scenarios for Future Strategy

In addition to collecting data on investment leaders’ views of changes they are expecting in the industry, we developed four scenarios that describe the way the future of investment management could unfold.

Fintech Disruption

Major Elements

- Fintech develops globally with a particularly strong Asia-Pacific element

- Regulatory infrastructure in finance gradually integrates technology-driven models

- Traditional active management shrinks; some growth in alternatives, smart betas, and outcome-oriented solutions

- Smart machines and systems, data analysis, and inference play a disruptive role in finance’s evolution

- Financial services becomes highly personalized and digitalized everywhere

- Robo-advice and its “cyborg” variants become preferred style or tool for delivering investment advice

Parallel Worlds

Major Elements

- Better worldwide education, healthcare, and telecoms increase societal engagement

- Potential for mass disaffection; consequences in anti-globalization, populism, and authoritarian nationalism

- New-style financial institutions enabling personalized, simple, and speedy engagement; trust is also needed

- Big data serves customization of investment products to specific segments; more reflection of personal values

- Improvement in financial literacy and empowerment produce better financial participation

- The “have-nots” act on their disillusionment with the system

Lower for Longer

Major Elements

- Limited success with interest rate normalization; natural interest rates stay low

- Growth challenges: indebtedness, adverse demography, excess savings, slower growth in China/emerging markets, and companies hoard cash

- Large gaps in pension coverage with longevity; pension poverty

- Moves to lower-cost, higher-tech investment solutions; premium on innovation; industry consolidates

- Disappointment with outcomes rubs off on trust; investment skill under pressure to demonstrate its value

- Geopolitical instability connects with social instability; inequality fissures; negative feelings deepen; job fears; immigration challenges

Purposeful Capitalism

Major Elements

- Firms and investment organizations integrate their wider purpose alongside their profit motivations

- Asset owners are more influential; they add focus to longer-term value creation and sustainability

- There is an increased attention to fiduciary responsibility in investment with better alignment

- Fierce competition for leadership talent among investment organizations; diversity and culture are draws

- Investment providers need to have a “clean license to operate,” including ESG principles

Whatever the outcomes, it is our hope that the steps and ideas outlined in the study help the investment industry to realize its fullest potential.

The Future State of the Investment Profession was co-authored by Rebecca Fender, CFA; Robert Stammers, CFA; Roger Urwin, FSIP; and Jason Voss, CFA.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©CFA Institute