Poll: Will China’s New “Super Agency” Lead to Faster Financial Reforms and Liberalizations?

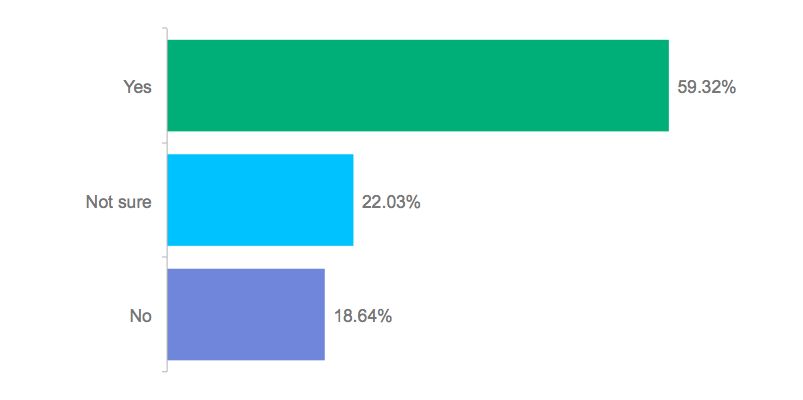

In a poll conducted earlier this week in the CFA Institute Financial NewsBrief — Asia Pacific Edition, we asked readers whether China’s recently established “super agency” will lead to further acceleration of financial sector reforms and liberalizations.

China’s State Council has recently established a super agency headed by Governor Zhou Xiaochuan of PBoC (the central bank) to coordinate the four financial sector regulators — CBRC (banking), CSRC (securities), CIRC (insurance) and SAFE (foreign exchange). With this super agency, will we see further acceleration of financial sector reforms and liberalizations?

The lack of coordination among regulatory agencies within China’s financial sector is a common concern. Thus, it is not surprising that a majority of poll respondents view the new super agency favorably, believing it might pave the way for faster reforms and liberalizations. With only 19% of respondents voting no to the question, the reception appears better than expected, given that many remain highly skeptical about the new leaders’ resolve and ability to push through reforms and liberalizations, which are among the main themes that have been frequently mentioned by officials since the 18th Party Congress last year.

Concrete actions have been taken to liberalize the Qualified Foreign Institutional Investor (QFII), Renminbi Qualified Foreign Institutional Investor (RQFII), and Qualified Domestic Institutional Investor (QDII) schemes, as well as the cross-border mutual recognition of funds. As the pace of liberalization determines the timing and extent of China A-shares going into the MSCI and FTSE global indices, the super agency helps promote further internationalization of China’s equity market, bringing offshore capital as well as international management and governance best practices into China’s companies.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.