Is It Time for the Fed to Contract Its Balance Sheet?

The Federal Reserve can keep their balance sheet at the current size (and keep the risk asset party going) or it can position itself to be able to hike rates — but it cannot do both.

Last week, the Fed announced that purchases of agency mortgage-backed securities and US Treasuries would fall to $35 billion per month. If they continue reducing their purchases by $10 billion per month, the incremental purchases should be finished by October.

So what will happen? Their current policy is to reinvest principal runoff and maturities from existing holdings, which means their balance sheet will stay roughly the same size once they stop buying new bonds. As we consider the future of fiscal policy in this country, one of the key questions will be what the Fed is capable of doing.

JP Morgan’s CFO Marianne Lake recently described the impact on the industry, saying, “We should note that a significant portion of the growth in deposits that the industry has experienced has been as a direct result of the Fed’s QE policy and reserve bills. So if you look at JP Morgan, since the end of 2009, the firm’s deposit rate has grown by about $350 billion and we believe a significant portion of that growth has been a direct result [of] QE.” In that same call, she noted that JP Morgan (JPM) has estimated it may experience a deposit outflow as large as $100 billion in the second half of 2015.

How Does QE Work Again?

It’s often mentioned that the Fed buys bonds in asset swaps. This is true. Where many people get confused is that it is not an asset swap for the banks. When the Fed buys bonds, they typically buy them from non-banks. The bonds are removed from circulation and put on the Fed’s balance sheet, while the Fed pays for these bonds with newly created reserves. Now these reserves must be deposited at a bank, so they will show up at a bank as new deposits.

For the bank, these deposits are liabilities and the corresponding assets are the reserves sitting at the Fed earning “interest on reserves” of 0.25%.

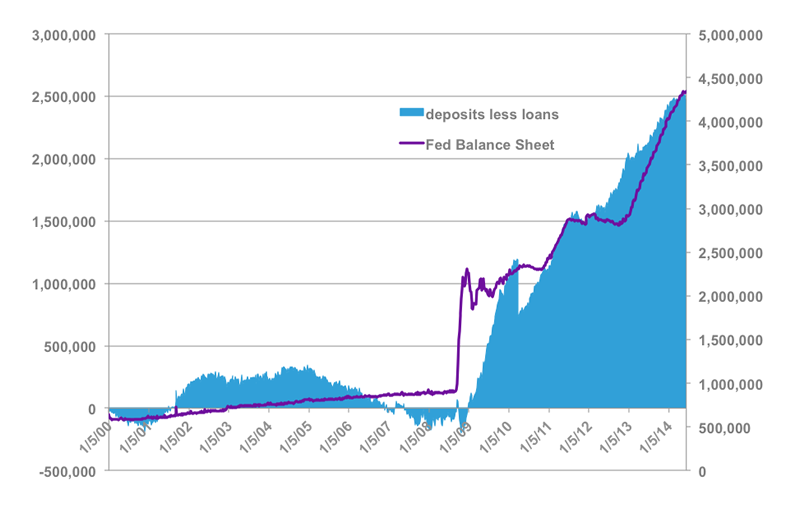

So think about this: Every dollar of QE purchases must end up at a bank in the form of a new deposit. This is not a theory, it can be seen by viewing asset and liability data from the Fed’s H8 report. As you might notice, the difference between the deposit over loan excess ties almost exactly with growth in the Fed’s balance sheet.

Deposits Less Loans of All Commercial Banks versus Fed Balance Sheet

Source: Federal Reserve H8 Report

Comments from Federal Reserve members indicate they are reluctant to cease the reinvestment of principal runoff. I would assume this reluctance stems from their belief not only that the size of the Fed’s balance sheet gives credibility to “forward guidance,” but also that contracting the balance sheet could begin an unwind of various risk asset trades.

Recently, the Fed has introduced two tools to drain reserves from the system: the reverse repo (RRP) and term deposit facilities (TDF). With the TDF, for instance, a bank would have a term deposit (right now one week) with the Fed and earn a few extra basis points (bps) over interest on excess reserves (IOER). The first question is how much compensation would a bank need over the current IOER rate (25bps) to entice them to utilize these tools? Is it 10 basis points? 20? 50? Nobody knows.

Maybe a more fundamental question is this: Is there a big difference to the market in terms of whether they drain reserves by cutting off principal reinvestment or by utilizing RRPs and TDFs? My answer is an unequivocal yes. The goal of RRPs and TDFs is to ensure that enough reserves are removed from the system so that demand will exist to borrow Fed funds. I might be naïve, but I am skeptical that a bank would voluntarily tie up too many reserves only to have to go right back into the market and borrow from someone else.

Meanwhile, if the Fed ceased reinvesting runoff, then reserves would automatically leave the system as bonds paid down and deposits left. Put another way, I have a hard time believe removing reserves temporarily via RRP/TDF will get the overnight markets to a “normalized state.”

Moreover, can the Fed do this in a great enough size to achieve its goal? The most recent TDF auction on 16 June raised a bit over $92 billion, which is insignificant in terms of the Fed’s whole balance sheet.

This is all so important because it is my belief that the Fed cannot raise interest rates with such a large amount of reserves in the system.

Alternative Option: Stop Reinvesting Principal Runoff

The recent year-over-year (YoY) consumer price index data pushing past 2% led some to argue that the Fed should take a more hawkish stance. Much to that group’s dismay, higher inflation projections were not present in the Fed forecasts and Federal Reserve Chairperson Janet Yellen did not seem overly concerned about the spike in her subsequent comments.

Whether or not inflationary pressures are building is debatable. I believe, however, it’s in the Fed’s best interest to start reducing the size of its balance sheet in advance in order to reduce reliance on reserve draining via repos and term deposits. The Fed is currently not in a place where it can raise rates with trillions of dollars of reserves in the system. Thus, if inflationary pressures somehow do arrive, then the Fed has real problems.

The other reason to start taking down the balance sheet is to be proactive in preventing excessive risks in the markets. It’s well documented that the chase for yield continues, and now that even the most esoteric instruments have been bid up, leverage is being employed to hit yield targets.

Shrinking the balance sheet would likely send a shock to carry traders, maybe even similar to last summer’s “taper tantrum,” but it’s probably a healthy thing to do. Opponents of this philosophy might say that such a strategy might risk disrupting one of the only benefits of QE, which is the rise in wealth through rising financial asset prices.

This raises some interesting questions: If you assume risk assets could sell off with a contraction in the balance sheet, would the underlying economy be strong enough to withstand a shock? Would a move sabotage the economy’s momentum and be hurtful in the end? Nobody knows, but there’s a limit to the rise of financial asset prices and excessive risk taking, and leverage buildup has to be considered in terms of the cost-benefit analysis for the Fed. Manmohan Singh of the IMF believes that it could cause great disruptions, but it is all speculation at this point.

It’s more important for the Fed to be in a position to raise rates than it is for the party in risk assets to continue at its current feverish pace. I have real questions about the efficacy of RRPs and TDFs on a large scale, and believe the better option is to “reverse” the purchases through natural runoff. RRPs and TDFs can have some impact, but the “heavy lifting” will be accomplished through runoff and sales. I estimate the average life (time it takes to get half your investment back) of the Fed’s holdings to be about five years, so this wouldn’t be an immediate process. But in my opinion, if the Fed believes inflation and credit creation are starting to take hold then ceasing runoff reinvestment is the optimal choice at this stage of the game.

If you enjoyed this post, consider subscribing to the Enterprising Investor via Email or RSS.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Photo credit: ©iStockphoto.com/RobertDodge