Is CalPERS a Canary in the Coal Mine?

CalPERS’s announcement of its intention to exit its $4 billion hedge fund portfolio on 15 September grabbed industry headlines. And rightly so. CalPERS (California Public Employees’ Retirement System) has a long history of thought leadership in its corner of the institutional investing world, and its actions are widely watched by other large pension funds. In fact, almost exactly 15 years ago, CalPERS touched off a firestorm with equal bravado by proclaiming it would invest in hedge funds for the first time.

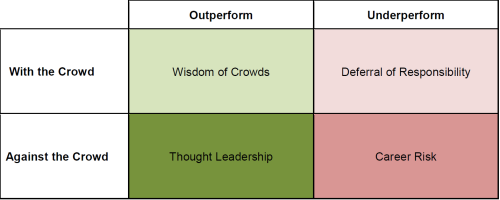

More broadly, the CalPERS news can be applied to a framework that considers the impact of investment leadership and job risk on both an individual decision maker and future industry trends. As depicted in the following chart, a simple 2×2 matrix pits investment decisions on the y-axis against the ex post outcomes of those decisions on the x-axis. We simplify investment decisions as either following the crowd or going against it, and we describe the result as either a winning bet (outperform) or a losing one (underperform). The chart shows what we believe to be the likely assessment by the actors making the investment call.

Career risk, according to Jeremy Grantham of GMO, is by far the biggest challenge for professionals. By choosing to invest with the crowd, the outcome in either ex post performance scenario is perfectly acceptable to the decision maker relative to the alternative. If the investment works out, the constituents are usually happy, irrespective of the path taken. If the investment falters, the decision maker can talk about the rational process involved and not get fired for hiring the perceived market leader (IBM in the 1980s, Goldman Sachs in the 1990s, Blackstone in the early 2000s).

When going against the crowd, the investor follows a riskier, binary path. If successful, he could either be seen as a hero or find that fiduciaries nevertheless question the wisdom of his unusual approach. An unsuccessful investment probably signals the end of the road for his career. Given these choices, rational actors often seek to minimize career risk. In the elegant words of John Maynard Keynes, “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.”

This matrix reveals the significant challenge faced by a professional investor in sticking his neck out and leading others in a new direction. The question at hand is whether CalPERS’s recent announcement will become a successful example of thought leadership that prompts a wave of outflows from the industry.

The Fortunes and Misfortunes of Market Leadership

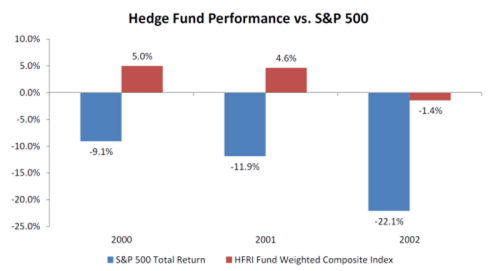

The world gets far more interesting when someone outspokenly defies the crowd and subsequently earns outsize returns. David Swensen of Yale University came to prominence in part by writing a tome about Yale’s investment process and in part by backing up that differentiated asset allocation with an impressive track record after the book’s publication. CalPERS became a thought leader in the hedge fund space from a combination of its 1999 announcement and the terrific performance by hedge funds amid market turmoil in 2000–2002, as shown below.

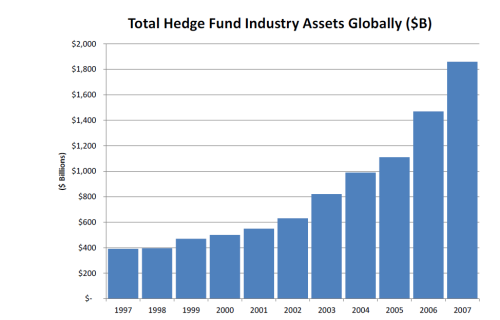

When a thought leader takes a new stance and succeeds, her peers’ career risk shifts from investing in the new thing to not investing in it. Back in the 1990s, investing in hedge funds was a form of job risk for institutional allocators, whose boards were leery of so-called secretive pools catering to the wealthy. Yet, those taking the unconventional approach back then had a robust opportunity set and were rewarded with uncorrelated, equity-like returns. As that occurred, the conversation at the board level and the commensurate job risk shifted from investing in the new thing to being left out of the game, and hedge fund industry assets soared. In the five years from 2002 to 2007, following this golden era of hedge fund relative performance, hedge fund industry assets tripled from approximately $626 billion to $1.8 trillion.

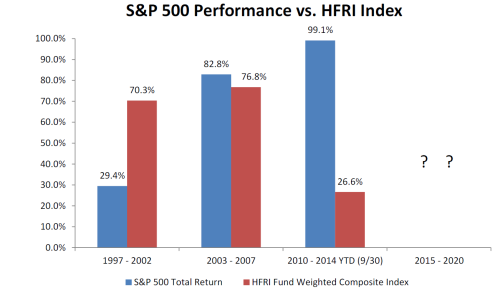

Alternatively, industry participants tend to ignore leading-edge shifts when thought leaders’ prognostications fail to deliver. Whether calling for market moves (see Meredith Whitney, Elaine Garzarelli, or James Glassman) or a novel asset allocation strategy (George Washington University endowment), leading thinkers without performance follow-through are soon forgotten. For institutions to follow CalPERS’s lead, hedge funds would likely need to experience a prolonged period of pronounced underperformance.

A Coal Mine or a Lump of Coal?

Through this lens, we can attempt to forecast the industry’s reaction to CalPERS’s announcement by looking both back at its incentive in making the announcement and ahead to whether its divestment from hedge funds will be a winning bet. As a starting point, CalPERS’s decision this time around was not a controversial, leading-edge change. For its own idiosyncratic reasons, CalPERS never made the commitment to hedge funds it originally intended to make 15 years ago.

First, at only 1.5% of its assets, hedge funds were insignificant to CalPERS’s overall investment program. In fact, the $4 billion in its portfolio today never came close to achieving the $11.25 billion long-term target it articulated in 1999. Moreover, CalPERS denominated that original goal in 1999 dollars. At today’s purchasing power, the target would equate to between $22 billion and $25 billion of hedge fund investments, or around six times the amount it actually invested. Ramping up to that scale quickly and effectively would be an insurmountable challenge for any allocator — or any hedge fund manager for that matter.

Second, we would surmise that this relatively small investment likely led to a significant misallocation of CalPERS’s internal resources. Hedge funds often command more research time than do traditional investments, so the subportfolio may well have taken up far more than 1.5% of the staff’s efforts. Even worse, with public scrutiny at the forefront of the CalPERS debate, the subject of hedge fund fees no doubt took up far more than 1.5% of its board’s discourse.

Lastly, following the unfortunate passing of former CIO Joe Dear, the organization’s new CIO has a chance to make his own mark. By headlining the fee savings of divestment, Ted Eliopoulos can earn a quick win with his constituents, an important step in his building long-term confidence as a leader.

In summary, regardless of the program’s performance, which appears to have been well below hedge fund industry norms, CalPERS seemed ill suited to making a substantial commitment to hedge funds. Other very large pools with similar constraints that are currently underallocated to hedge funds may find themselves challenged to scale up and may follow CalPERS’s lead. However, we believe that those who currently have a meaningful and well-performing hedge fund program also have stronger hands and a different set of conditions to evaluate.

Looking forward, our suspicion is that CalPERS’s recent announcement is like a canary in a coal mine but perhaps not the one the organization intended. Far from signaling the industry’s demise, we think that CalPERS’s announcement means that it has thrown in the towel with respect to its hedge fund program at just the wrong time in the market cycle. We believe that the next five years in the equity and bond markets are highly unlikely to look anything like the stimulus-induced last five. After five years of poor relative performance, hedge funds are overdue for their day in the sun.

The core focus of hedge funds — to protect the downside — continues to resonate with investors, who have bolstered allocations even as the industry has underperformed. Without the tailwinds that have allowed passive investing to lead active management in general and hedge funds in particular, allocators must seek other routes to achieve investment goals. Thus far, many institutions have stayed the course in partnerships with the best and brightest investment talent in public markets globally.

With great respect for CalPERS’s willingness to take a public stance — and recognizing that career risk may shift for some followers — we continue to believe that hedge funds constitute an important part of a well-diversified investment program, especially if the rosy skies of the last five years give way to darker clouds down the road.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: Courtesy of CalPERS