When Will Marketplace Lending Platforms Offer Mortgages?

Fintech and the financial sector’s shift toward a digital and mobile future have been popular for a while, with marketplace lending — or peer-to-peer/crowd lending — holding particular fascination.

Lending platforms like Zopa and Lending Club reduce the friction of traditional bank lending through software and automation, lowering the cost of originating and underwriting credit. They connect borrowers and lenders directly, without a bank in the middle, allowing people and companies access to credit at better rates than a credit line or credit card. At the same time, investors earn higher interest than with traditional savings accounts providing near-zero percent interest.

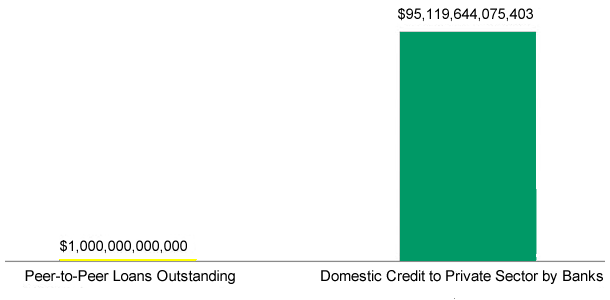

Marketplace lending is so popular that Foundation Capital’s Charles Moldow predicts that by 2025 these platforms will originate $1 trillion in loans globally. And while marketplace lending accounts for only a small portion of the domestic credit sector, start-up founders anticipate the end of traditional banks is near.

For this to be true, marketplace lenders must obtain the Holy Grail of credit — and the main source of income for retail banks — and offer long-term mortgages. Yes, $1 trillion may sound like a lot, but in the big picture, marketplace lending in its current form accounts for just a drop in the entire credit pool.

On the other hand, marketplace mortgages could divert billions of dollars of income from banks, which would hurt their already thin margins and shake up — even transform — the credit sector.

Estimated Outstanding Bank Credit and Marketplace Loans (2025)

Sources: Domestic credit provided by financial sector in percent of GDP from World Bank, extrapolated to 2025 with a constant growth rate of 3%, which is lower than the current growth rate predicted by “IMF World Economic Outlook (WEO) Update: Cross Currents January 2015“; “Marketplace Lending, Financial Analysis, and the Future of Credit.”

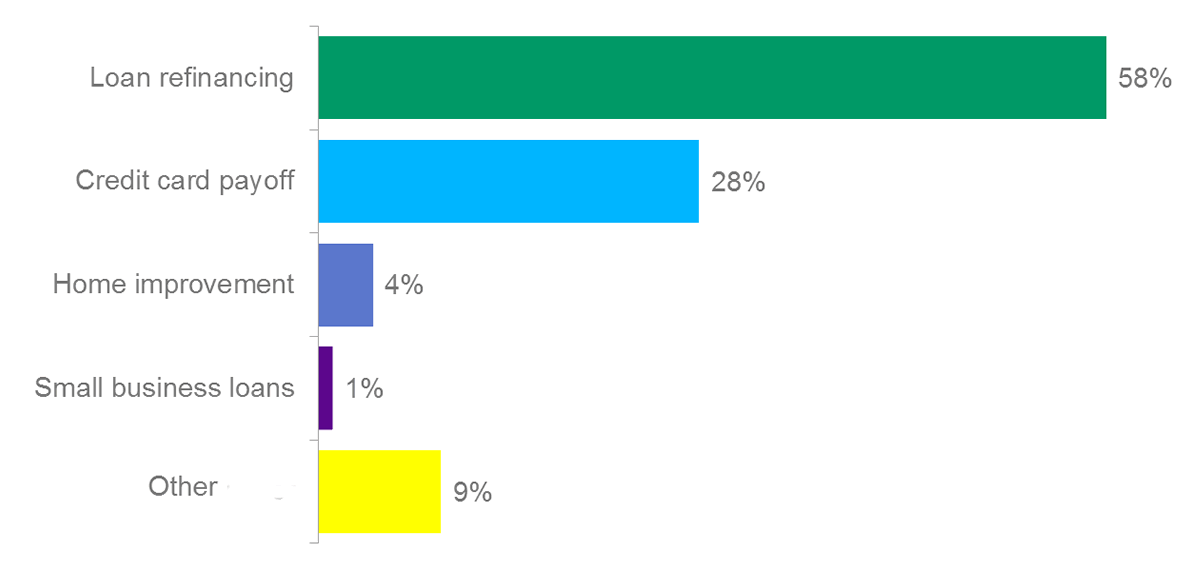

But structural boundaries stand in the way of marketplace lenders taking up mortgage underwriting. For one, loans have a relatively short duration without collateral from creditors or a central bank guarantee. Also, lending platforms rarely roll over loans. Investors lack the faith to continually commit new cash to marketplace loans for the long term, mainly because the sector is nascent and has yet to weather a crisis. So creditors use marketplace loans for smaller purchases, while mortgages remain the sole provenance of banks — for the time being.

Uses of Marketplace Loans

Sources: “Debt Crowdfunding Holds Much Promise“; company websites.

Several marketplace lending entrepreneurs I interviewed said they avoid direct competition with banks. They prefer to serve a small segment of the credit sector that banks have little to no interest in.

Such modesty is uncalled for. Marketplace lending is an explosive idea with enormous potential. Cost reduction and lower interest rates for credit are the obvious benefits, but opening up private and commercial debt to retail investors as an investable asset class is revolutionary.

By allocating a few hundred dollars to a fixed-income portfolio, individuals can transparently select and pool themselves — as with marketplace lending — in areas that have long been the exclusive domain of large institutional investors or private banking clients. Marketplace lenders should embrace this disruptive potential and stretch a little farther to strengthen their business model.

So what must happen for marketplace lenders to start underwriting mortgages? In a perfect economic environment, marketplace loans perform well, and nothing stands in the way of lengthening the duration or increasing ticket size. But when my colleague, Ioannis Akkizidis, and I stress tested a portfolio of marketplace loans from one of the major US platforms, returns diverged toward zero already under moderate stress. In addition, if banks manage to compete with the interest rates offered by these lending platforms, a wave of prepayments could ripple through the sector, curtailing interest income. Medium and strong stress resulted in losses for investors, which was accelerated by the absence of collateral.

Under ideal market conditions, the future of marketplace lending looks bright. In times of volatility or lower interest rates, however, its fortunes dim. To shield against potential trouble, marketplace loans need collateral or insurance that minimizes potential losses. This is imperative if the sector is to match the inflow of capital that banks receive from debit and saving accounts.

Investor trust is also key to marketplace lending’s future. Instead of simply spreading risk, platforms should eventually guarantee for potential risk and articulate a clear understanding and full transparency about the sector’s inherent risks.

None of this will be easy, but such measures are critical if marketplace lenders are to offer a viable alternative to banks.

The stars are aligning for marketplace lending platforms, but they need to ramp up the pace of innovation if they want to give the banks a real run for their money.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©iStockphoto.com/krolone