Governing the Capital of Europe’s Insurers: Resilience versus Capital Mobilization

EU insurance companies are a formidable group of institutional investors, but most policymakers think they punch below their weight. Portfolio allocations in listed equity, private, or unrated assets are widely seen to have been overly constrained by the bloc’s 2016 prudential framework for the sector, Solvency II. A revision of that law is now being finalized and mirrors a recent liberalization in the United Kingdom, albeit with less overt political pressure. As a result, European insurers may well adopt a more active investment style, including in private assets or in the emerging markets.

Amidst Europe’s shortfall in private capital market funding, insurers’ investment portfolio of which stood at EUR 8.9 trillion in 2024, roughly 44% of EU GDP, has predictably come into focus.

From the start of the EU’s revision of Solvency II in 2020, the goal was to stimulate equity investments and other long-term investments—creating a framework for recovery and resolution of insurance companies in the process. In its most recent capital market strategy, published in March, the EU Commission again stated that insurers should play a more active role in equity and alternative assets markets.

But it is hard to argue that insurers’ portfolio is misaligned given the need for predictable and long-duration cash flows in the sector. The picture now is at least more nuanced than when the EU kicked off the lengthy revision process:

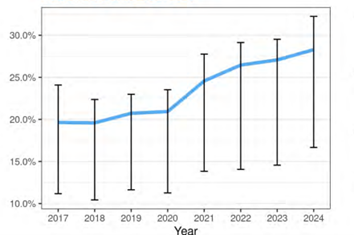

- The allocation into equity has risen slightly over the last few years to an average of 28% in 2024 (though it varies widely between EU countries), according to the EU’s latest set of capital market indicators (see Exhibit 1). However, this is mainly accounted for by index and unit-linked accounts where policyholders bear the risk. Investments in equity for life, non-life, and reinsurance are much lower—between 7% and 8% of investments—according to a 2022 study.

- There has also been a push into private markets, as insurers already seem to have utilized the existing framework to adopt riskier investment strategies. While exact asset types are hard to pin down in published data, rating agency Moody’s in a June report estimated private credit exposures in all of Europe (including the UK) at 13% for the insurance sector, with about 80% of survey respondents signaling plans to expand this exposure further.

- Barriers to sub-investment-grade or unrated assets explain an allocation of less than 5% to emerging markets. Investments in non-OECD countries or in unrated assets have clearly been frustrated by high capital charges under Solvency II. A study of five European insurance markets attributed miniscule allocations in emerging markets at least in part to this so-called regulatory cliff.

Exhibit 1: Equity Holdings of Insurers in the EU, 2015–2024

Note: Bars show the highest and lowest quartile of the 27 EU Member States.

Source: EU Commission, “Monitoring Progress towards a Capital Markets Union” (3 September 2025, Indicator 12).

Five years after the Solvency II revision was first conceived, Europe’s private sector investment shortfall and financing costs seem to weigh more heavily on regulators. Regulation of institutional investors, including insurers, is now seen as a tool in stepping up investment in infrastructure, technology, defense, and green projects that will help Europe overcome its growth and competitiveness challenges.

Due to a late-stage push by the European Parliament, the technical standard that elaborates on Solvency II released in late July takes an even more liberal approach than was originally apparent. With backing from key EU states, though with some qualms expressed from the EU supervisor, the EU Commission is about to push through a more flexible capital framework.

A wide range of equity investments, including in some regulated funds, will benefit from preferential capital charges for long-term investments. Assets under public sector guarantees or those delivering on certain EU-wide policy priorities will similarly benefit from lower capital charges. Separate proposals released in June already eased capital requirements on investments in securitized assets, and, as we commented at the time, the proposals seem largely sensible and in line with the actual default record of these assets. The imminent Solvency II liberalization, therefore, fits a pattern of relaxation of other post-global financial crisis rules, such as securitization.

An insurer’s capital is an inherently subjective measure of funds in excess of future obligations to policyholders. The Solvency II revision in essence recognizes the predictability of cash flows from assets and of claims from future liabilities to a much greater extent, reducing the variability in regulatory capital. For instance, a risk margin that discounted the value of long-term insurance contracts, including to reflect changing interest rates, is now seen to have been excessive. Volatile asset values are less of a problem in light of long-term investment horizons. The so-called ‘matching adjustment’ will become more flexible, recognizing that for many firms, particularly those in life insurance, cash flows from liabilities are well matched with those from assets.

Taken together, these changes are set to free up capital buffers over and above the regulatory minimum. The EU insurance sector has been relatively resilient throughout recent market volatility. In the minds of policymakers, insurance firm failures seem rare, though the risk of a crisis in the sector seemed to weigh more heavily on the minds of supervisors. Because of the crucial role of insurers for the real economy, the systemic disruptions of an individual capital shortfall could be particularly severe. Non-life insurance, with its typically short-term contractual horizons, could be particularly prone to rapidly withdraw coverage.

Since the Solvency II revision was first initiated, risks that could impact insurers’ capital buffers may have become more complex:

- European Insurance and Occupational Pensions Authority (EIOPA), acting as the EU-level supervisor, has for some time flagged that climate change physical risks will complicate calculating appropriate capital coverage for insurers. A risk unlike any other may well defeat insurers’ ability to predict future losses and price products accordingly. Solvency II is set to tighten criteria for climate risk calculations and will require more sophisticated analysis and data that go well beyond past loss records. Belatedly, and just like for Europe’s banks, insurance supervisors will need to have difficult conversations about the quality of data and the use of climate scenarios.

- Supervisors have also voiced concerns over less liquid and more opaque private assets becoming a significant part of insurers’ portfolios. Just like other investors, insurance companies are attracted to private markets and their seemingly higher returns and diversification benefits. Private asset exposures are particularly pronounced for life insurers that seem to see long-duration assets, such as real estate, as a good match for their liabilities of similar duration. Private asset holding will undermine the ability to liquidate assets to meet liabilities and unexpected cash demands. Valuation is also a potential problem, as it is subject to lags or biased from models or judgments. Lack of transparency will constrain credit ratings, while internal ratings are often opaque.

- Risks on the asset or the liability side that are hard to quantify could be a problem where national supervisors use their discretion under the EU framework. Unlike in the banking sector, there has been limited harmonization or centralization of insurance supervision. EIOPA, with its roughly 150 staff in Frankfurt, is largely limited to coordinating national agencies, holding few powers of its own.

It is clear that the implementation of the new capital framework by supervisors will define success of this more flexible framework for risk-bearing and long-term assets:

- Unlike in the EU banking sector, insurance supervisors operate on national grounds, with some discretion, and they may be challenged by limited resources. The EU should streamline processes and design a presumption for the treatment of certain asset types that would encourage industry investment.

- The predictability and speed of approvals by supervisors are key factors in ensuring success. The UK’s Prudential Regulation Authority (PRA) is now consulting on a framework that would speed up approval of specific assets for more generous capital treatment within portfolios in which assets and liabilities of similar cash flow profiles are matched.

- The treatment of the expanding private assets portfolio will require skills and consistent treatment by supervisors. Complex assets require experienced investment managers (see, for example, our assessment of governance issues here). Supervisors accustomed to conservative bond portfolios will need to skill up.