Excess Reserves at the Fed: Lazy Money or Potential Hazard?

It wasn’t so long ago that bankers were embarrassed to keep excess reserves at the Federal Reserve. Explaining to investors why they were hording a ton of money in the Fed’s vault where they earned nothing couldn’t have been an easy discussion come quarter end. Moreover, keeping too much at the Fed was almost an admission that things were “unsettled” at your bank.

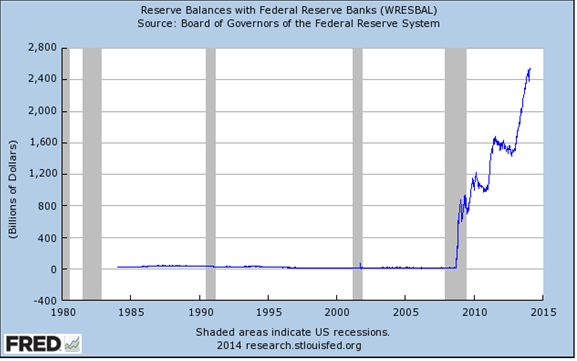

But that was before the Fed became the easiest, no-risk 0.25% a banker could earn anywhere, anytime. Launched in the days of fog and fright in 2008, the Fed’s decision to pay interest on excess deposits was a way to enable banks to earn on their excess funds overnight without having to put their money at risk on the solvency of their fellow bankers. That solvency was in question due to the lack of transparency into what they all held in on-balance-sheet loans and mortgage-backed securities, and in off-balance derivatives and securitization trusts. Weeks after introduction of the Fed’s deposit program, deposits climbed from a mere $9 billion to more than $800 billion. The sum topped $1 trillion in October 2009, and currently stands at more than $2.5 trillion.

Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis: Reserve Balances with Federal Reserve Banks (WRESBAL); http://research.stlouisfed.org/fred2/graph/?s[1][id]=WRESBAL; accessed February 10, 2014.

That $2.5 trillion amounts to a lot of what my fourth grader’s science class would call “potential energy,” i.e., energy that is ready for release under the right circumstances. It is part of the adjusted monetary base noted in this post from October 2012.

The big question is whether the Fed can keep this energy at bay until it wants it released without creating the financial equivalent of a nuclear reaction. No one really knows because these are unchartered waters and reaching heights that are at the least rare, if not first-time-ever economic circumstances.

The Fed under former Chairman Ben Bernanke expressed confidence that it could “sop up” the excess liquidity in the marketplace without any difficulty. If it were so easy, and considering that the banks have had so little use for the reserves — why else would they leave them on deposit for a mere 0.25% per annum — then why didn’t the Fed do something about it before now? It wasn’t like those reserves were fueling a robust economic recovery. One could make the case that the interest on those deposits would go a long way toward rebuilding bank balance sheets, bruised and battered from the bungled mortgage lending in the last decade.

Yet, the balances at the Fed have continued to grow, even as those balance sheets have recovered. Since January 2013, alone, banks added more than $1 trillion to their Fed balances, a 67% increase in one year.

I have my doubts about the Fed’s ability, let alone its willingness, to engage in “sop up” ops, now or in the medium term. But I don’t know what to make of this huge pile of bank cash sloshing about in the Fed’s vault. It doesn’t look like the old greed shibboleth accorded to bankers. After all, the 0.25% may be easy money, but it is anything but greedy.

Does it mean, as the Austrians would say, we will see inflation in the future? Is it (the hording of funds at the Fed) the reason small and medium-sized enterprises are fishing the crowdfunding markets for capital? Is this a cause or an attribute of the “tapering” growth in the economy?

I’d like to open the forum to readers to see what you think this means.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: ©iStockphoto.com/FaberrInk

Updated 24 February 2014 to correct error in second paragraph