Where to Find Valuable Investment Information

One of the existential considerations for investors is: Where do I find valuable investment information on companies?

This question is so natural to the investment process that every single person in our business encounters it early in their career. But this encounter is usually charged with a bit of terror, too. Why? Because each of us recognizes that our business is fundamentally about understanding information, and yet there is a tsunami of investment data to sift through. How do we digest this information and turn it into mental nutrition? How do we extract the signal from the overwhelming noise? And, of course, there’s the perennial anxiety: What if I overlook something valuable that my competitors do not miss?

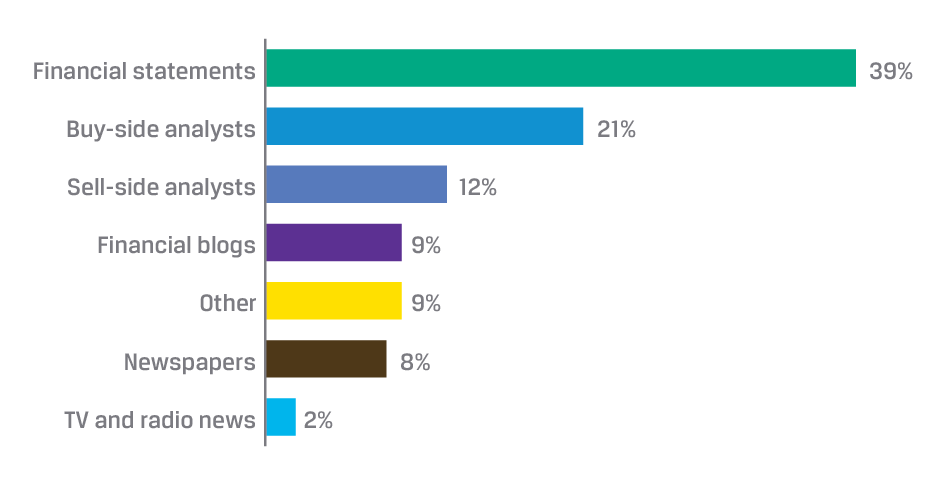

It turns out that the answer to this existential question takes a good deal longer to discover than it does for investors to recognize the puzzle. Deciphering an answer was the focus of our most recent CFA Institute Financial NewsBrief poll. Among the 536 respondents, the plurality (39%) said that the most helpful source of valuable investment information on companies comes from their financial statements. This answer is entirely understandable as the epicenter of the earthquake of information on a business originates within the company itself. All other data about a firm is derived from its own activities. Yet, companies have large economic incentives to appear alluring to investors. This self-serving flimflam means that each of us must be diligent in our analysis of financial statements. And, of course, regretfully, mistakes are sometimes made.

Consequently, many analysts look for bulletproofing as protection against a company’s financial statements. For about one in three of us, this protection comes courtesy of our professional analyst peers. Of this group, by a ratio of almost two to one (21% to 12%), poll respondents believe buy-side analysts protect against the financial fallacies of firms better than their sell-side counterparts. Again, I am guessing this preference has to do with an understanding of incentives and how they can push objective data into the realm of subjective opinion and appearances. Of course, there is more embedded in respondents’ answers than mere bulletproofing. Analysts also source information about a company’s competitors, the operating environment, management, channel checks, and so forth. Our peers can also be relied upon to poke holes in our own theses.

Where do you find the most valuable investment information on companies?

Some of us also seem to recognize that objectivity is difficult for buy-side analysts, too. For example, if they already own shares in the business, then they likely want your bid above the spread and at large volumes, in order to push up the share price. Thus, some respondents to the poll rely upon the advice proffered by financial blogs (9%). Obviously, as a writer for Enterprising Investor, this makes me smile. I hope that we count among the community that inspired this answer. Many bloggers strive to not only report the truth, but also to discover it through proper contextualization: placing a company’s investment information within the appropriate framework to reveal an essential understanding! Huzzah!

Perhaps surprisingly, the formal media — newspapers, television, and radio — rank only about as high as financial blogs, registering 10% combined among poll respondents. Maybe this is because the information tidal wave concerning companies and their operating environments is barely contextualized by the media. Instead, the facts are usually all that is provided. At best, a comparison to a prior quarter or a recent company-related newsworthy event will be mentioned (e.g., “since the new CEO took over,” “since the launch of their new product,” or “since the collapse of pricing in the industry”). What is usually missing is the preferred context of the investor digesting the media’s information, as well as a time horizon that jibes with the investor’s outlook. In other words, media information requires more work to make sense of.

Lastly, almost one in 10 poll participants opted for “other” as their preferred source of information. To fill this answer in with more substance, it would be fantastic if some of these respondents shared what some of these sources are in the comments section below. After all, we are all trying to answer the same question: Where do we find the most revealing and valuable investment information on companies. In the meantime, you may be interested to know that the finishing touches are being put on a first-of-its-kind Investment Idea Generation Guide. Look for it soon!

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.