Women on Corporate Boards: Global Trends for Promoting Diversity

We last explored the topic of gender diversity on boards, in particular the underrepresentation of women on them, late in 2012, but much has happened globally on the subject since then. More countries have adopted regulation on the issue that range from “comply-or-explain” rules to quotas for the percentage of women on boards.

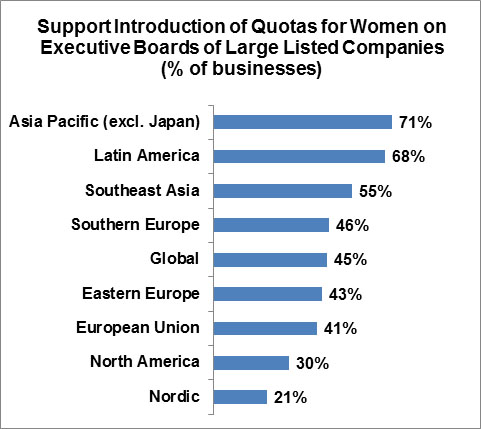

A 2014 Grant Thornton report, Women in Business: From Classroom to Boardroom, finds more leaders warming to a quota system, with 45% of international business leaders supporting quotas — up from 37% just a year ago.

Source: Grant Thornton: Women in Business: From Classroom to Boardroom

Below is a brief summary of some of the most recent developments concerning women on boards.

Australia

Australia has been more successful than many other markets in boosting the number of women on boards. By August 2014, 18.3% of directors on ASX 200 boards were women, up from 8.3% in 2008, according to the Australian Institute of Company Directors (AICD). The percentage has nearly doubled from 10.7% in 2010. Over the past four years, the number of Australian boards with no women dropped from 87 to 42.

The AICD gets some of the credit for the increase in female board representation in Australia, as its diversity initiative includes a chairmen’s mentoring program that has led to a number of female director appointments since it was implemented. The AICD-backed Australian Securities Exchange diversity reporting guidelines were adopted in 2010 and started a board training program for women in the corporate pipeline.

Brazil

A bill pending in the Brazilian Senate would impose a 40% female quota on the boards of state-owned enterprises by 2022. At this time, the rule would not apply to public companies that are not state-owned. The measure was first proposed in 2010, but has not been acted on to date.

Canada

In January 2014, the Ontario Securities Commission (OSC) drafted comply-or-explain rules that would require companies listed on the Toronto Stock Exchange (TSX) to disclose policies and targets for female directors as well as how many female directors they have. At the time, a majority of TSX companies did not report any of this information.

In March 2014, the Boards of Directors Modernization Act was introduced to the Canadian Senate. The act received a second reading in the Senate in July and was referred to the Standing Senate Committee on Banking, Trade, and Commerce.

If enacted, the boards of directors of public companies, state-owned enterprises, and certain financial institutions would have to comprise at least 40% women and 40% men. These quotas would take effect as of the sixth annual meeting of shareholders and policyholders after the passage of such a law, and the quotas would be 20%, respectively, as of the close of the third annual meeting.

In June 2014, a federal advisory council of business leaders recommended a target level of 30% female board representation within five years, but rejected a quota system.

European Union

In November 2013, the European Parliament voted 459 to 148 (with 81 abstentions) to back the European Commission’s proposed law to improve gender balance on the boards of European companies. The legislation would require nonexecutive directors to be 40% women by 2020, up from 16.6% in 2013

Small and medium-sized enterprises are excluded from the scope of the directive, but EU Member States are invited to support and incentivize them to significantly improve the gender balance at all levels of management and on boards. Member States cannot exempt companies from the law where members of the underrepresented sex make up less than 10% of the workforce, as was originally considered in the rule.

Under the Parliament’s text, sanctions for failure to respect the provisions concerning selection procedures for board members should include exclusion from public procurement and partial exclusion from the award of funding from the European structural funds.

The rules would apply to large listed companies within the EU by 2020 that have more than 250 employees, and state-owned companies by 2018. If enough European governments back this proposal it could become law. However, there may be a “blocking minority” of countries that do not support the issue of enforced quotas, preferring to adopt voluntary measures.

To become law, the Commission’s proposal needs to be adopted jointly by the European Parliament and by the EU Member States in the Council (which votes by qualified majority). The rule is currently pending joint adoption by European Union Member States and European Parliament.

France

In July 2014, the French Parliament adopted a bill referred to as “real equality between women and men.” It touches on the issue of women on boards, as well as many aspects of French life, and reaffirms the application of the Zimmermann Copé law of 2011. The law requires French public companies making at least 50 million euros in turnover and employing more than 500 workers to have 40% female board representation by 2017. The real equality bill would extend the Zimmermann Copé requirements to companies with more than 250 employees, with a goal of achieving the 40% threshold by 2020.

In this arena, France is outperforming the US and UK, according to an Ethics & Boards report. It finds as of 12 June 2014, more than 30% of directors on boards and supervisory boards of CAC 40 companies were women, topping levels of Dow Jones 30 companies (23.5%) and FTSE 100 companies (22%) at the same time.

A paper published in June compares and contrasts the French and EU methods used to achieve a better gender balance on boards. It suggests that the French approach is wider reaching as it covers executive as well as nonexecutive board members, while executive directors are exempt under the EU plan.

Germany

In November 2013, Germany’s Christian Democrats and Social Democrats agreed on a gender quota on supervisory boards. Issuers would be required to have women comprise 30% of nonexecutive directors by 2016. According to the plan, as of 2015 major companies would be required to set their own binding goals for increasing the number of women on their supervisory boards. The planned legislation would require firms that don’t meet the 30% mark to leave those seats vacant.

At the end of 2013, among the 30 largest companies on Germany’s blue-chip DAX index, women held about 22% of supervisory board seats and about 6% of executive board seats.

The current plans under discussion by the government would apply to listed companies with employee representation on their supervisory boards, which would affect more than 100 firms.

The quotas are to be phased in beginning in 2016, with the emphasis on filling vacancies with women rather than overhauling supervisory boards.

India

In 2013, the Indian Parliament enacted a new Companies Act, which replaced the original 1956 law. The new law made many changes to corporate governance in India, including a mandate that all listed companies must have at least one woman on their board of directors. Diversity on boards in India is currently low, because many companies do not have any female directors; as of 2010, only 5.3% of directors at Indian companies were women. .

Many companies are expected to meet the October 2014 deadline for naming women to the board, yet there is concern that some companies may not honor the spirit of the new rule, instead naming women who are connected to the leadership of the company. This has already happened at Reliance Industries Ltd., which recently named the wife of the company chairman to the board.

Italy

An Italian law that took effect in 2012 sets a target of one-third as the proportion of women on boards at Italian-listed and state-owned companies by 2015.

The terms of these so-called “pink quotas” are set at:

- One-fifth of the members of the board of directors for the first year

- One-third of the members of the board of directors for the following years

The regulatory body for the Italian Stock Exchange (CONSOB) will issue a warning to noncompliant companies, asking for compliance within four months.

If a company does not comply, CONSOB can impose a monetary penalty between €10,000 and €1 million. If noncompliance continues, CONSOB can terminate the appointment of a company’s board members.

Japan

In early 2014, Prime Minister Shinzo Abe announced the goal of increasing the percentage of women in executive positions at Japanese companies to 30% by 2020. On 3 September, he named five women to his Cabinet, sending the strongest message yet about his determination to change deep-seated views on gender and revive the economy by getting women in leadership positions. In time, these women would likely increase the percentage of females on Japanese boards, but to date no government action has been taken concerning this issue.

As of 2012, only about 1% of board members in Japan were women.

Netherlands

In 2013, new legislation came into force in the Netherlands concerning gender diversity on boards. Under the law, large companies (net turnover of more than €35,000 and more than 250 employees) should strive to have at least 30% of the seats in their executive boards and in their supervisory boards held by women, and at least 30% of these seats held by men.

The quota is not mandatory. If a large company does not meet the quota requirements, it must provide an explanation in its annual reports on why the quota has not been met and address ways it plans to meet the quota in the future.

The legislation is also temporary. The law will be suspended on 1 January 2016, at which time the Dutch government will evaluate its results and then decide whether to extend the regulation.

Norway

Norway was one of the first countries to introduce a law calling for a quota for women on boards; the quota was set at 40% in 2003. A recent study looks at some of the results. Released in 2014, the study finds that Norway’s quota law has not led to the appointment of unqualified directors as companies feared. Researchers found that the qualifications of women appointed to boards of public companies have improved since the reform. Researchers also found that quotas for boards have not reduced gender inequality overall within Norwegian firms, and has not shifted the wage gap between men and women.

Singapore

The Diversity Task Force regarding Women on Boards (DTF) was set up in 2012 by the Ministry of Social and Family Development to examine the state of gender diversity on boards, and its effect on performance and governance. In April 2014, the DTF issued a report that shies away from recommending quotas concerning women on boards, but acknowledges that gender diversity is lacking on the boards of Singaporean companies.

The report makes 10 recommendations:

- To continue highlighting the importance of gender diversity for the long-term competitiveness of our companies and economy.

- To place more importance on gender diversity in the Code of Corporate Governance and the Singapore Exchange’s rules.

- To involve captains of industry as role models, advocates, and mentors.

- To introduce programs to train and develop board-ready female candidates.

- To give awards and publish rankings.

- To publish research on gender diversity as well as establish a local resource on best practices.

- To leverage on existing “board match” initiatives in corporate and nonprofit sectors.

- To develop gender diversity policy for the board and company as well as discuss gender diversity at board meetings.

- To adopt a formal search and nomination process for board appointments (including the use of search firms or professional associations where appropriate and necessary).

- To implement initiatives or programs to help qualified women to take on senior management or board positions.

United Kingdom

The 30% Club was launched in 2010, and remains one of the forerunners in pushing for more female representation on boards. The club members are chairs, CEOs, or equivalent roles at companies and other organizations who support the mission of the club to place more women on corporate boards. Although the group was founded to push for more female representation on boards in the United Kingdom, the group now boasts clubs either recently launched or starting this year in Australia, Canada, Hong Kong, Ireland, and the United States.

In January 2014, the UK Professional Boards Forum released a report showing that women now make up 20% of FTSE 100 boards, up from 17% early last year. The report suggests that the UK may reach 25% by 2015, a goal set by the Mervyn Davies review in 2011.

A progress report on women on boards released in March 2014 by the UK Department for Business, Innovation & Skills showed that the representation of women on the boards of FTSE 250 companies rose from 12.5% in 2011 to 20.7% in 2014. The report highlighted progress made in placing women on boards and in opening new avenues to leadership positions for women, but also addressed the challenges of reaching the targets set by the original 2011 report of 25% board representation. The report found that only 25% of executive search firms claim a commitment to the code on their websites, and just 12% share data on their success rate in hiring women. The report goes on to recommend creation of a database of board-ready women to share with search firms and boards.

United States

The 2013 Catalyst Census: Fortune 500 Women Board Directors report offered some sobering news for those pushing for more women on boards in the US. According to the survey, released at the end of 2013:

- Women held 16.9% of board seats in 2013, virtually no change from the previous year (16.6%).

- In 2012 and 2013, less than one-fifth of companies had 25% or more women directors, while one-tenth had no women serving on their boards.

- Less than one-quarter of companies had three or more women directors serving together in 2012 and 2013.

- Women of color held 3.2% of board seats, essentially the same as 2012 (3.3%).

In March 2014, the Thirty Percent Coalition, which is committed to the goal of women holding 30% of board seats by 2015, launched its Champions of Change initiative to convince US corporate issuers to promote women on corporate boards. The group believes that gender diversity on boards can be achieved by:

- Corporate leaders committing to developing and recruiting talent:

- Taking steps to ensure that women candidates are routinely sought and included in the pool from which director nominees are chosen for every board search.

- Identifying within their corporations the senior executive women who are potential external board candidates, and developing and sponsoring them for membership on other corporate boards in accordance with company policy.

- Boards adopting best practices for improving gender diversity:

- Adopting and implementing governance policies and practices that eliminate barriers to gender diversity in areas such as board recruitment, candidate screening, committee assignments, and overall board participation.

- Committing to policies in support of board member inclusiveness, realizing that gender diversity requires a critical mass of women on each board.

- Including in governance and nominating committee charters the goals of diversified board representation, inclusive of gender.

- Expanding director searches to include director nominees from corporate positions beyond chief executive officer and from diversified environments such as former government, academia, and nonprofit organizations.

In May 2014, the UK 30% Club, which aims to have 30% of board seats filled by women by 2015, launched a US chapter. Similar clubs have opened in Hong Kong and New Zealand, with further clubs planned in Canada, Ireland, and Australia. The 30% Club in the US has a similar mission to the US Thirty Percent Coalition, which also aims to have 30% of board seats filled by women by the end of 2015. It is unclear at this time if the two groups have worked together.

In June 2014, the Pax Ellevate Global Women’s Index Fund launched, which tracks companies with a large share of women directors and in management. The fund is a joint effort by US socially responsible investing (SRI) fund Pax World and Ellevate Asset Management.

A recent survey by PWC’s Center for Board Governance in September 2014, titled Governance Trends Shaping the Board of the Future, found that board gender diversity is seen as very important by 61% of female directors and only 32% of male directors. Only 4% of female directors said that gender diversity was not very important, while 20% of male directors felt this way.

CFA Institute Position

CFA Institute supports board diversity but does not have an official position concerning the specific issue of women on boards or quotas. Our official position on board composition and the rationale behind it is as follows:

Position: The board should strive for a diversity of backgrounds, expertise, and perspectives, including an increased investor focus.

Rationale: Board composition with these attributes will:

- Improve the likelihood that the board will act independently of management and in the best interests of shareowners

- Reduce the influence of board members who are executive or financial officers of other companies who might have a natural inclination to support management’s perspectives

- Ensure that board members are able to understand the many complicated financial transactions and activities

- Ensure that company activities are presented properly in the financial statements

- Ensure that shareowner and investor views are considered along with the perspectives of CPAs.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo credit: iStockphoto.com/SergeyNivens