The Role of Data and Technology in Transforming Financial Reporting

Today’s financial reporting system is based on paper, as we noted in our 2013 paper “Financial Reporting Disclosures: Investor Perspectives on Transparency, Trust, and Volume,” and it neglects the ways that data and technology can improve the quality of information.

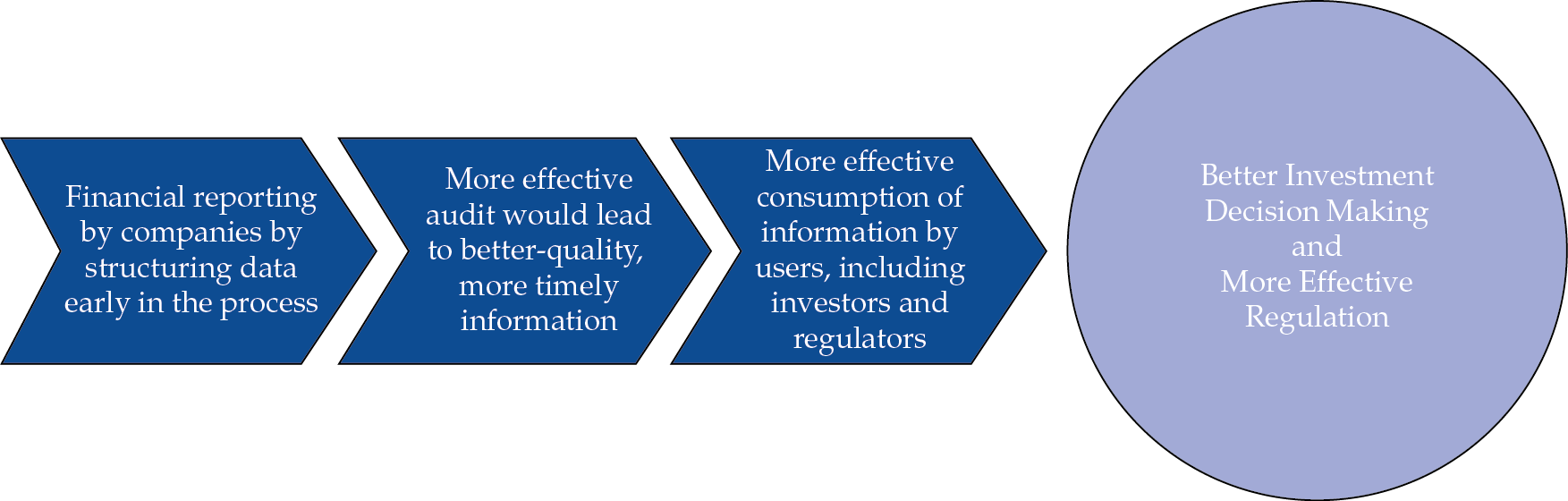

We conducted a study to examine the current financial reporting process, assess the inefficiencies in the system, and determine the ways that data, data analytics, and technology could potentially improve or even transform that process. The transformation would mean that investors — including CFA Institute members (primarily analysts and investors) — would receive more transparent information on a timely basis. The following figure shows that this improvement would lead to more effective investment decision making.

Financial Reporting Process: Companies

Let’s start at the beginning of the financial reporting process with companies. As noted in a PwC report, the current processes companies use of manually assembling and reviewing financial reports require both time and money. These processes can be enhanced by standardizing across disparate data sources or software silos the data and formulas used in the presentation of financial information and effectively implementing disclosure management applications. When data are standardized, these applications are able to pull information from different data sources to write automated reports, which will streamline current labor-intensive processes. Such standardization not only saves companies time and resources but also reduces errors in data because of less manual intervention. But to achieve these benefits, companies need to structure data early in the reporting process, not at the regulatory filing stage.

Financial Reporting Process: Auditors and Regulators

Structuring data early in the process would not only benefit companies but also would allow auditors to use data analytics to make an audit more efficient and potentially provide users with better quality and more granular financial information, in addition to more frequent reporting and possibly a higher level of assurance. The change in process would also allow regulators to use data analytics to cull structured data from financial reports to identify violations of financial reporting regulations.

Benefits to Investors

Investors also seek structured quantitative data — combined with management’s explanation of results in a quantitative and qualitative fashion — that are not bounded by the document in which the information is contained. With the availability of technology to sift through data and crunch the numbers, investors would be in a better position to perform faster and better analysis. When some of their finite resources are freed up, analysts can not only research more companies but also take a closer look at the companies they already follow, which would support better-informed investment decisions. Greater efficiency with higher-quality investment decisions is a win for the capital markets. Structured data could also bring bigger and better opportunities in small- to mid-cap companies by making it easier and less costly for analysts to cover these companies.

Role of Policymakers

To achieve these changes, regulators need to improve access to and the searchability of information within the regulator’s primary source documents. This step would serve to increase the use and the integrity of primary source information. Currently, data providers extract information and provide it in a substantially more useful format than existing regulatory filings, resulting in investors and analysts increasingly using such secondary sources. Improvements by regulators could even disintermediate the data providers and thereby truly democratize information.

Our Vision

In the report on our findings from the study, we outline our vision for the future — the broader and deeper use of structured data.

Structured reporting is most effective when it is applied broadly to all aspects of reporting — that is, to earnings releases and all regulatory filings, proxy statements, tax reporting, and so forth. And structuring needs to apply to all companies, big and small.

Furthermore, regulators need to require structured reporting beyond just the financial statements by applying structuring to all reports in their entirety, which will allow investors a deeper look into annual reports and other reports, including the notes and management commentary.

Broader and deeper use of structured data across all reports in their entirety would bring about untold efficiencies and transparency for all users.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©iStockphoto.com/Apiruk