Can Investors Make Money in a Low-Growth Industrial Economy?

The easy money has been made. I am not referring to picking the market bottom reached on May 9, 2009. That would have been speculation, not investment. In fact, just six months before I attended a conference where Emerson Chairman and CEO Dave Farr spent 10 minutes explaining that his cash and liquidity position could withstand a two-year depression with no profit. Every presenter who followed did likewise. I never want to see that again and neither do you. Many attendees, of course, are no longer in the business.

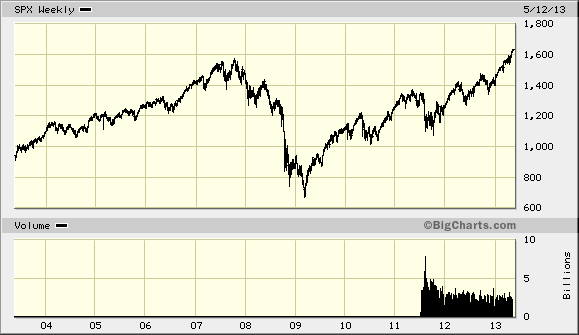

Stabilized conditions + Fire sale asset prices = Alpha. This sounds trite, but once conditions stabilized, easy pickings were available. Stability meant that (1) capital markets were functioning thanks to global government action, (2) unemployment had stopped rising, and (3) data points were improving (and “getting less bad” counts as improving). Fire sale prices to us mean big discounts on peak earnings. Leaving out “plunge” level lows — by the second half of 2009 the Lehman lesson had been painfully learned and governments were printing paper to prop up their banking systems and voter solvency but after that stock prices must climb a wall of worry. Generally speaking, they have. Next opportunity: end of the next recession.

Decelerating orders, revenue misses, and lowered guidance. Aside from that, first quarter results were fantastic. We remain in a moderate-growth global economy, which means moderate growth in demand for capital equipment. I see no significant change: We will continue to see one quarter slow followed by one quarter re-stock for some time as the United States, Europe, and Japan continue to work through high debt and graying populations. Governments, by and large, are doing about as well as can be expected in dealing with the twin urges of “spend less” and “spend more,” given the level of disagreement within their electorates, which amounts to a complete lack of consensus on almost anything. The United States is better positioned to recover sooner because residential real estate price improvement benefits employment, bank balance sheets, property taxes, and potentially even the immigration debate. China will grow, although slower than before and with a different focus than on exports.

Our macro outlook will be similar to others; where we differ is in how to play it. My firm collects, organizes, and analyzes data and information from 55 key global industrial companies across 10 key verticals and all major geographies, deriving deep granular insight. But to keep things simple, here is the thematic picture:

RESOURCES (Oil and Gas, Mining): Weak. The secular drivers are intact; the world wants more energy and hard commodities. Unfortunately, the capital investment party got out of hand and has led to overcapacity in both oil and gas (unused compressors on site in fracking areas) and mining equipment (layoffs and capital spending cuts) along with junior miners cutting projects and possibly reneging on taking deliveries). We believe that oil and gas will correct soon but that mining can — and likely will — get worse.

INFRASTRUCTURE (Power and Energy, Road, Rail, Marine): Long-cycle refining and chemical projects are progressing, which should be helpful beginning in the second half of 2013.

INDUSTRIALIZATION (Machinery, Automation, General Industrial): Machinery is generally weak outside of agriculture, but construction equipment inventory is working lower and comparisons get easier. Automation markets remain generally soft (a weak Europe means weak China exports, which means weak Chinese capital spending).

URBANIZATION (Construction, Consumer, Aviation): Improving. Residential construction is up (from a trough), the auto industry is stable, and aerospace build rates are increasing.

There are things to do, and there are things not to do. Patience, discipline, and common sense are key. I will be celebrating my 25th anniversary in the investment management industry on May 22. This means not only that I am getting older but also that I am starting to know what I am doing. Plenty of tread marks attest to those years. For all the supposed challenges of investing in a “global” world with “greater sophistication” and “high frequency” trading, I see the same (stupid) stuff happening — but faster. That’s fine with me. For example, from December 2012 to early February 2013, machinery stocks rallied strong in anticipation of a recovery in China and expectations of inventory drawdown for construction equipment. Why anyone thought a new regime in China could step into its new role, turn a key, and drive 10% GDP growth so that our stocks could go up is beyond me. And by early February, the market started to get the joke, pummeling the machinery sector right back down.

Things we like:

Bombardier (BBD.B TO): Investors need to own this. The company operates in two areas — commercial aerospace and passenger rail. Aerospace is what matters. BBD is migrating upward from its business/regional jet base and entering the narrow-body market with the CSeries. Investors get to play the aerospace cycle, share gain (CSeries), accelerating sales, margin and cash flow. Two near-term events should help: CSeries’s first flight by the end of June, the Paris Air Show in July. The first delivery takes place in 2014. As production ramps up, you get volume, leverage, and declining capital spending (to C$1 billion from C$2 billion by 2015). Where can the shares go? Our 3–5 year view is C$10–17 in 3–5 years depending on whether you wish to use happy juice or realistic scenarios. In the next 12–18 months, we see C$7 as very realistic, and it has been there in the last two years.

Caterpillar (CAT): We turned cautious in mid-2012 as construction began to roll over and guidance started coming down. Until recently, we remained on the sidelines, even as CAT caught a bid and ran up by 20% off its December low to the beginning of February on everything except actual fundamentals. The stock is now attractive in the sub-$90 area. Downside is 10 points to about $80, upside to $100 (firm) and possibly $115 (it’s been there twice over the past two years). While mining remains a mess, and will for longer than most people think, the company is still predominantly construction, and that piece is set to improve as excess inventory is worked down and production levels rise. Any time I get a 2:1 up to down ratio and fundamentals getting ready to turn in my favor, I want to buy.

Things we don’t like:

Eggplant, property taxes, and traffic jams. With respect to stocks:

Xylem (XYL): Water infrastructure (pumps, treatment, testing). Fairly valued stock (over 9 times EBITDA) with no growth because the customer is either broke (municipalities = 36% of sales) or not spending (industrial = 40% of total).

SPX Corporation (SPW): Frustrating stock. Trading around $75. Upside to $100+ on a breakup; recent involvement of Relational Investors has dramatically improved the capital allocation profile, which means they have to put a stop to management destroying shareholder value by overpaying for deals. Bad news — the breakup value is contingent on several things, including thermal being monetized (not currently possible), transformer recovery (happening, but takes time), and better execution.

Industrial automation names in general (fair value, weak growth): ROK, EMR, and ABB.

We encourage you to visit our website www.langenberg-llc.com, and you should follow us on twitter here.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.