Materiality: Investor Concerns

The Financial Accounting Standards Board (FASB) recently issued two proposals on materiality. Of the various proposed changes, we address one that may present the most significant concern for investors.

Topic 105, Generally Accepted Accounting Principles, states that provisions of current standards do not need to be applied to immaterial items. The proposed change indicates that disclosures are only required if they are material, which assumes that if an item is not material it is automatically immaterial.

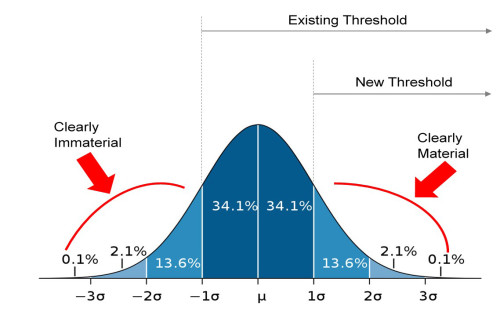

This may seem sound. However, as we state in our report Materiality: Investor Perspectives, certain items are clearly material and certain items are clearly immaterial. But there is a large gray area in which many items are subject to a high degree of judgment, as we illustrate here.

Investors are concerned that shifting the disclosure threshold from not disclosing items that are immaterial to only disclosing items that are material moves the disclosure threshold too far.

Investors worry that this language will leave certain disclosures in the gray area on the cutting-room floor and their materiality will not be fully evaluated.

For more on investor perspectives on this subject, please see our comment letter to FASB.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: CFA Institute