Edelman Trust Barometer 2015: Finance Services Industry Still Has Room for Improvement

The results of the 2015 Edelman Trust Barometer — which measure attitudes about the state of trust in business, government, nongovernmental organizations (NGOs), and media across 25 countries — reflect the myriad negative occurrences that filled the world’s news in 2014. “There has been a startling decrease in trust across all institutions driven by the unpredictable and unimaginable events of 2014,” said Richard Edelman, president and CEO of Edelman. “The spread of Ebola in West Africa; the disappearance of Malaysian Airlines Flight 370, plus two subsequent air disasters; the arrests of top Chinese Government officials; the foreign exchange rate rigging by six global banks; and numerous data breaches, most recently at Sony Pictures by a sovereign nation, have shaken confidence.”

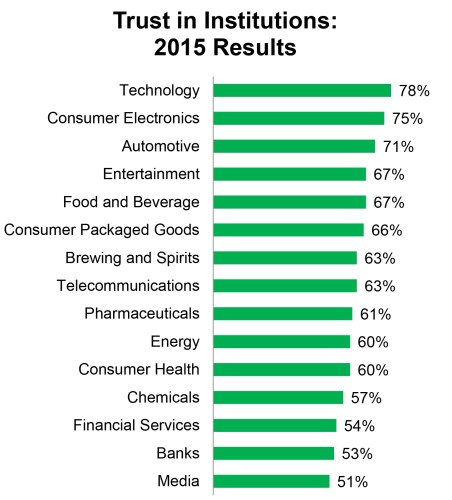

Not surprisingly, public views of banks and financial services remained largely unchanged, with trust levels of 54% and 53%, respectively, in 2015. The media ranks as the least-trusted institution in the survey at 51%. For the first time, online search engines are now a more trusted source for general news and information (64%) than traditional media (62%).

Source: 2015 Edelman Trust Barometer

Integrity and Engagement

The 2015 Edelman Trust Barometer sought input around key attributes for rebuilding trust, such as whether the firm has ethical business practices; has transparent and open business practices; places customers ahead of profits; and communicates frequently and honestly on the state of the business. Investment industry firms and individual practitioners that adhere to CFA Institute codes, standards, and guidelines understand the importance of these attributes in serving their clients.

Trust in Innovation

A new line of questions in the 2015 survey gathered insights on product and service innovations. When it comes to desired rates of innovation, 51% of respondents believe changes are occurring at too fast a pace. Further, the survey shows that business growth (66%) and greed/money (54%) are more likely the drivers of change over societal impacts, such as improving people’s lives (30%) and making the world a better place (24%). Through its Future of Finance initiative — a global effort to shape a trustworthy, forward-thinking financial industry that better serves society — CFA Institute recognizes the role the financial services industry can play for the greater good.

Survey respondents believe that government regulation is critical to improving transparency around business innovation. In response to questions about the desired level of regulation, 46% indicated that all businesses did not have enough regulations, compared to 24% who indicated that firms are over-regulated. When looking at the results for the financial services industry, the gap significantly widens: 54% said there was not enough regulation while only 15% cited too much regulation. Clearly, in this industry the public is looking to the regulators for protection.

What’s more, trusted companies are firms that demonstrate the benefits of changes and provide greater transparency. Alternatively, distrusted companies lack these organizational attributes. Ben Boyd, president of practices, sectors, and offerings for Edelman, offers a new formula for firm-led changes called “Trusted Innovation.” Boyd reflects on how Trusted Innovation is derived from the discovery process, the benefits of the innovation, and the integrity of the firm. These elements are further enhanced by the transparency provided from outside verification.

Boyd states, “We live in an era where trust must be earned and not managed, where the microscope for transparency is constant and where business must listen and measure the interactions, intentions and sentiments of shareholders. At the same time, the need and capacity for innovation that solves and disrupts has never been greater. Business can lead. For the world to follow — indeed for citizens to help clear the path forward — trusted innovation is the way.”

The need for this new formula is reinforced by the survey results, which reveal that 80% of respondents choose to buy products or services from firms they trust, and 63% refuse to buy from a distrusted company. And more specific to the investment industry, 28% bought shares of trusted companies, while 18% sold shares of companies they distrusted. For anyone active in the investment management industry, including the 1,100 firms claiming compliance with the CFA Institute Asset Manager Code of Professional Conduct, you have to consider both the reputation of your firm and the investments you recommend to clients.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo credit: iStockphoto.com/Mlenny

Interesting, but is the idea of restoring / improving “trust” over-rated?! Trust can be so easily abused (it is what enables sociopathic types to be so successful – a la Madoff et al). Perhaps instead we strive for fee transparency, clarifying probable payoffs (empirically supported strategies, anyone?) which are aligned with the goals of our clients, and educating our clients to be rigorously skeptical. Or as I think Harvard Negotiation Project said in one of their negotiating tomes “Trust, but Verify” (or was it “Don’t trust, and Verify”)? In sum, trust can be a goal to be earned – but surely it should not be freely given because of a PR campaign, or financial services lobby contributions… ?!

Thank you for the comments Celia.

We are in agreement that trust between a client and an investment professional must be developed and maintained over time. To that end, CFA Institute recommends many best practices that help individuals in the investment industry demonstrate their commitment to serving the interest of clients in a trustworthy manner. The more individual professionals and their firms work towards rebuilding the trust of clients, the greater the likelihood the general perception of the financial services sector will also improve.