ESG Education: Bridging the Gap for Better Informed Investment Decisions

In the 2015 Volkswagen emissions scandal, investors realized after the fact that Volkswagen was carrying significant governance risk. Similarly, in 2012, investors realized after the fact that South African mining company Lonmin was carrying significant social risk, when the company experienced a breakdown in its relationship with its workforce. Earlier, in the Gulf of Mexico oil spill in 2010, it was also a similar story. Investors realized after the fact that BP had a significantly worse health-and-safety record than its peer group and was carrying significant environmental risk.

Was it possible to better assess these risks before the fact using ESG analysis to complement traditional financial analysis?

That’s arguably a subjective debate. What is, however, not subjective in such cases is that there often is publicly available ESG information that could have helped investors better manage these risks.

The first step towards better ex ante ESG analysis is education regarding ESG issues. As part of its wider efforts to educate investment professionals to better manage ESG risks and opportunities, CFA Institute has published Environmental, Social, and Governance Issues in Investing: A Guide for Investment Professionals.

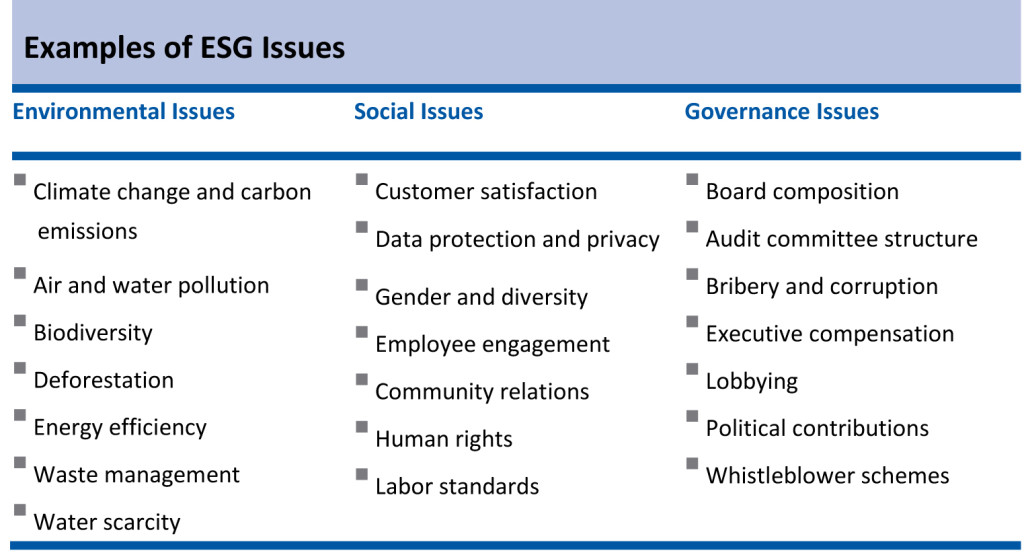

Examples of ESG Issues

There is no one exhaustive list of ESG issues. ESG issues are often interlinked, and it can be challenging to classify an ESG issue as only an environmental, social, or governance issue. These ESG issues can often be measured (e.g., what is the employee turnover for a company?), but it can be difficult to assign them a monetary value (e.g., what is the cost of employee turnover for a company?).

ESG Considerations Are Not New

The consideration of ESG issues in investing for economic value is not a new phenomenon. Many investors have long considered such issues in fundamental investment analysis by including an assessment of reputational risk, regulatory developments, or such megatrends as an aging population. Some ESG analysis is also built into traditional analytical frameworks, such as Porter’s Five Forces. The modern references to ESG analysis, however, refer to a systematic consideration of relevant and material ESG issues rather than to a cursory inclusion of one or more of them. The consideration of ESG issues is a complement to (not a substitute for) traditional fundamental analysis, and ESG issues remain relevant throughout the investment process — from the initial analysis to the buy/sell/hold decision to ongoing ownership practices.

Moral Values vs. Economic Value

Investors consider ESG issues for various reasons. Some may see them solely as economic risks and opportunities — a source of economic value. Others may see ESG issues not just as risks and opportunities but also as a matter of moral values. Those motivated by moral values may not wish to become complicit in actions they find objectionable or may actively attempt to make a positive impact on society or the environment. For instance, regardless of the economics of investing in the tobacco industry, an individual investor or a health-related charity may find investing in tobacco unacceptable because smoking is harmful to one’s health. But other investors may not share the same concerns. They may invest in the tobacco industry if they believe it is an economically attractive investment, and they may look at ESG issues simply to complement their traditional financial analysis. A fundamental point in the “value versus values” debate is that all investors pursue the same economic value (even if with different investment objectives and time horizons), but they inevitably have different moral values.

Focusing on the Relevant and the Material

There are numerous ESG issues, and an investment analyst must narrow them down to a set of issues that are most relevant and material. This process requires reasoning and empirical work and will vary by sector. For example, utilities face greater exposure to environmental risks than do software providers, just as clothing manufacturers face supply chain challenges concerning labor standards that do not seem to affect the financial services industry. A company that incorporates ESG exposures into its long-term strategic planning and adequately communicates that fact to investors will provide a more complete picture of its prospective value.

Relevance across Asset Classes

Most of the discourse on ESG issues has been focused on listed equities, but the practice of considering ESG issues with respect to other asset classes, most notably fixed income, is growing.

In fixed income, ESG issues are mostly about risk. ESG analysis in fixed income considers how such issues as carbon emissions, labor relations, and corruption might affect issuers’ creditworthiness. A useful reminder is the case of the mining company Lonmin. After violent labor conflicts in Marikana, South Africa, in 2012, the company was forced to issue a warning regarding the servicing of its debt. Thus, risk pertaining to social issues, which could easily be overlooked in a traditional financial analysis, could also prove costly for fixed-income investors.

Financial Performance

Financial performance is one area that has received substantial, if not the most, attention in research on ESG issues. The Sustainable Investment Research Initiative Library, a searchable database of academic studies, lists hundreds of research papers covering ESG issues, many of which are on performance.

In 2014, a report by the University of Oxford and Arabesque Partners analyzed about 200 studies to assess how sustainable corporate practices can affect investment returns. It concluded that “88% of the research shows that solid ESG practices result in better operational performance of firms and 80% of the studies show that stock price performance of companies is positively influenced by good sustainability practices” (Clark, Feiner, and Viehs 2014).

There are other such literature reviews and metastudies. The metastudy on ESG issues and performance by Mercer (2009) — “Shedding Light on Responsible Investment: Approaches, Returns and Impact” — reached similar conclusions.

The key point is that, on the whole, the empirical evidence does not support the notion that ESG considerations necessarily adversely affect performance.

The Bottom Line

The practice of considering ESG issues in investing has evolved significantly from its origins in the exclusionary screening of listed equities on the basis of moral values. A variety of methods are now being used by both value-motivated and values-motivated investors in considering ESG issues across asset classes. There is, however, a lingering misperception that the body of empirical evidence shows that ESG considerations adversely affect financial performance. For investment professionals, a key idea in the discussion of ESG issues is that systematically considering ESG issues will likely lead to more complete investment analyses and better-informed investment decisions.

If you are a member of CFA Institute and you would like to participate in our educational initiatives regarding ESG issues, we invite you to join the CFA Institute members LinkedIn discussion group on ESG issues in investing. Access ESG-related continuing professional development resources provided by CFA Institute, which are available to both members and nonmembers.

If you liked this post, consider subscribing to Market Integrity Insights.

Image credit: iStockphoto.com/Daniel Rodríguez Quintana