Ethics in Practice: Futures, Feed Yards, and Furtive Actions. Case for Week of 4 Dec.

Analysis now posted below!

There is no such thing as too much practice. Read on for this week’s ethics case. And be sure to tell us why you picked the answer that you did.

Case

Rosenthal Collins Group (RCG) is a registered futures commission merchant with a number of branch offices, including one in Memphis, Tennessee. Phillips is hired to be the branch manager of the Memphis office, supervising a number of employees, including Lewis. Phillips allows Lewis to work from home, and as a result, Lewis has no physical office in the Memphis branch of RCG or even access to the building. Unknown to Phillips or RCG, Lewis also works for another futures commission merchant (AFCM). Lewis arranges swap agreements for AFCM, including orders with several cattle feed yards. And through another employee at RCG, he helps open new futures accounts for the feed yards RCG represents. Although the other employee at RCG receives all the commissions for the feed yard accounts, she surreptitiously splits these commissions with Lewis. This commission sharing arrangement is also unknown to Phillips. Phillips actions as a supervisor are

- acceptable if RCG did not develop adequate policies and procedures for the detection and deterrence of possible misconduct by its employees.

- acceptable if Phillips was not provided adequate training from RCG on its compliance policies and procedures.

- acceptable if the RCG home office conducted regular audits of the Memphis branch.

- unacceptable because Phillips did not diligently perform his supervisory responsibilities.

Analysis

This case is about adequately exercising supervisory responsibility. CFA Institute Standard IV(C): Responsibilities of Supervisors states that “[CFA Institute] members must make reasonable efforts to ensure that anyone subject to their supervision or authority complies with applicable laws, rules, regulations, and the Code and Standards.” At a minimum, supervisors must make reasonable efforts to detect and prevent legal, regulatory, and policy violations by ensuring that effective compliance systems have been established. They must also understand what constitutes an adequate compliance system and make reasonable efforts to see that appropriate compliance procedures are established, documented, communicated to covered personnel, and followed. Supervisors must alert their superiors and firm management if there is an inadequate compliance system in place and work with them to develop and implement effective compliance tools. If the absence of or inadequacy of the compliance system prevents effective supervisory control, an investment professional should decline to accept supervisory responsibility until the firm adopts reasonable procedures to allow the effective exercise of supervisory responsibility.

If Philips knew that RCG had not developed adequate policies and procedures for the detection and deterrence of potential misconduct by RCG employees, it would be incumbent on him to bring this to the attention of RCG, help develop adequate compliance policies, or decline supervisory responsibility. In the absence of adequate compliance policies, it would not be acceptable for Phillips to act as branch manager. A lack of adequate policies would also not be an excuse for failing to detect potential misconduct by RCG employees, including Lewis, which means Answer A would not be correct. Similarly, if RCG did not properly train Phillips on RCG compliance policies that did exist, Phillips should decline supervisory responsibility until he adequately understands RCG policies and procedures and expectations for maintaining his subordinates’ compliance with those policies. Lack of training on how to supervise should not be an excuse for inadequate supervision but a catalyst to seek out that training, thus making Answer B not the right choice. A regular audit of the Memphis branch by RCG home office compliance personnel could be an excellent way to ensure that branch employees are complying with applicable law, regulations, and RCG policies. But it is not a substitute for effective and regular supervision by Phillips, the onsite branch manager, making Answer C incorrect. Although it is not clear from the case what steps Phillips did take to diligently exercise supervisory responsibility, the fact that Lewis worked from home and did not have access to the branch office, suggests that Phillip’s “hands on” supervision was minimal at best and obviously ineffective. Answer D is the best choice.

This case is based on an enforcement action by the US Commodity Futures Trading Commission from 2014.

Have an idea for a case for us to feature? Send it to us at [email protected].

More About the Ethics in Practice Series

Just as you need to practice to become proficient at playing a musical instrument, public speaking, or playing a sport, practicing assessing and analyzing situations and making ethical decisions develops your ethical decision-making skills. To promote “ethical exercise,” we are excited to introduce Ethics in Practice.

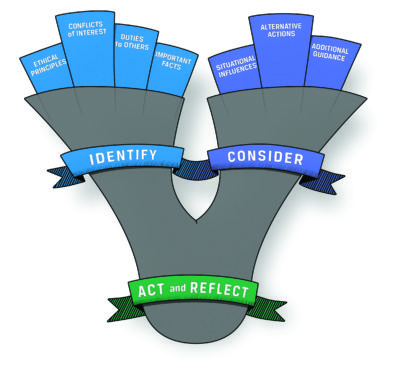

Each week, we post a short vignette, drawn from real-world circumstances, regulatory cases, and CFA Institute Professional Conduct investigations, along with possible responses/actions. We then encourage you to assess the case through the lens of the Ethical Decision-Making Framework and the CFA Institute Code of Ethics and Standards of Professional Conduct and let us know which of the choices you believe is the right thing to do and why. If you are not a CFA Institute member, you can post your choice and reasoning in the comments section below. For CFA Institute members, we would like you to join the conversation in our new Member App and post your responses there. Later in the week, we will post an analysis of the case and you can see how your response compares.

CFA Institute Member App

The Member App gives CFA Institute members access to a content from multiple CFA Institute publications, including these weekly Ethics in Practice posts. Best of all, the app allows in-app submission of Continuing Education credits, which members can earn by reading and participating in the conversation for each case. (0.25 CE, 0.25 SER). The app is available in the Apple and Google Play stores. After downloading, simply log in using your CFA Institute website credentials (e.g., [email protected] + password). Hint: Save the post to your library in the app to find it easily.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: ©CFA Institute