Coming Soon to an Income Statement Near You: Comprehensive Income

So, did Bank of America have a profit or loss in 2011? Well, as Jonathan Weil of Bloomberg News reports, that depends on how you look at it. The answer is either a $1.4 billion profit or a $3.9 billion loss. Although both numbers are accurate, it takes a little more digging to identify the latter loss in the company’s financial reports. While the net income stares you down on the face of the income statement, the loss hides behind a curtain known as “comprehensive income” — buried in the company’s statement of changes in shareholder equity where it is easy to miss. But that is about to change.

What Is Comprehensive Income?

It’s important to understand that comprehensive income includes traditional net income and also the effects of changes recorded in “other comprehensive income” (OCI). So what are comprehensive income and OCI? Comprehensive income and OCI are terms created by accountants nearly 15 years ago. While common in accounting parlance, many non-accountants and analysts are not familiar with the terms. OCI includes items such as the unrealized investment gains and losses on certain marketable securities; unrealized gains and losses on derivatives used in cash flow hedging; and gains and losses relating to pensions and other post-retirement benefits, foreign currency translation adjustments, etc. Basically, these are items that are politically unpalatable to the accounting standard setters for inclusion in traditional net income because of their volatility. As a result, OCI has been tucked away in the statement of changes in shareholders’ equity, where it is more difficult to find and understates the importance of these measurements.

Comprehensive income, meanwhile, includes all measures of income, meaning it is the sum of net income and other comprehensive income. Some companies present comprehensive income along with OCI in the statement of changes in shareholders’ equity, but most include this more complete measure of income — which offers a better picture of economic events impacting the organization in an accounting period — in the notes to the financial statements.

Presentation Alternatives

Beginning in the first quarter of 2012, the prominence of (not the elements or methods of computing) comprehensive income will be increased, which should help financial statement users better understand the causes of an entity’s change in financial position as well as results of operations. Companies will be allowed two options with respect to how they present comprehensive income:

1) Present comprehensive income and its components on the face of the income statement

2) Break the presentation into two consecutive statements, and present comprehensive income on a separate page.

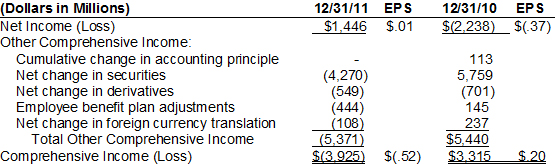

Under the revised presentation requirements, Bank of America would show comprehensive income figures on either the face of the income statement or in a separate consecutive statement as follows:

The expectation is that most companies will choose the option of presenting comprehensive income on a separate statement. Doing so will allow companies to de-emphasize sizeable adjustments that reflect volatility in earnings. One major apprehension with these presentation changes is that the long-established earnings per share (EPS) measure based on net income might give way to a separate EPS measured on comprehensive income. While we believe the most appropriate presentation is the single statement of comprehensive income, the added transparency provided by either of these presentation options, and the increased attention drawn to the components of OCI and comprehensive income, should increase investor awareness to key matters affecting income.

Other Comprehensive Income Needs Definition

CFA Institute supports comprehensive income as the most complete picture of an entity’s financial results and has argued for years against the use of OCI. Our argument against OCI is premised on the fact that OCI has never been properly defined in accounting or economic terms, and we believe it obscures information that is essential to financial statement analysis. Very simply, OCI is a political accounting construct, created by standard setters to deal with controversial areas. It is used to defer income statement recognition of valuation changes that would add volatility to reported net income. The line between net income and OCI has been arbitrary and does not reflect any underlying economic difference. The presentation changes are a first step in bringing to the fore the importance of comprehensive income. We would like the Boards to consider an earnings-per-share measure for comprehensive income as an evolutionary next step. Further, we are pleased to see that the FASB and IASB are considering projects to properly define OCI as a part of the current agenda-setting activities.

“Recycling”

The prominence of OCI and comprehensive income may also serve to raise awareness on something many analysts are not aware of — the concept of “recycling.” Recycling is the term used to describe when an economic event impacting the entity originated in OCI but was then transferred out of OCI and into net income. Take for example a bond whose unrealized gains, previously recorded in OCI, are ultimately recognized upon the sale of bond in net income. The unrealized gain was first recognized in OCI and then removed from OCI and reflected as a realized gain in net income. Due to the fact that such “recycling” or “reclassification” impacts are not identified in the financial statement caption in which they occur in net income, it is our concern that the impacts of these events may not be accorded economic meaning in the proper accounting period, and as a result, may be double-counted. The FASB proposed to display these reclassifications adjustments separately as a part of this change in presentation of comprehensive income, but then reversed its decision late last fall. We believe it is important for the FASB to continue with this project to display these reclassification adjustments so that the economic meaning of transactions is not obscured.

We would also observe that the FASB and IASB have different views with respect to what should or should not be “recycled” through net income. The FASB “recycles” all items, the IASB does not. These differences in treatment will permanently alter the comparability of net income, other comprehensive income, and comprehensive income. This lack of comparability is detrimental to investors.

A Step in the Right Direction

The movement toward comprehensive income is a step in the right direction as it gives prominence to economic events which impact the organization. The standard setters also appear willing to discuss what OCI really means as they pursue other matters on their technical agendas. This is progress, albeit slow, in arriving at more meaningful information. As investors look at the financial statements this quarter, this new presentation will allow them to have a clearer picture of comprehensive income and maybe do their own calculation of comprehensive income per share.

If you liked this post, consider subscribing to Market Integrity Insights.

Interesting Article, I am sure with greater transparency and upcoming IFRS convergence would help sort some of these issues atleast

Perhaps I am missing something in your recycling comments – is it not the case that an unrealised gain in OCI, when recycled, would still be recorded as a gain when realised in net income (and not as a realised loss as you state)?

Also, would the presentation described above not highlight any issues around double counting of such gains over the life cycle? There would be a ‘loss’ in OCI as the ‘gain’ is realised and recycled to the income statement. The incremental impact in comprehensive income should have been recognised prior to this event from the change in fair value of the instrument over the life?

OCI seems to be a more complete way of reporting but does creat volatility.

OCI should be eliminated and everything reported under Net Income.

We agree with you. We have long advocated for the elimination of OCI.

In many of our comment letters you will see we have asked the standard setters to define what OCI represents and what should be included in OCI.