Investment Property “Entities” — Seriously? Measure All Real Estate Investments at Fair Value

The International Accounting Standards Board (IASB) has long had guidance on how to measure investment properties. Recently, the Financial Accounting Standards Board (FASB), to achieve consistency with its counterpart across the pond (at least that was the theory), set out to measure some investment properties at fair value. But what it came up with was quite different from the IASB guidance.

Indeed, the FASB’s recent proposal devises a new type of entity: Investment Property Entities (IPE). The proposal lays out six criteria that an entity must meet to qualify as an IPE. And it requires only those entities qualifying as IPEs to measure their investment properties (real estate held for investment purposes, as opposed to all other real estate) at fair value. Unlike the IASB guidance, the requirement to measure investment properties at fair value is not based upon the asset itself. Rather it is based on who owns the asset (an entity-based approach) and why they say they own it (an intent-based approach).

Oppose Entity- and Intent-Based Approaches

The FASB has not explained — perhaps because it defies explanation — how the economic value of an asset differs depending on what sort of entity it is “housed” in. Nor does an asset’s “value” differ because management expresses an intent, which can change over time, to hold it for investment purposes. This is not grounded in economic logic.

Surely an asset’s value goes up or down depending on the market, not because of who owns it or why. Fair value is the most relevant measure for all investment properties — not only for those held by these so-called IPEs — because it reflects what is going on in the marketplace.

Relevance of Fair Value for Real Estate across Broad Spectrum of Enterprises

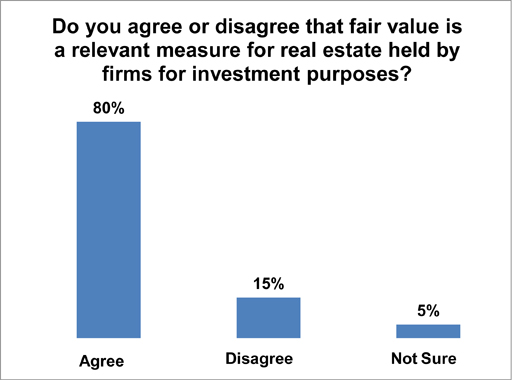

We asked our members whether they believe fair value is the relevant measure for real estate held by firms for investment purposes. A staggering 80 percent of survey respondents said it is!

Our members have told us they believe fair value is the most relevant measurement basis for investment properties irrespective of the type of entity owning the real estate. We believe it is reasonable to assert that fair value is the most relevant measurement basis for all real estate properties (not just investment properties) held across a broad spectrum of enterprises (not just IPEs).

In our comment letter to the FASB, we analyze several examples that provide empirical evidence of the relevance of real estate fair value information to the investment decision-making process across a range of enterprises:

- Real estate development and/or operating companies (St. Joe Company)

- Entities which invest in real estate to support operating activities (MetLife)

- Businesses that utilize real estate in their operations (Sears)

- Diversified businesses (General Electric)

In this blog post we provide one of the examples, but we would encourage you to consider the other examples contained in our letter as they are amazingly vivid illustrations of the point we are making to the FASB.

Let’s look more closely at the St. Joe Company. A recent Wall Street Journal article, “St. Joe Pares Back Its Florida Vision,” analyzes an SEC filing where the company discloses a long-awaited impairment charge as a result of adopting a “new real estate investment strategy.” This strategy resulted in a real estate write-off of $374.8 million — nearly 80 percent of the value of the related real estate of $466.2 million — to a value of $91.4 million. The write-off represented nearly 40 percent of the company’s total assets and equity prior to the write-off. Until then, the company had not disclosed the fair value of the real estate.

The article talks about two well-known fund managers, Bruce Berkowitz (long position) and David Einhorn (short position) who took opposite views on the company based upon the underlying — but undisclosed — real estate fair values. Why is this example important? Because it illustrates that while Berkowitz and Einhorn may have had very different views regarding the value of the real estate, the fair value of the real estate is highly relevant to the valuation of such companies — companies which would not be IPEs under the FASB proposal and thus would not disclose fair value in the financial statements. It does not matter which party is right; what matters is that both parties took different positions based upon the lack of available information regarding real estate fair values. The example illustrates that fair value of real estate is relevant even if housed within a real estate operating company like St. Joe.

Further, the example illustrates fair value is relevant irrespective of management’s stated intent. In this circumstance management intent changed over time because market conditions forced the change (the stated intent to develop was unrealistic and the underlying market conditions driving the fair value of the property prevailed). Management’s desired intent was irrelevant.

The St. Joe Company example also demonstrates that while sophisticated shareholders such as Berkowitz and Einhorn, who have the resources to obtain estimated property values from tax records, may have an informational advantage over other shareholders, even they may not be able to make reliable estimates given the lack of sufficient disclosure. Only management had the complete information upon which to obtain reliable fair value estimates.

Our view is that this example (and the three others in our comment letter) illustrate why it is important that real estate investment properties be measured at fair value — even in entities that are not IPEs — and that fair value be disclosed for all other real estate. Investors are best served when valuable, relevant information is provided in a timely manner.

Approach We Suggest the FASB Take

We support an asset based approach that requires measurement of investment properties at fair value with disclosure of fair value information for all other real estate.

Fantastic article……I believe that IASB standards has the good guidance to measure investment properties. I would trust them 🙂

hi mohini can you plz tell me how to prepare for level exams in india

Julia: Thanks for your comment. Mohini

Those examples about real estate illustrates that the fair value is relevant irrespective of management’s stated intent. Glad to know that there is now guidance on how to measure investment properties.

I agree. Only with relevant information will property investors be able to make informed decisions. I hope the FASB agrees with this and amend its guidelines accordingly.

Fair value for all types of properties makes sense. Thank you for this enlightening post!

Great article Mohini! Interesting thoughts, transparency is crucial for informed real estate decision making. An asset based measurement approach does make sense and would support this notion.

Thank you for this post. True, measurement of real investment properties should be based on economic logic.

Thank you all for your comments. CFA Institute will continue to monitor developments in this space.

I concur. Just with applicable data will property financial specialists have the capacity to settle on educated choices? I trust the FASB concurs with this and revise its rules as needs be.