Treasury China Trust: Governance Clouds Value

ERRATA: (23Nov2012) Since original publication on October 3, we have become aware of two factual errors in this post. (1) We referred to Richard Barrett as “self-appointed Chairman” of THRE, when in fact Mr. Barrett was appointed by the Board of Directors of THRE. (2) Our assertion that Treasury Holdings owned about 30% of TCT is incorrect. In addition the chart on TCT structure is now replaced by an organization structure that is extracted from the Introductory Document of TCT dated 21 May, 2010. TCT and THRE are separate entities and therefore our statement that the winding up of Treasury Holdings will have implications on TCT unitholders is incorrect.

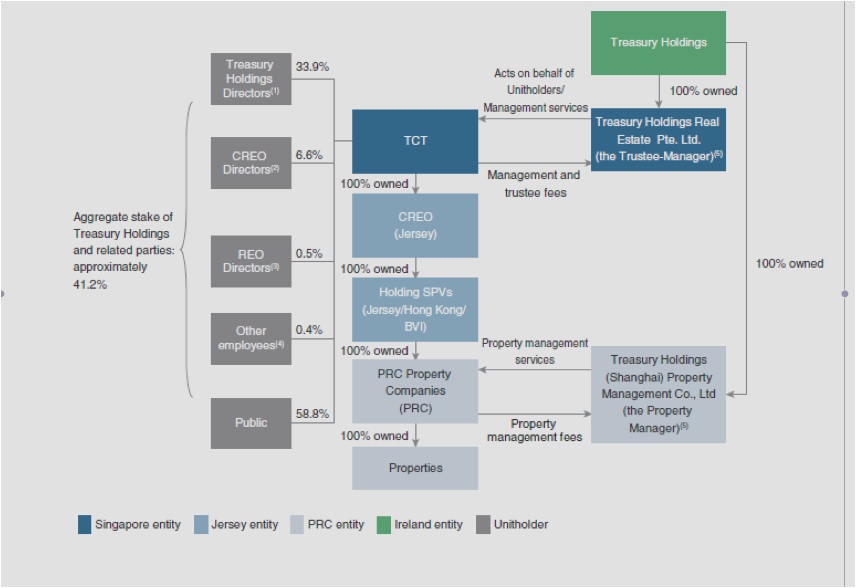

Business trusts are gaining popularity in Singapore. A variety of companies outside of Singapore have used this structure to list their assets there. One of these business trusts, Treasury China Trust (TCT), was in the news recently in Singapore for poor governance and potential financial difficulties. TCT was listed in June 2010, and the assets are properties mainly in Shanghai but also in Beijing and Qingdao. It is a profitable company, and the latest half-year results are impressive — its net property income is S$33 million, EPU is S$0.098, NAV is S$4.49, and its debt to asset ratio is 33.4%. So what is the problem? The problem is not with the assets in TCT but with what is happening in Ireland as the controlling shareholders of TCT — Richard Barrett and John Ronan, who together own about 30% of TCT through Treasury Holdings (TH) — are facing financial difficulties through their property development projects in Ireland. The National Asset Management Association (NAMA) and KBC Bank Ireland have petitioned the High Court in Ireland to wind up TH; this has resulted in a fight for control over TH between Barrett and the liquidators. If the liquidators are appointed to TH, they will have control over Treasury Holdings Real Estate Pte. Ltd. (THRE, the trustee-manager), TCT, and the Treasury Holdings Property Management (THPM, the property management company that manages the assets in China). This sets the stage to discuss governance issues surrounding TCT and why investors need to be aware of ongoing developments.

A business trust, unlike a listed stock, can be likened to a REIT, but with a few important differences. Business trusts do not only operate in the real estate sector but also invest in other businesses such as shipping vessels or infrastructure. Unlike REITs, which are collective investment schemes governed under Singapore’s Securities and Futures Act, business trusts are subject to regulations in the Business Trusts Act. When business trusts invest in real estate, they are not restricted to just passive investments in real estate but can undertake property development. (More information on REITs in the Asia-Pacific region can be found in the 2011 CFA Institute publication on building trust through better REIT governance.)

In the REIT model, the trustee and manager are separate. In the business trust model, the trustee, which is referred to as the trustee-manager, is both the legal owner and manager of the trust assets. To provide better investor protection, the majority of directors in a business trust must be independent from management and business relationships with the trustee-manager. (A summary of the differences between listed companies, REITs, and business trusts in Singapore can be found in a 2011 Business Times article.)

The ongoing TCT case brings up a number of issues resulting from business trust regulations. The shareholders of THRE have sole discretion on the appointment of the directors of the trustee-manager, and Barrett is the self-appointed chairman. TCT’s unitholders have no say on the appointment of directors of the trustee-manager. At present, the trustee-manager can only be removed or dismissed with a 75% vote by unitholders; Barrett and Ronan currently control about 30% of the TCT units and are allowed to vote on any resolution to remove the trustee-manager, which they own.

THRE was owned by TH, a Dublin-based property developer, until recently. It had debts of €1.7 billion to NAMA and €75 million to KBC Bank Ireland, according to the Irish Times. NAMA and KBC Bank Ireland are petitioning Ireland’s High Court to have TH wound up, and the next hearing will take place on 9 October. To protect TCT from TH’s creditors, THRE was sold to Oriental Management Services limited (owned by Barrett). In addition, TH’s shares in THPM were also transferred to Oriental.

Adding to the complex situation is a convertible bond (worth S$59.7 million, or about €37 million), which TCT issued in February 2011. THRE said that holders of these bonds will have the right to cause TCT to redeem them if a liquidator is appointed to TH and successfully challenges Barrett’s purchase of THRE using his company. THRE said it intends to take all steps necessary to bolster its cash position in the meantime. This includes disposing of two of its properties, Central Plaza and Beijing Logistics Park. The worst-case scenario, which includes the winding up of TH and TCT having to redeem the convertible bonds, may have a significant impact on the unitholders.

Good governance and transparency is put to the test in such a situation, and investors should take note of ongoing developments at TCT. First, THRE removed its three independent directors on 25 July. The removed independent directors claimed that TCT had been slow in releasing information on legal action facing TH in Ireland.

In a 26 July press release, TCT announced that four new independent directors had been appointed. THRE now has a total of seven directors and has met the regulatory requirements to have a majority of independent directors on the trustee-manager board. There is one caveat though. The vice chairman and lead independent director have received consultancy fees from TCT over the past three years and, therefore, do not qualify to be an independent non-executive director (INED) under business trust regulations. There is, however, a loophole in the business trust regulations on regulation number three. If the THRE board is satisfied that the director can exercise independent judgment and ability to act with regard to the interests of all unitholders, he can be designated as an independent director.

Second, the sale of THRE and THPM were valued by two accounting firms, and the transfer price of €2.263 million was based on the higher of the two assessments. In 2011 the two companies received €15.7 million in fees from TCT, a related-party transaction. If TCT was listed as a REIT or a listed company under SGX listing rules, the rules on related-party transaction would have applied to the sale of these two assets to Oriental. This sale would have required disclosure of the firms that conducted the valuation and required shareholder approval.

Third, the plan to sell two properties to raise cash to repay bonds will further impact the long-term profitability of TCT. TCT is already trading at a deep discount to the net tangible assets of TCT — the current price of around S$1.05 compared to the NTA of S$4.49 (as of 30 June).

Fourth, when TCT issued S$59.7 million of convertible bonds in February 2011, should it have disclosed the significant terms and conditions of the bonds to unitholders? On 7 August, TCT made public that in the event of a change in control of THRE, as a result of action taken by the government of Republic of Ireland relating to any debt of TH, the bondholders will have a right to redeem in whole the convertible bonds issued.

The transfer of TH holding of the shares in THRE to Oriental is to provide a “legal fence” in the event that TH fails to stop the Irish court from appointing a liquidator to TH. Only time will tell whether this defense mechanism will work? On 9 October, its unitholders will look to Ireland. On that day the High Court is set to consider a winding-up petition against TH, and the results will have implications for TCT investors.

If you liked this post, consider subscribing to Market Integrity Insights.

Interesting. What does the Singapore regulator think about this?

Whilst we are pleased to see the two corrections made by the CFA Institute to this blog, and to the Business Times article which was written as a consequence of this blogger’s comments, we would like to use this forum to make a third and far more important correction to the bloggers comments at an event where he presented these opinions, a point which was subsequently picked up by Business Times and which we are disappointed has not been made clear to its readers as part of this Institution’s corrections, and that point is this: there is no question that the liquidator appointed to Treasury Holdings will ever have the authority or right to sell TCT assets in settlement of the outstanding debts of Treasury Holdings. Clearly this is of crucial importance to our investors and we find it disappointing that this question was left hanging in his speech and not subsequently clarified via the Business Times, after the situation was explained to him, along with the corrections they did choose to make.

We also note that the author has tried to caution readers over the corporate governance of TCT. The few matters raised in the article as evidence of “Good governance and transparency put to the test” were conclusively addressed in a forum hosted by SIAS on 18 Sept 2012 in Singapore and widely covered by all major media in Singapore.

Cindy Ma

Director of Investor Relations

Treasury China Trust