Bank Regulatory Capital: What Does Enhanced Transparency Look Like?

The underperformance of major global banking stocks since 2007 is, in part, indicative of the belated recognition by investors that banks had for too long been too highly leveraged. Adequate loss-absorbing equity capital is necessary to ensure the solvency and financial stability of banking institutions. Although the determination of regulatory capital is usually considered the purview of prudential regulators, both bond and equity investors pay significant attention to regulatory capital levels. Thus, ensuring sufficiency and comparability of loss-absorbing capital is necessary to restore investor confidence in the banking sector.

Capital guidelines such as Basel III aim to remedy excess leverage of the banking sector by improving the quality and quantity of capital buffers. Relative to Basel II, Basel III requires tighter definitions of Tier 1 equity. For example, common equity has been increased from a minimum of 2% to between 7% and 12% (i.e., inclusive of countercyclical and conservation buffers and a systemically important financial institution (SIFI) surcharge). That said, depending on their jurisdiction, global banks tend to be at different stages of adoption of Basel requirements. For example, Japanese and many other countries’ banks have adopted Basel III, while EU banks have delayed adoption of Basel III and U.S. banks are still applying Basel I.

Why Regulatory Capital Transparency Matters for Investors

Regardless of the capital guidelines that banks adhere to, investors would be interested in the following aspects when they are evaluating regulatory capital levels:

- Transparency of regulatory capital attainment: How is regulatory capital determined? What measures are banks taking to meet regulatory capital? How do these measures impact on shareholder value?

- Comparability: Is the regulatory capital, which is derived from risk weighted assets, comparable across reporting institutions? Incomparability of regulatory capital can effectively arise due to significant differences in methods used to determine risk-weighted assets.

Transparency of Regulatory Capital Attainment is Important

A 2012 Bank of International Settlements (BIS) paper analyzed 100 global banks and observed that between 2008 and 2011, large European, U.S. and Japanese banks raised their common equity-to-total assets ratios by 20%, 33%, and 15%, respectively. To replenish capital and meet minimum regulatory capital requirements, banks have to take one or more of the following steps:

- Raise new equity capital

- Shrink their balance sheets by selling assets

- Increase retained earnings through generating profitable operations and/or through avoiding dividend payments and share buybacks

These actions can either positively or negatively impact long-term shareholder value. For instance, payment of dividends in a stressed environment could benefit investors in the short term but also increase the likelihood of shrinking balance sheets and reduced profitability — if there are difficulties or it is undesirable to raise equity finance due to depressed bank stock prices. Incidentally, the BIS paper observed that banks have retained a steady dividend policy of 5% of book equity even during periods when earnings plummeted. It is not clear whether such a sustained dividend policy is beneficial for long-term shareholder value.

Furthermore, the BIS paper noted that since 2008 Japanese banks have experienced asset growth and ostensibly raised capital ratios via equity issuance, while U.S and EU banks usually raised these ratios by shrinking their balance sheets. Regardless of choice, a clear discernment by investors of how banks are achieving their capital ratios is necessary, and disclosures, which shed light on financial policy and capital management choices, are beneficial to investors.

The Financial Stability Board Enhanced Disclosure Task Force (FSB EDTF) issued a report in October 2012 with recommendations of enhanced disclosures. These included:

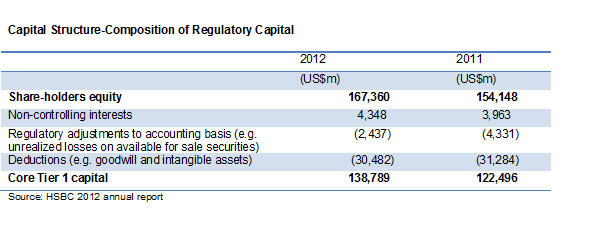

- Disclosures that provide greater granularity around regulatory capital composition, including a reconciliation of regulatory capital to the accounting book equity

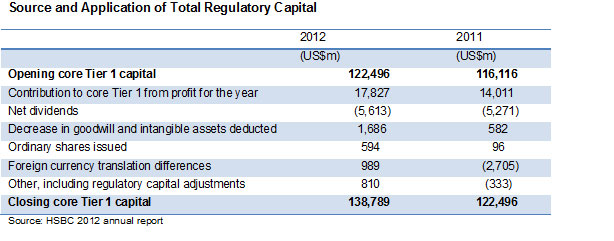

- A statement of source and application of regulatory capital across reporting periods (i.e., a flow statement)

As the HSBC 2012 annual report excerpts below show, these disclosures contain very useful analytical information. The reconciliation effectively provides granularity around regulatory adjustments. The breakdown within the reconciliation and flow statements gives a sense of the adjustments made to book equity (e.g., goodwill) whilst determining regulatory capital. It also readily illuminates on key capital management and financial planning choices. For instance, dividends comprise 4.6% and 4.5% of book equity in 2012 and 2011 respectively, while equity issuance was less than 1% of book equity for the same reporting periods.

Comparability Challenge: Inconsistent and Limited Transparency around Risk-Weighted Assets

Comparability Challenge: Inconsistent and Limited Transparency around Risk-Weighted Assets

Consistent with reflecting risk-adjusted capital, a key input to determining regulatory capital is the determination of risk-weighted assets (RWAs). Apart from the significant question of whether RWAs are correctly calibrated to reflect the risks of all assets and liabilities, a vexing issue has been the inconsistent determination of RWAs across banks. For example, it has been widely noted that EU banks have much lower levels of RWAs when compared with U.S. banks. In addition, a January 2013 sell-side equity research paper from Barclays shows that RWA for EU banks have been dropping since the early 1990s and that investors struggle to trust RWAs.

There also tends to be limited transparency from banks regarding the methods, inputs, and assumptions used to determine RWAs. It is challenging to understand why RWAs varied from one period to the other. Due to the noted shortcomings, the EDTF recommended enhanced disclosure of RWAs in its report, including:

- A flow statement of the period-to-period changes of RWAs

- A breakdown of the assumptions and inputs that influence RWAs

Broader Application of EDTF Disclosures Would Benefit Investors

The primary question for investors is the extent to which regulatory capital reflects the economic capital necessary to safeguard bank solvency. The question of sufficiency can be informed by having comparable measures of regulatory capital across banks. The EDTF recommendation to enhance the disclosures of regulatory capital and RWAs provides a useful reference point.

These disclosures can also illuminate how the regulatory capital levels are attained such that investors can judge whether the strategic and financial policy choices have a positive or negative impact on shareholder value. As previously discussed, the opportunity to enhance investor trust in banks exists if major banks can more broadly adopt these types of enhanced disclosures.

Photo credit: ©iStockphoto.com/carterdayne