Navigating a Maze: Audit Profession’s Solution for Disclosing Engagement Partner

The debate continues regarding the Public Company Accounting Oversight Board’s (PCAOB) proposal to require disclosure of the name of the engagement partner in the auditor’s report. This topic was covered in a recent CFA Institute blog post on audit transparency and accountability. An interesting subplot is emerging in the debate over where to provide the disclosure.

The Center for Audit Quality (CAQ) is essentially a lobbying organization for the public accounting profession, with a publicly-stated objective of being “dedicated to enhancing investor confidence and public trust in the global capital markets.” It objects to identifying the engagement partner on the face of the audit report. However, should the PCAOB decide to require disclosing the engagement partner against the CAQ’s wishes, the CAQ wants it reported on the PCAOB’s Form 2. Investors on the other hand — the very group that the CAQ seeks to protect — strongly favors disclosure of the engagement partner on the face of the audit report.

Here is what the CAQ says in its comment letter to the PCAOB:

However, we do not believe the identification of the engagement partner will provide meaningful information to financial statement users or results in audit quality, and could result in many practical challenges and liability considerations, particularly if such identification is included in the auditor’s report. Should the Board continue to move forward with this aspect of the Proposal, we believe some of these challenges would be mitigated if identification of the engagement partner was reflected within the Form 2 filing, with possible submission of this information on a more timely basis, or in the audit committee report (or elsewhere in the proxy statement), as opposed to including the information in the auditor’s report.

The CAQ goes farther in its letter to say that Form 2 is a more appropriate alternative to reporting in the auditor’s report because it is “convenient and accessible for financial statement users.”

What is PCAOB Form 2? All public accounting firms file a Form 2 with the PCAOB at least annually, and it lists basic information about the audit firm and the public companies it audits. If the proposal is adopted, this is where the name of the engagement partner could be found, based on the CAQ proposal.

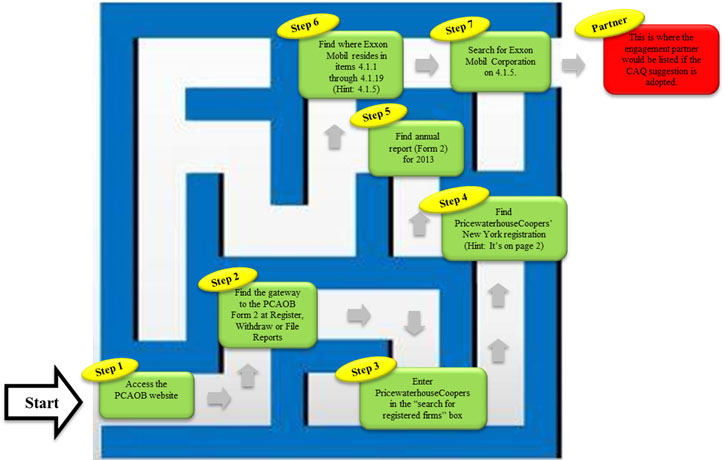

How to Find the Engagement Partner on the PCAOB Form 2

So, just how convenient would it be for an investor to access this information? We thought we would try accessing it for a random company like Exxon Mobil. You also try the seven “easy” steps and judge for yourself.

Is this really a convenient way for investors and others to locate the engagement partner? We don’t think so. We believe that disclosure of the engagement partner should be readily transparent and easily accessible by placing the information directly in the auditor’s report.

Photo credit: iStockphoto.com/Jorisvo

CAQ,’s stance speakers for itself. Who are they really trying to protect. If it is really investors, there is no question about where this disclosure should be, right in the audit report.Seven easy steps to find it? Really?

I agree fully with Ivy Hesse.