Bank Risk-Weighted Assets: How to Restore Investor Trust

As we delve deeper into the bank earnings season, it is worth taking a closer look at two important risk and performance metrics: risk-weighted assets (RWA) density, which is defined as “RWA/total assets,” and return on risk-weighted assets (RoRWA), where RWA rather than either total assets or book value equity is the denominator of this particular profitability metric.

Take for instance HSBC Bank, which recently reported an RoRWA of 1.5% for the year ended 2014. This return is lower than the stated target of 2.2% to 2.6%, but it still stacks up relatively well when compared to average Europeanwide bank RoRWA during recent years (e.g., 0% in 2008, 1.3% in 2010, and 0.5% in 2012), as shown in a 2013 Bain report (Balancing between Risk and Return). Yet, how effectively investors are able to interpret any particular ratio depends, in large part, on the comparability of the underlying inputs, and RWA is a common input for calculating both RWA density and RoRWA.

Notwithstanding the daunting complexity and fluid state of the Basel capital adequacy rules, the risk-weighting methodology — which necessitates assigning risk weights whilst determining RWAs and thereafter determining the necessary capital requirements — makes both intuitive and economic sense. For instance, a €10 million German government loan, with an assumed though sometimes questionable zero risk-weighting, should have a lower overall risk-weighting and capital allocation than a residential real estate loan of the same magnitude but of higher credit risk. That said, a recurrent concern voiced by investors and other stakeholders in recent years is the limited comparability and the unexplained, and possibly unwarranted, variation of RWAs across countries and banks.

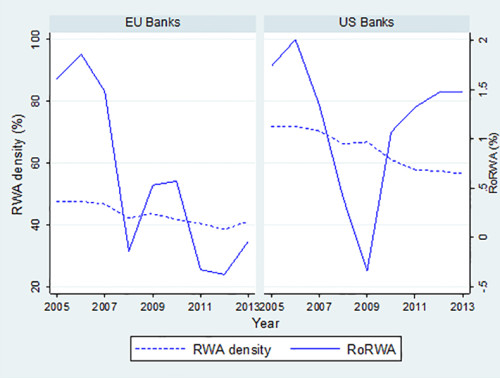

There has also been a question of whether aggregate RWAs effectively signal relative aggregate risk across banks. In other words, is a higher RWA density bank really a riskier bank, or are there phases during the economic cycle in which sounder banks will have a higher proportion of RWAs. The below chart illustrates the multi-period trend of RWA density and RoRWA across a sample of US and EU banks. Though the RoRWA multi-period trends sensibly reflect how bank returns changed through the economic cycle, there is the notable trend of either declining or near flatlining RWA density across these banks that is difficult to readily economically interpret. For the EU banks, a part of the decline can be explained by the shift from Basel I to Basel II requirements (as we explain below).

RWA Density and RoRWA Trend Analysis

Source: Bloomberg

In addition to Barclays Capital’s 2012 research (“Bye, Bye Basel,” featured in an FT Alphaville article and various other outlets), which highlighted investors’ mistrust of RWAs, there is a series of excellent papers from the International Monetary Fund, Basel Committee, and several other organizations that shed light on the factors underpinning the variation of RWAs across countries. These include the following:

- Revisiting Risk-Weighted Assets: Why do RWAs differ across countries and What Can be Done About It?

- Working Paper: The credibility of European banks’ risk-weighted capital: structural differences or national segmentations?

- Basel Regulatory Consistency Program: Analysis of risk-weighted assets for credit risk in the banking book

- Basel Regulatory Consistency Program: Analysis of risk-weighted assets for market risk

The factors causing variation include, but are not limited to, the following:

- Variation of business model and asset mix across banks

- Varied levels of adoption of Basel requirements: Basel II requirements, unlike Basel I, allows a variety of methodologies for determining RWAs including internal rating-based (IRB) models. IRB models allow flexibility on the probability of default (PD), loss-given default (LGD), and exposure at default assumptions applied by banks that are deemed to have sophisticated risk-management capabilities. Furthermore, Basel 2.5 requires risk-weighting for market risk while earlier versions of Basel do not.

- Variation in model assumptions (e.g., point-in-time versus through-the-cycle PD, and LGD for low-default asset classes)

- Differences in supervisory requirements across countries

Effectively, RWA differences can be explained, in large part, by differences in business models, asset mixes, methodology, modelling inputs, and supervisory regimes. In addition, observed RWA density differences between US and EU banks (US seems to have higher RWA density) can be explained by differences in accounting offsetting of financial assets requirements during balance sheet presentation that result in relatively lower total assets for IFRS (International Financial Reporting Standards) reporting banks (see update on IFRS offsetting requirements).

That said, across different empirical studies, there is an acknowledgement of unexplained RWA variation. For example, the Basel regulatory consistency assessment of hypothetical portfolio exposures across banks reveals unexplained differences for these similar portfolios, though in theory they should be expected to yield the same level of RWAs.

What are the remedies to the challenges investors face with RWAs and, by implication, derived performance and capital adequacy ratios? Multiple ideas have been proposed, including prohibiting IRB-based methodologies because of their built-in flexibility that undermines the generation of comparable RWAs, a situation that is exacerbated by the limited transparency of underlying inputs within IRB models; imposing constraints on IRB parameter estimates; expanding the mandatory disclosure requirements; and harmonizing the supervisory regimes across countries.

Enhanced Disclosures Necessary

The push for enhanced and comprehensive disclosures including Pillar 3 and those proposed by the Financial Stability Board Enhanced Disclosure Task Force (EDTF) would certainly benefit investors. For example, the RWA movement statement helps to identify how changes in RWA during a particular reporting period are respectively driven by changes in book quality (risk exposure), methodolgy and policy, and model updates, etc. In the latest HSBC and Barclays annual reports, there is a clear and helpful delineation of RWA movement, as shown below:

RWA Movement Statement - 2014 Annual Reports

| HSBC | Barclays | |

|---|---|---|

| Billions | USD | GBP |

| RWAs at 1 January 2014 | 534.8 | 442.5 |

| Foreign exchange movement | -20.1 | -1.5 |

| Acquisitions and disposals | -8.5 | -14.5 |

| Book size | 37.6 | -17.4 |

| Book quality | -11.2 | -5.3 |

| Model updates | 13.6 | 11.9 |

| Methology and Policy | 52.2 | -12.9 |

| Other | -0.9 | |

| RWAs at 31 December 2014 | 598.4 | 401.9 |

In addition, the disaggregation of RWAs by assets class and methodology (standardized, foundation, and advanced IRB) that is disclosed can help financial statement readers to contextualize the extent to which any two banks can be compared.

Is Assurance of RWAs Needed?

Another area of discussion is whether investors should require assurance on disclosed risk-weighted assets. If so, what level of assurance would suffice; for example, is it adequate to provide assurance on the governance, internal control, and processes behind the generation of the risk-weighted assets, or should the assurance be closer to that provided for financial statements, including notes to the financial statement where auditors opine on whether reported numbers are materially misstated? Is there any trade-off between desirable reporting frequency and obtaining assurance? These are just some of the considerations that are shaping the evolving discussion on whether assurance is required for RWAs to add to the credibility of these reported numbers.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo credit: iStockphoto.com/Dutko

This is one of the best RWA articles I seen in couple of years sir

Mm

Thanks for the feedback, Marc.

Mr. Papa,

This is an excellent article on RWA transparency and preventing potential gaming of risk-weights.

To me, the best course would be to have detailed RWA to assets reconciliation statements in the notes to the financial statements, which would be reviewed by auditors.

The additional checks and transparency would provide comfort to both investors and regulators.

Urval,

Thanks for your comments, and I agree that a linkage between regulatory/risk disclosure information, with similar information presented in financial statements and notes to financial statements (e.g. IFRS 7 disclosures), is beneficial.

This is an excellent article and it was very useful for my bachelor degree’s thesis about a comparison between european and american supervisory systems.

I have only a question, how is the sample of banks built? thanks a lot in advance!

Papa,

That was an excellent piece on RWA. You really provided justification for the use of RWA density. I am going to cite this in my paper ‘Internal Controls and Credit Risk in Europe’ which I am working on for a conference in June 2016. I hope to contact you for more and further discussions.