Sliding Down the Slippery Slope: Simplified Standards for Small Public Companies?

In our report Addressing Financial Reporting Complexity: Investor Perspectives, released in 2013, we talked about how on the one hand, the creation of separate simplified reporting standards for private companies would certainly reduce companies’ compliance costs. But on the other hand, it would make it more difficult for investors to compare private and public companies and thus increase the burden for those who invest across both private and public companies.

We also warned that the creation of private company standards could be a slippery slope leading to different standards for different types of entities. Now, there is talk of possibly applying the simplified private company standards to small public companies.

In 2004, the Financial Accounting Standards Board (FASB) established the Small Business Advisory Committee (SBAC) to obtain more active involvement by the small business community in the development of financial reporting standards. In 2016, the FASB shifted the primary focus of the SBAC to small public companies. The role of the SBAC is to “Assist the FASB and its staff in their consideration of whether private company accommodations should be extended to others in the small business community (for example, banks and other small public companies).”

Concerns with Extending to Public Companies Same Accounting Alternatives

Now, the FASB is contemplating extending private company accounting alternatives — meant

to reduce compliance costs — to public companies. This approach is different from the FASB’s normal due process. Normally, topics are added to the technical agenda based on a demand from constituents for improvements in financial reporting rather than exceptions granted simply to reduce compliance costs.

The concern is that changes to private company accounting that were intended to reduce compliance costs are subsequently being used to alter the accounting and disclosure requirements for public companies. The basis for the change to private company accounting was not grounded in the need to most appropriately reflect the underlying economics of transactions in the financial statements and provide the most decision-useful information to investors, which any modifications to reporting standards for public and private companies should be based on. And those modifications should be added to the agenda, subjected to the same due process, and provided with the same degree of profile and awareness as other standards.

In fact, extending private company standards to small public companies may well increase complexity for investors because they will have to determine which companies are applying the simplified standards and which companies are not. The responsibility will be on investors to price these differences.

Accounting Alternatives Shouldn’t Be Extended to Public Companies

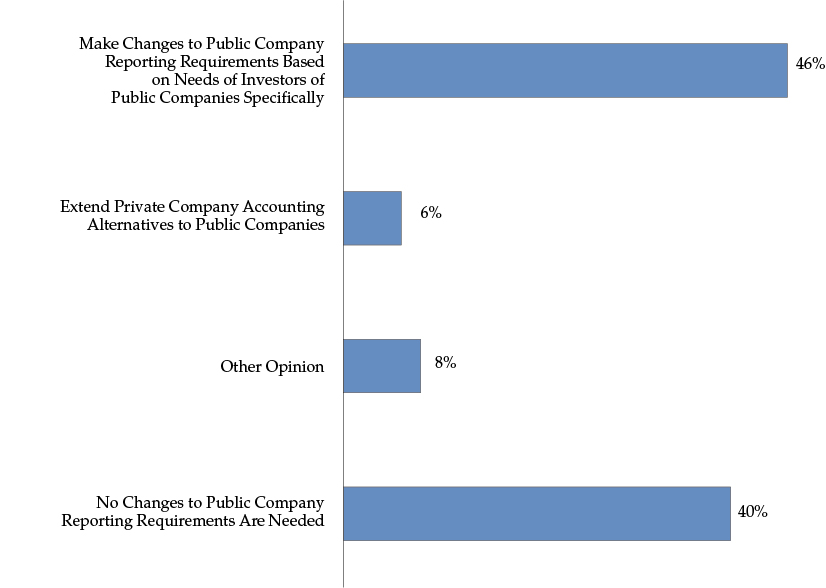

In the report mentioned earlier, we provided results from a survey that sought insights from investors on the impact of separate private company reporting requirements on investors’ financial analyses as well as how investors view extending such reduced requirements to public companies.

The findings, shown in the following figure, support our assertion. Only 6% of survey respondents believe that private company alternatives should be extended to public companies. Instead, respondents believe changes to public company reporting requirements should be based on the needs of investors of public companies. This quote from a survey respondent sums it up well:

Changes in public company reporting are needed but such changes are unrelated to decisions regarding private company reporting.

Private Company Simplifications Should Not Be Extended to Public Companies

Note: The question was, “With respect to the financial reporting requirements of US public companies, do you believe the FASB should…?” N = 156

In addition to creating separate private company standards and extending some of these alternatives to public companies, the FASB’s efforts to address perceived reporting complexity is intended to “simplify” requirements under full US GAAP. Similar to efforts to create separate US private company standards, this initiative also appears focused on reducing cost and complexity for the preparer community.

Finally, financial reporting complexity is a necessary consequence of the operating, investing, and financing choices made by businesses throughout the economy. But some companies that may be less likely to engage in these complex business transactions — especially very small companies — will not be required to apply the more complex accounting rules.

We suggest that if a company chooses to enter into complex business transactions, then the financial reporting complexity it faces is a consequence of that decision. If companies have the business acumen to enter into complex transactions, then it is reasonable to expect them to have or be able to obtain the accounting expertise to account for such transactions.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: ©Getty Images/SusanWoodImages