Investors Want Complete and Quality Financial Disclosures, Not Necessarily Less

At the Data Coalition’s Financial Data Summit in March, the predominant sentiment in the room was one of optimism about the current administration’s stance of being pro-business. And pro-business was equated with spurring the business community to be more active in the economy by reducing the number of regulations it faces.

There was a consistent cry from corporate representatives about disclosure requirements being voluminous, costly, and often immaterial as well as about the burden of having to provide the same information to different regulatory agencies.

What seemed to be missing from the room — other than the lone voice of CFA Institute — was the investor perspective. What was concerning was the singular focus on the regulatory burdens of preparers. No one seemed to be concerned about how reducing the reporting burden on corporations by simply reducing disclosure requirements might impact investors. Also concerning was the view that somehow being pro-investor was being anti-business.

Do Financial Disclosures Really Need to Be Curtailed?

Over time, many generalized claims have been made that financial statement disclosures contain voluminous, unnecessary, redundant, and even immaterial information, and therefore, disclosures need to be curtailed to only what is essential. CFA Institute has always maintained that more specific research is needed to find examples of these types of inclusions before the conclusion can be drawn that extensive amounts of useless information are indeed being included in financial statements. For example, a review could be done on the financial statements of companies in the Dow Jones Industrial Average 30 to identify whether, or the extent to which, any unnecessary and/or immaterial disclosures have been made and, if so, why. Furthermore, investors and preparers for these entities could be interviewed and results developed based on both empirical and anecdotal evidence.

However, the focus should not simply be on reducing the perceived burden on preparers. It is also important to consider what reducing disclosure requirements would mean for investors. Would it simply shift the burden from preparers to investors, who would then be in a more difficult position to ascertain the information needed for their financial analysis?

Ideas for Change

Participants at the Financial Data Summit suggested that companies should consider the filing of a “core document” or “company profile” featuring information that changes infrequently. We agree with the separate filing of standing information as long as the information is updated regularly. This approach could streamline information investors receive and allow them to focus on matters of importance in the current reporting period.

We also agree with the elimination of redundant information. For example, information pertaining to litigation issues appear in different parts of the annual report — in a section often labeled “legal proceeding,” in the risk factors in the Management Discussion and Analysis (MD&A), and in the notes to the financial statements. Often companies simply repeat the information contained in the financial statements, but instead, ways should be found to avoid repetition. Investors only need to be told the information once.

Investors’ Views

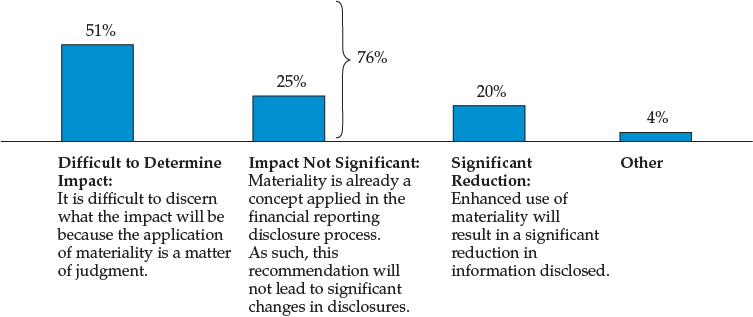

But investors do not believe that financial statements are full of immaterial clutter that obscures key messages. The results of our 2012 Disclosure Survey revealed that the majority (76%) of respondents do not currently observe the inclusion of obviously immaterial information. One reason may be that users — as research demonstrates — generally have lower materiality thresholds than preparers and auditors.

Investors Surveyed See No Obvious Inclusion of Immaterial Information

Notes: Participants were asked the following: Which of the following statements most accurately describes your view regarding enhanced use of materiality in financial reporting disclosures as well as the deletion of disclosures that do not contain material information? As for responses, N = 301.

Given the recent focus on enhancing disclosures principally through a reduction in quantity, we asked members whether the volume of disclosures is an area of investor concern. In the results of our survey, which were published in our report Financial Reporting Disclosures: Transparency, Trust, and Volume, 80% of respondents indicated that volume is not a significant financial reporting concern. This finding is consistent with the response others receive from sophisticated investors; however, it is a finding not well publicized. CFA Institute members also rejected recommendations on ways to reduce disclosure volume by excluding certain information that was deemed useful by the investor community, such as accounting policy footnotes and other publicly available information. Respondents cited concerns over the need for comprehensiveness of the financial statements, the dynamic nature of information sources, and the cost to investors of collecting such information as their major objections.

Many preparers, pointing out the growth of annual reports, posit that they contain excessive information without considering whether the information provided is complete. Investors do not equate disclosure volume with complete and comprehensive information. Instead, they note the disclosure shortcomings evidenced during the 2008 financial crisis and wonder what is being done to ensure that disclosures address these shortcomings and afford greater transparency.

The results of our work suggest that efforts to reform disclosures should focus on increasing the quality and completeness of disclosures, not reducing the volume of disclosures. Investors neither seek a reduction in disclosures nor believe they can be overloaded with useful information. After all, additional useful information provides investors greater transparency into their holdings.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/peepo