Bigger Ideas Need Big Data

Editor’s note: to coincide with the launch of our Future of Finance project, we are showcasing the thinking of a select group that is actively working to build next-generation financial products and services. This series will run all week, and we invite your active participation. If you’d like to get involved, visit our Future of Finance page or email us here.

When was the last time we created a revolutionary invention that changed the very foundations of our society?

Yes, we have flashy mobile phones, supercomputers, and nanotechnologies — but have any of these recent advances come close to changing society in a way that is comparable to the invention of refrigeration, cars, planes, antibiotics, or the radio?

The Economist recently discussed this concept at length, featuring a toilet on the cover of the issue and suggesting that nobody has come close to developing anything half as useful as the flushable toilet.

“We wanted flying cars, instead we got 140 characters,” complains Peter Thiel, one of the early Facebook investors. He is part of a growing group of radical thinkers who argue that stagnation of true technological innovation, and not the recent financial crisis, is the root cause for the collapse of advanced-country growth.

Of course, Thiel and his gang would have to concede that we are still in the early days of the internet, the most important innovation of our time. It has only been 15 to 20 years since we all familiarized ourselves with the soothing sounds of the dial-up modem. The Industrial Revolution, by comparison, played out over a period of 80 to 100 years.

Nevertheless, we are at an important inflection point. Opportunities are everywhere, with technologies converging and societies becoming more connected. But if we are to capitalize on these trends, we need to focus our energies on solving the big problems of the world, and not waste everyone’s time by building another “me-too” social media platform or photo-sharing app.

The pace of innovation in the financial sector has also been bewildering, but the general public has failed to acknowledge the benefits of recent advances. High-frequency trading and financial engineering, for example, have done a lot to improve liquidity, but the general public has come to associate these innovations with flash crashes and market manipulation. Even Warren Buffett labeled these as “financial weapons of mass destruction.”

One could also argue that financial technology innovations have come to undermine investor participation, even threatening market integrity. After all, why would a mom-and-pop investor want to take on a supercomputer that could complete thousands of trades in the time that it took you to read this sentence?

The time has come for the financial industry to use technology in a way that advances society, instead of profiting from the inefficiencies of the general public.

Instead of spending billions of dollars on faster computers and algorithms to eke out the diminishing supply of alpha, let’s focus on developing breakthrough innovations that will help industry leaders and regulators make proactive decisions, avoid bubbles, and safeguard the global financial system.

The Promise of Big Data

We believe that Big Data will be the spark that could lead to an explosion of innovation in many sectors, including financial services.

Data are becoming a byproduct of our everyday lives, and we leave digital footprints wherever we go. All those search engine queries, cell phone check-ins, credit card transactions, tweets, blog posts, and Facebook updates pile up, so much so that 90% of the data in the world have been created in the past two years alone.

Some are quick to shout “Big Brother” when they hear about these trends, but we believe there is massive value to be found in these data. Demonizing Big Data is equivalent to demonizing knowledge, and that is never wise.

Just look at Google’s abilities to track virus outbreaks, or Twitter’s ability to predict large-scale social unrest.

With Big Data, it is possible to track the behavior of every economic participant. Those in charge of monetary policy can track and analyze petabytes of economic data on every person in every zip code, which can help them predict future trends in the same way meteorologists use air pressure and wind speed data from New York City to predict tomorrow’s weather in Boston.

And by training algorithms to detect sentiment in news headlines and online comments, it also becomes possible to track investor attitudes in real time.

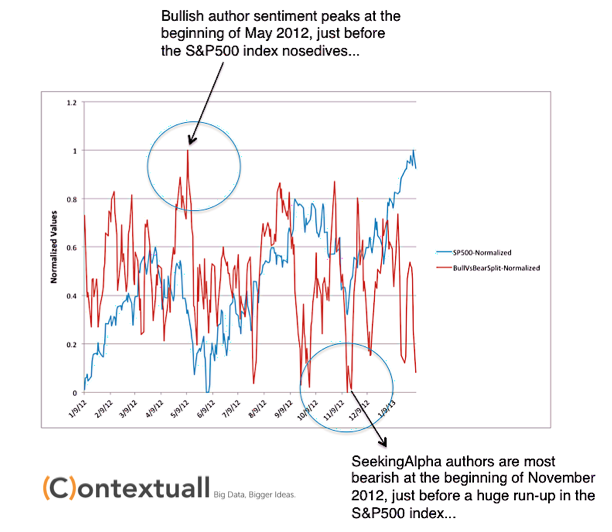

To demonstrate, our team at Contextuall built a prototype tool to track the relationship between financial media sentiment and stock market performance. We applied these algorithms to headlines posted on the popular investment site SeekingAlpha.com, analyzing all headlines from the start of 2012 until February 2013.

It is well-known that excessive sentiment is a contrarian signal, and our study confirmed this — when bullish SeekingAlpha authors outnumber bearish authors by a significant margin, the stock market underperforms over the next month. Similarly, when bearish sentiment peaks, the stock market tends to rally over subsequent sessions.

This prototype tool is still far from being perfect, but this type of sentiment technology could eventually evolve into a valuable warning signal for investors and policy officials when herd mentality takes over, in the same way that Google could use its search query data to warn at-risk users if they live in an area seeing a spike in flu medication searches.

How many crashes could be avoided if a sufficient number of investors were made aware of unbalanced market sentiment? How many decisions could be improved by extracting insights from the millions of machine-processed financial research and news reports published every day?

These are the big questions that we’re facing as an industry: How much of the Big Data progress are we going to keep locked away at the expense of the general public, and how much are we going to open up and share?

Big Data help us to develop knowledge, and history has showed us repeatedly that society benefits when knowledge is open and shared. Maybe those top-secret high-frequency algorithms can be better used in developing open source high-flying cars.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Photo credit: iSTockphoto/MHJ

Eben, Great article. I could not agree more. I look forward to our next conversation with regards to this. Keep up the great work.