Conn’s Can’t Keep Growing: What Ordinary Investors Miss

Editor’s Note: This is part of a series highlighting the role of technology in bringing about the Future of Finance.

How do you go about researching equity investments? Most individuals who don’t work at hedge funds or big banks have very little at their disposal to make sound investment decisions. Sure you have those penny stock tip e-mails that flood your mailbox, or you hear of a stock pick from someone at a cocktail party, or you read about a new company on the cover of your morning newspaper. But none of these sources enable you to make fundamental and rational investment decisions.

The decline of the individual investor in the United States is real, and it is driven by the fact that all the valuable investment information is channeled to large financial institutions. The silver lining to all this, however, is that with the onset of today’s community-based sharing online, these institutional barriers are starting to crumble, and valuable investment analysis is just beginning to become available to the individual.

Quality Research

Financial institutions get most of their investment idea generation and analysis through Wall Street research, proprietary analysis, and idea sharing with other professionals. These tools have not been universally available to the investing public until just recently. Interactive Buyside (IB) combines these sources of idea generation and distributes analysis and ideas to individual investors for a nominal fee.

What Good Research Shows You

Conn’s, Inc. (NYSE: CONN), has risen 145% over the past year, versus a 13% increase in the S&P 500 Index. Conn’s, a big-box retailer of consumer products ranging from electronics to home furniture to office products, has been a major outperformer because of the aggressive lending tactics of its credit portfolio. Although the company’s credit segment makes up only 18% of its revenue, the credit segment contributes 50% of the company’s operating income because the lending arm charges 18% interest to customers and has limited overhead. Conn’s has been able to double its EBITDA, which bottomed out at $55 million (6.4% margin) a few years back and is now $110 million (12.9% margin) as of the 12-month period ending 31 October.

The Conn’s bull argument is simple: Improving economic conditions will lead to continued recovery of the consumer, and the company’s lending capabilities enable it to earn superior margins and growth trends.

The Conn’s bear argument, however, delves a bit deeper and is laid out in full in the Conn’s IB Analyst report. Without giving away too much detail, the IB analyst outlines a few pillars of his bear thesis (directly from the analyst’s 1st person perspective):

Rising Retail Prices Soon to Hit a Wall

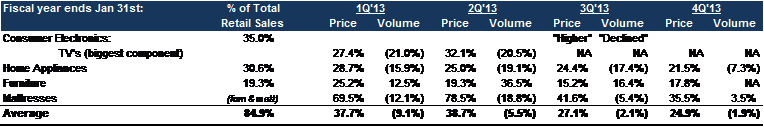

Because of the dual retail and credit service that Conn’s offers, the average price points on the products it sells to customers are significantly higher than those of its peers. A company representative informed me that, for example, televisions are sold at an average 60% premium to other big-box retailers because of the company’s customer credit offering. Conn’s has been aggressively raising prices year over year on most of its retail products in order to inflate its retail gross margin.

The company has been increasing product prices by over 20% year over year for more than a year now, and a Conn’s rep finally admitted to me that the most recent quarter would most likely be the end of aggressive price increases. Management publicly stated that its long-term retail gross margin goal is 35%, and for the 12-month period ended 3Q’13, the retail gross margin was 34%. The margin expansion story is on its last leg.

Loan Portfolio Statistics Are Peaking

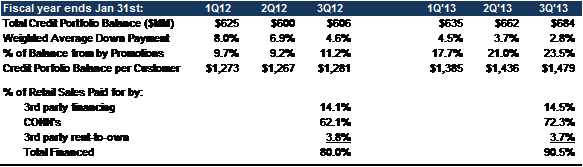

Because much of Conn’s retail business is a function of its credit portfolio, we take a deep dive into the health and trends of Conn’s credit segment. Conn’s now finances 91% of its retail business (72% in-house financing, 19% third-party financing), whereas one year ago, 80% of its retail sales were done using financing (62% of which was in house). The average FICO credit score of its customers is 603, with the average down payment on each item financed at 2.8% (versus an 8% down payment at the beginning of 2011). The growth of its credit portfolio balance has also been fueled by promotional financing offerings (such as payment-in-kind features), which made up 24% of its total outstanding credit balance at the October quarter end. Customer account receivables are now at an average balance of $1,479 per customer.

This “balance per customer” metric has surpassed the $1,400 per customer peak in 2008. Conn’s is now financing an over-levered customer base as it jacks up prices, requires minimal down payments, and increases its use of promotional lending practices.

Intrinsic Value of Business Shows Serious Downside

Wall Street pegs Conn’s to continue with its outsized growth through FY2015, with Street consensus projecting an average of 28% EPS growth a year over the next two years. You may think paying 17× EPS (currently where Conn’s trades on an FY2014 estimated basis) is fair for a retailer with such high growth prospects, but you must value Conn’s retail and credit businesses differently.

- On the retail side, trading ranges of big-box retailers can go from 3–4× EBITDA (e.g., Best Buy) up to 7–8× EBITDA (e.g., Wal-Mart, Target), depending on scale and offerings. A 6–7× multiple for Conn’s retail business is probably generous because the company is offering relatively commoditized retail products, but I use 6.5× to be conservative re the short thesis. Using a discounted cash flow and forward EBITDA multiple valuation analysis yields a retail segment valuation range of $580 million to $740 million ($660 million midpoint), assuming peak margins and outsized growth are sustained in perpetuity.

- The credit business is very different because it is essentially a portfolio of subprime or high-yield debt. As investors, we look to get a certain yield or return on this asset portfolio of receivables. Conn’s charges its customers an average gross interest rate of ~18%; however, after deducting charge-offs, some SG&A (selling, general, and administrative) expenses, interest and taxes, the net return (or net income) Conn’s is generating from its credit portfolio is less than 3% of its receivables. Corporate high-yield debt is currently yielding 7–8%, so if we take next year’s expected net return on Conn’s credit portfolio and imply a 7.5% yield, the credit business is worth $280 million. Again, this estimate assumes no hiccup in the company’s collections even as its customer base is over-levered and its promotional offerings are at all-time highs.

Combining the above valuation scenarios, which are quite optimistic, provides an implied stock price of $18 per share, compared with the current share price of $34.

Evolving Investment Landscape

The analysis and sharing of quality investment ideas has been a key component in investment management for decades, and these ideas have not historically been available to the public. The next evolution within the individual investment community is going to be the availability of compelling investment ideas, with detailed analysis and research to go along with these recommendations. The retail investment community is still 28 million strong, and these investors will not continue to rely on the blogosphere to invest their money wisely so long as a more sophisticated alternative exists. Equity investors take heed: Know what you’re missing, and now go find it.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Great article. Conn’s was a great deal when it was trading far below book and I made money off of it, but now it’s getting absurd. I have a short position that I initiated at about $30 / share, which I am getting clobbered on. I think it’s a question of when their share price declines, but I’m hoping I don’t get squeezed out here.