CFA Institute Global Market Sentiment Survey: Cautious Optimism, Unresolved Financial Crisis Problems Cast Shadow

It is around this time of year that we survey our 110,000-plus members around the world to gauge their expert opinion on the health of the markets, world and local economies, and the state of financial market integrity around the globe.

First let me give you the option to skip my brilliant explanation, and to see the results and interpret them for yourself, here.

In summary: things are getting better, but things are not getting better.

Let me explain.

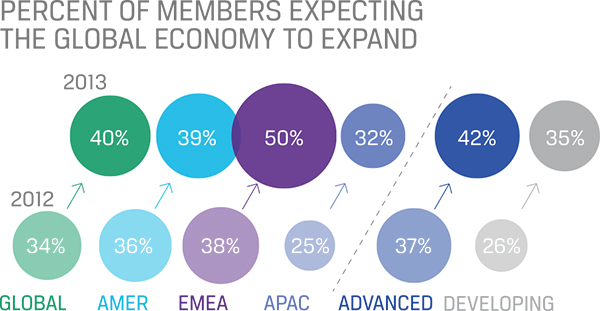

First the good news, because everyone prefers good news. When we asked CFA Institute members whether they believed the global economy would expand, contract, or stay roughly the same over the coming year, about 40% answered that the global economy would expand, with 20% predicting a global economic contraction.

In normal times, we would not highlight the fact that fewer than 50% of CFA Institute members believe that the world economy will expand. These, however, are not normal times. One year ago, the mood was decidedly more pessimistic, with only 34% forecasting that the global economy would expand and nearly as many (29%) expecting the global economy to contract. Such an improvement in sentiment is pretty impressive in the face of an ongoing European debt crisis, slowing growth in China, and the pending fiscal cliff in the U.S.

About 50% of those surveyed expect global equities to outperform all asset classes, up from approximately 41% a year ago. In the short term things are steadily improving. The outlook of our members on other metrics, such things as improved perceptions of local economic growth to employment opportunities for financial professionals, also has improved slightly over the past year.

But …

This cautious optimism tends to be focused on short-term issues — improvement in the coming year — that are trending in the right direction. Longer-term issues, the ones that helped bring us the financial crisis, whose effects are still being felt, have yet to be dealt with.

When it comes to the culture at financial firms, the results are not as positive. Asked which factor has most contributed to the current lack of trust in the finance industry, more than half (56%) of respondents identified the lack of ethical culture within financial firms. The survey options of market disruptions (failed IPOs, flash crash, etc.) and poor government regulation and enforcement tied for a distant second, garnering only 16% of the vote. Said another way, it is not the failures of the market or government action that is the problem, but the culture of the financial industry itself.

And we all know that cultures change very slowly. It didn’t take just one year for the public to lose trust in much of the financial industry and many of its practitioners — trust has been eroding for decades.

But while trust will not be regained in the coming year, there are obvious places to start. When asked which of the following firm-level actions is most needed in the coming year to help improve investor trust and confidence, respondents answered:

- 40% Improved culture established and encouraged by top management and executives

- 26% Increased adherence to ethical codes and standards

- 13% Clarifications of fiduciary duty responsibilities

- 13% Improved compensation practices

- 5% Increased staff training and education

- 3% Other

Those top two answers represent about two-thirds of our membership saying we need to re-establish a culture of ethics and integrity in the financial world.

Is that happening at your firm?

If you liked this post, consider subscribing to Market Integrity Insights.

Photo credit: ©iStockphoto.com/scyther5

Matt

Matt

I suspect that many of the fewer than 50% of the survey respondents who indicated that the world economy will not expand in 2013 are not very knowledgeable re historical global economic data. The consensus outlook and experieced economic forecasters such as the IMF project that this year’s global growth will be in the 3%-3.5% range. 2009 .- – a year when the global economy was suffering from the depressing effects of the credit crisis — is the only year in recent history that global growth was not positive. Do most of the responents to your survey think that a global depression is the most likely outcome for 2013? Ed Sullivan, CFA

Thanks for your comments.