EMEA Investment Professionals More Optimistic about Global Markets in 2013, but Pessimism Dims Home Market Outlook

Maybe it’s just a matter of perspective? This would seem to be the case when looking at the results of the 2013 CFA Institute Global Market Sentiment survey — at least from the viewpoint of members in the Europe, Middle East, and Africa (EMEA) region.

According to survey results, EMEA CFA Institute members are more optimistic about the global economy than the rest of the world and, not surprisingly, more pessimistic about the prospects for Europe still lurching towards some remedies for the sovereign debt and banking crises.

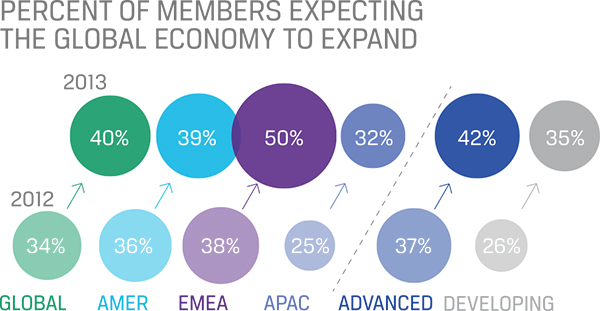

When members were asked whether they believe the global economy will expand, stay roughly the same, or contract in 2013, those in EMEA proved to be the most optimistic:

Asked the same question a year ago, only 38% of respondents in EMEA predicted the global market would grow, while 27% thought it would contract. The faith in the expansion of the global economy is even more pronounced when individual markets are taken into consideration. Those stating that that they expected the global markets to expand:

- Germany: 62%

- France: 61%

- Spain: 61%

- Austria: 58%

- UK: 55%

- Netherlands: 51%

- South Africa: 46%

- UAE: 42%

Core Europe is feeling decidedly bullish!

However, contrasting this with answers to the same question regarding 2013 expansion in a local economy context only:

| Global Results | EMEA | |

| Expand | 45% | 33% |

| Stay Roughly the Same | 38% | 42% |

| Contract | 16% | 24% |

Now look at the market by market breakdown of those that said they believed their local market would contract:

- Spain: 66%

- France: 44%

- Netherlands: 49%

- Italy 49%

- Germany: 18%

- South Africa: 13%

- UAE: 2%

Echoing the media fixation on problems in Spain, it’s not surprising that Spanish respondents are feeling pretty negative about local economic prospects for the coming year. The crisis is being tackled with vigor and consumers are feeling the pinch.

In general it would appear that members in EMEA feel that the world economy will continue to grow just fine, thank you very much. But the same can’t be said for the Eurozone itself. South Africa and the UAE are not so pessimistic, but then again, they are not in the Eurozone.

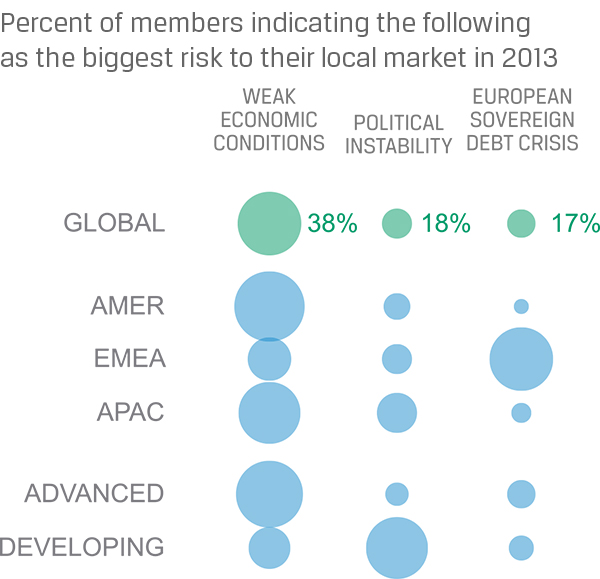

Further questions confirm this sentiment. When asked about the biggest threat to their local markets, the top answers fall along predictable lines:

Employment prospects for those in EMEA also offer little cheer. When asked if employment opportunities for investment professionals in the local market were set to increase, decrease, or stay about the same, survey respondents answered:

| Global Results | EMEA | |

| Increase | 17% | 11% |

| About the same | 49% | 38% |

| Decrease | 33% | 51% |

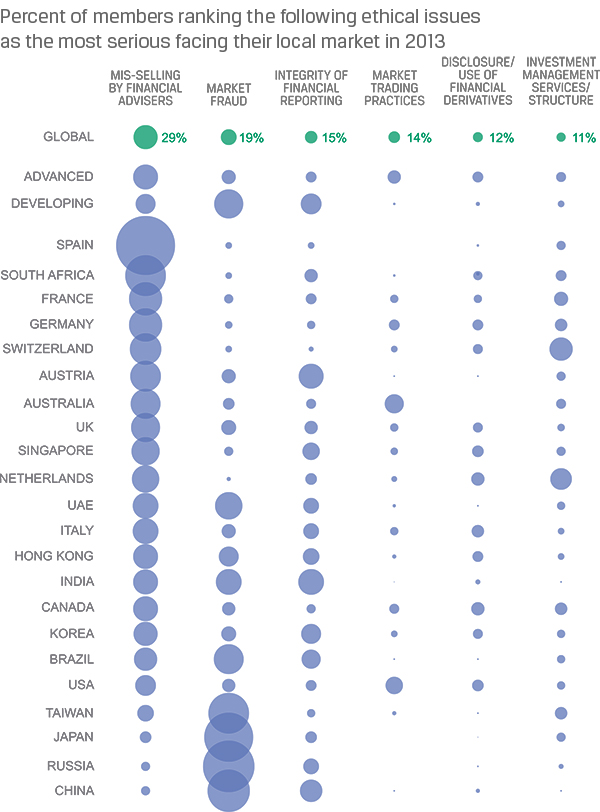

When asked to rank the most serious ethical issue facing their local market in the coming year, members in EMEA agreed with those in the rest of the globe stating that mis-selling by financial advisers was the top concern.

If there is a silver lining in all this negativity regarding prospects for the EMEA region it is this: thankfully most numbers are trending in the right direction, albeit from a very low base. (Many of the survey questions were asked of members for the second year in a row). Although concerns about growth in home markets persist and employment prospects could be better, they still represent an improvement over last year.. So here’s looking forward to 2013, and maybe this time next year sentiment in EMEA will have improved again, perhaps ever so slightly, but improved nonetheless.

Photo credit: ©iStockphoto.com/scyther5

Reading this blog really helps me it gives me an idea about investing thannks!