SEC Proposals for Systems Compliance and Integrity Bring Dark Pools into Scope

In the wake of a string of technological mishaps affecting the financial markets, the SEC recently proposed Regulation SCI — “Systems Compliance and Integrity” — to strengthen the controls, policies, and procedures surrounding market technology. For the most part, the regulation formalizes the SEC’s Automation Review Policy — the set of voluntary standards adopted by exchanges over the past two decades. But for the first time, these standards would also apply to alternative trading systems such as dark pools that execute a certain amount of volume — a tacit recognition of their growing prominence.

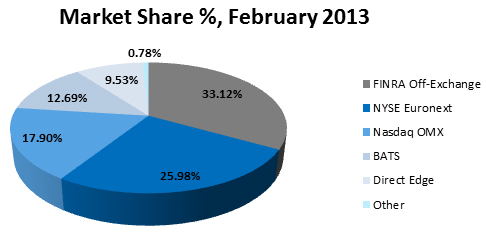

According to the recent CFA Institute report Dark Pools, Internalization, and Equity Market Quality, the volume of trading in dark pools and other undisplayed venues has grown by nearly 50% over the past three years to account for nearly a third of consolidated volume (see chart below).

The SEC’s proposed regulation would, among other things, require exchanges, significant alternative trading systems, clearing agencies, and plan processors to ensure that their core technology meets certain standards, that these entities conduct business-continuity testing, and that they provide certain notifications regarding systems disruptions and other types of technological issues.

The formalization of these rules is welcome. Evidence of system stress has been all too prevalent over the past year, including episodes such as the Facebook IPO malfunction and the Knight Capital rogue-algorithm induced trading loss, in addition to several smaller system mishaps at various exchanges. Each event has highlighted the challenges posed to market infrastructure by today’s high-speed, highly automated marketplace. The reliance on automation, coupled with liquidity fragmentation, can make for a more fragile ecosystem, which merely emphasizes the need to strengthen network resiliency. Absent robust processes and controls over market technology, systems are vulnerable to rogue algorithms, which can trigger bouts of volatility and transmit price dislocations across correlated financial securities, instruments, and markets.

Moreover, the application of these rules to alternative trading systems that exceed a certain volume threshold is an important and necessary step for two reasons:

- First, it ensures that all facets of the market infrastructure are adequately robust, providing comfort to investors whether they trade on or off-exchange.

- Second, it helps to promote fairer competition by removing a potential competitive advantage held by certain alternative trading systems over their exchange counterparts. In other words, the extension of the rules to large dark pools ensures that similar trading venues are bound by the same regulatory obligations.

When the Automation Review Policy was introduced after the 1987 crash, exchanges such as NYSE held the lion’s share of trading activity. But in the period since, trading on alternative trading systems such as dark pools and ECNs (Electronic Communications Networks, most of which have since been acquired by exchanges or have converted to exchange-status) has grown significantly. In fact, as the below chart demonstrates, trading on exchanges operated by the two primary listing markets — NYSE Euronext and Nasdaq OMX — accounts for less than half of all trading activity. Trading off-exchange, including alternative trading systems, accounts for one-third of trading volume.

Source: Thomson Reuters EMSR

Extending systems compliance and integrity rules beyond the traditional exchanges is, therefore, a necessary step to bolster the resiliency of the broader market network and create a more level playing field. Combined with robust filters and controls over algorithms and a consistent circuit breaker policy applied across exchanges, these systems compliance measures can bolster investor confidence and help restore integrity to financial markets.

Moreover, the rules should help ensure that investors experience similar technological protections whether they trade on exchanges or dark pools.

Photo credit: iStockphoto/Trout55