Sense and Sensibility Prevail: UCITS Fund Manager Bonus Caps Not the Answer

Today saw sense and sensibility finally prevail in the heated and divided debate on UCITS fund manager bonus caps. The European Parliament narrowly rejected by a vote of 341 versus 348 — just seven, or 1%, of total votes — the proposals to ban UCITS fund managers from receiving bonuses of more than their annual salaries. Concerns were raised about the measure being inappropriate for fund managers (to face similar bonus curbs to bankers) and the unintended consequences of driving up industry fixed costs, driving away talent, potentially curtailing returns, and harming pensions and savings. Members of EU Parliament (MEPs) backed alternative standards aimed at better aligning pay with performance, including provisions allowing awards to be clawed back when a UCITS fund loses money.

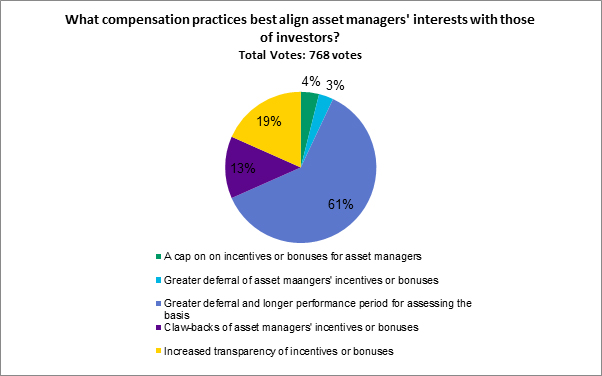

These concerns very closely mirror CFA Institute positions advocated to members of the European Parliament suggesting there are other ways to best serve investors’ interests. A recent CFA Institute Financial NewsBrief reader survey clearly demonstrated that investment professionals want to find effective ways to better align the interests of investment managers with those of their clients. However, almost two-thirds (61%) of respondents suggested that greater deferral of variable pay over longer periods of time is a better solution than a cap on bonuses or incentives.

Source: CFA Institute Financial NewsBrief

Today’s vote saw Christian democrats, conservatives, and liberals pitched against the socialists and Green Party supporters in a long-running debate that eventually boiled down to a close vote on just two points: the bonus caps and performance fees charged by funds. MEPs narrowly also rejected the planned restrictions on performance fees charged by funds by 355 to 331 votes. The more zealous supporters have argued all along that these measures were necessary to curb irresponsible risk taking, and to make pay rules consistent across the EU financial services industry.

Now of course we need to ask ourselves what happens next. There will inevitably be some shake-ups, firm restructurings potentially, but one shouldn’t overlook the fact that the fund industry has won a major battle today — and I am not talking about the bonus cap. This is recognition that the investment business is not the same as a banking business; it doesn’t pose the same systemic risk. It has different players, different drivers, different risks, and importantly, different cultures. The remuneration story I doubt is over (next to come Money Market Funds?), but it is over for UCITS fund managers for now at least.

Photo credit: ©iStockphoto.com/richterfoto