Corp Gov Roundup: Coca-Cola vs. Buffett, “Say on Pay,” Fiduciary Duty

It’s time to span the corporate governance globe to review important developments from the month of April.

International

The International Corporate Governance Network (ICGN) is welcoming member comments on the organization’s Global Governance Principles by 12 May. The ICGN Principles, which highlight the governance responsibilities of board directors and investors alike, aim to enhance dialogue between both parties. The principles were developed in consultation with committee chairs and the ICGN board of governors; they take into account the ICGN Global Corporate Governance Principles (2009) and other ICGN guidance, together with recent changes in corporate governance regulation and practice. This is the first time the ICGN has produced a single set of principles that covers the governance responsibilities of board directors and investors. All comments will be reviewed and taken into consideration for inclusion into a revised draft to be submitted for member approval at the next ICGN Annual General Meeting in Amsterdam in June.

The Cambridge Handbook of Institutional Investment and Fiduciary Duty was recently published, and offers a wide range of views on the topic of fiduciary duty in the investment industry. The handbook includes 35 articles by global experts on governance and fiduciary duty.

Australia

After a nearly two-year review, the Australian Shareholders’ Association (ASA) recently released a new policy platform for monitoring listed companies. The platform focuses on such issues as capital raising, remuneration, engagement, corporate governance, and director performance. In the case of directors, any director who has contributed to very poor performance at two companies will potentially be encouraged to depart all public company boards. ASA also has withdrawn support for resolutions being passed by a show of hands at annual general meetings (AGMs) because it prevents ASA from voting its undirected proxies. The ASA calls for poll voting at Australian Securities Exchange (ASX) 200 AGMs.

European Union

The European Commission has proposed its own say-on-pay policy. The proposed law is meant to enact key actions identified in the European Commission’s March roadmap to meet the long-term financing needs of the European economy.

The new law would require companies listed on Europe’s stock exchanges to disclose “clear, comparable and comprehensive” information about their remuneration policies. Under the EU shareholders rights directive, the remuneration policy would be subject to a binding vote (every three years), but the annual remuneration report with details of actual pay would be subject to an annual non-binding vote. The remuneration policy is focused on disclosing how compensation mechanisms align with long-term value creation and shareholder interests. Part of the rule is a disclosure requirement for the ratio of average employee to directors’ pay. (See our analysis on a pay ratio in the United States here).

This is a draft directive and will go through the political process later this year under the new European legislature and Commission.

See the CFA Institute Compensation Discussion and Analysis Template for guidance on making compensation communications clearer and more relevant to investors.

Norway

The Norwegian government has announced plans to shift responsibility for excluding investments from the Government Pension Fund to Norges Bank, which runs the fund, and in the process disband its 10-year-old Council on Ethics.

The Norwegian government wants to ensure that any such decision to exclude an investment is seen as one based on financial analysis and not on any political reason.

South Korea

In November 2013, the Financial Investment Services and Capital Markets Act was revised, forcing about 2,000 Korean companies to provide compensation information for directors. Companies will be required to disclose the pay of directors and executives who make more than Won500m (US $481,000) individually, rather than in aggregate as former regulations allowed.

The increased disclosure has revealed some interesting results.

A recent Financial Times article provides some of the highlights. Chey Tae-won, the chairman of SK Group was the highest-paid South Korean executive in 2013, bringing in Won45.1bn (US $42.5m) from companies under his control. He also began a four-year prison term in 2013 for embezzlement. His pay includes a bonus of Won5.6bn from SK C&C, one of the companies he defrauded.

The head of Hyundai Motors, Chung Mong-Koo, shares the company’s chief executive position with two other men but received pay of Won5.6bn, which was three times greater than either of his fellow chief executives, as well as Won8.4bn from Hyundai Steel and Hyundai Mobis.

United Kingdom

The UK government is looking to move forward with a plan to revamp the public registry of beneficial owners at companies. The rules would compel listed companies in the UK to list their true owners on a public register. The moves are partially aimed at combating tax evasion and money laundering.

The rules would require UK-registered companies to provide details about anyone with interests of more than 25% of a company’s shares or voting rights.

The plan would also abolish “bearer shares” that can be transferred without a paper or electronic trail, and looks to limit the use of corporate directorships in which companies and not a physical person can serve as the director of a company.

United States

Warren Buffett had trouble swallowing the Coca-Cola Co. executive compensation plan, but decided against using his 9% stake to vote against the company’s pay plan. Instead, he decided to abstain.

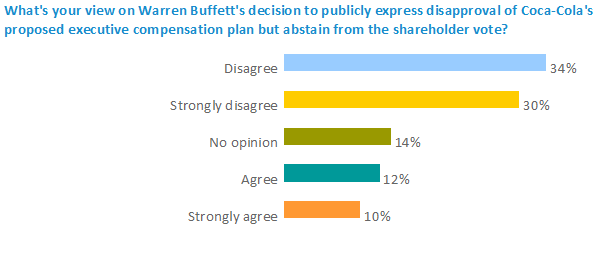

In a recent CFA Institute Financial NewsBrief survey, readers were asked their views on Mr. Buffett’s decision to publicly express disapproval of the executive compensation plan, but abstain from voting. Nearly two-thirds of those surveyed disagreed or disagreed strongly.

There is talk that Mr. Buffett’s displeasure with the company’s pay plan was communicated privately and that the company may be amenable to revising the plan before it goes into effect next year in order to address shareowner concerns about pay.

There is talk that Mr. Buffett’s displeasure with the company’s pay plan was communicated privately and that the company may be amenable to revising the plan before it goes into effect next year in order to address shareowner concerns about pay.

It will be interesting to see exactly what changes are made to the plan, and if this satisfies investors, particularly Warren Buffett, who always can decide to vote against the plan if he so chooses.

According to a recent study from the Investor Responsibility Research Center (IRRC) Institute and Institutional Shareholder Services (ISS), 55% of investors reported more than 10 engagements with companies over the past year, up from only 31% from a similar study done in 2011. Almost half of large US companies initiated more than 10 engagements with shareowners last year, up from 30% from a similar study done in 2011.

One interesting point from that report is that investors tend to think of engagement as a long-term process, sometimes lasting years, while many companies surveyed tend to think of a short meeting or even a single phone call with an investor as engagement.

Photo credit: iStockphoto/YinYang

Reading the headline, I was hoping their would be some discussion of Warren Buffett possibly breaching his fiduciary duty by voting one way (by abstaining) while believing the pay plan was excessive. As a trustee, doesn’t Buffett have a fiduciary duty to act in the best interests of his clients? How is it in their best interest to abstain when he thinks the pay package is too high. More importantly, if Buffett is wimping out, how many others are? Most people don’t want to upset those they work with.