Executive Pay: Updated CD&A Template Supports Better Pay-for-Performance Storytelling

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity …”

What do the opening lines of Charles Dickens’ A Tale of Two Cities have to do with the just-released, new and improved CFA Institute Compensation Discussion and Analysis (CD&A) Template?

They’re a metaphor for what investors don’t want in a company’s CD&A — long, meandering information that eventually gets to the crux of the matter, but it takes a while.

What do investors want in the CD&A section of the proxy statement? Think Hemingway — a clear, concise narrative of a company’s policies and decision-making related to executive pay. And that’s what the newly released CFA Institute CD&A template provides. Since we first published our template in 2011, many best practices have emerged from leading companies for creating a CD&A that tells a story like Hemingway, one investors can easily understand. To highlight these best practices and aid companies currently struggling with the CD&A process or with limited resources to clarify the elements of disclosure that are most useful to investors, CFA Institute has published a revised CD&A template.

More Meaningful CD&A Disclosure

Because the CD&A is a company’s primary engagement tool with investors, it must tell a company’s compensation story in a concise manner that investors will understand. The CD&A is also used to comply with US SEC requirements, but thinking of the CD&A first and foremost as a compliance document misses the opportunity to communicate more effectively with investors.

Perhaps most importantly, the CD&A is often the main document investors use to understand a company’s pay practices before that investor decides how to cast her or his ballot on a company’s “say-on-pay” vote. It is therefore imperative that a company and its board’s compensation committee tell their executive pay story in a clear and succinct manner so that investors can make informed decisions.

The aim of the CD&A template is to improve investor understanding of a company’s pay practices, serve as a global model for improved investor communications around compensation issues, and elevate compensation disclosure beyond an exercise in legal compliance.

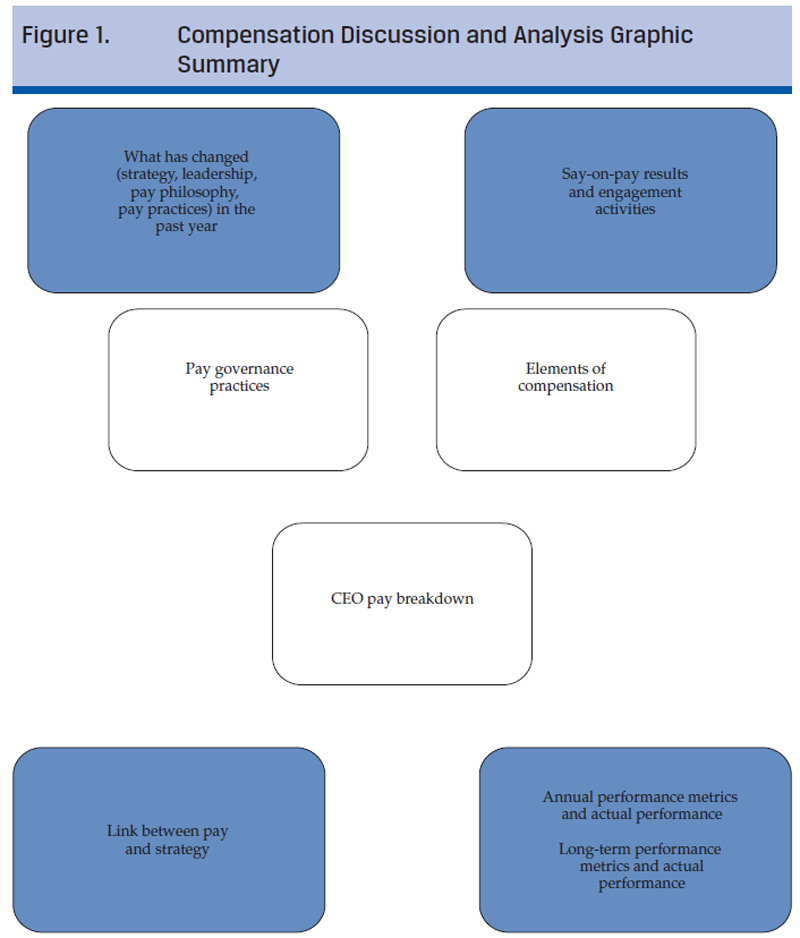

The sections of the CD&A template are arranged in order of importance from an investor’s perspective, starting with an overview of the company’s corporate performance for the previous year and an explanation of the link between that performance and executive pay. The remaining sections delve into detail about compensation elements and decisions, compensation-setting process and policies, and other areas of interest.

We have added a number of new features and new appendices to the template to better guide issuers in creating a more useful CD&A.

One of the main changes in the template is a graphic executive summary that attempts to present the main information investors are looking for in a concise, easily scannable format that covers only one or two pages. In the years following the first edition of the CD&A template, many companies established a best practice of drafting an executive summary of compensation disclosures at the front of a CD&A to highlight a few issues that are of the greatest concern to investors. The graphic executive summary aims to improve on this innovation by offering investors a more user-friendly executive summary format.

We also highlight best practices in the creation and execution of the CD&A in the first of three new appendices to the template. This section summarizes the best guidance of the CD&A working group of issuers, investors, and other practitioners in the compensation field.

A new appendix in this updated CD&A template highlights the best CD&A disclosure practices of more than 30 companies both large and small from a host of industries. This resource should give investors and issuers a better idea of what to look for in seeking out best-in-class disclosure.

Finally, with the aid of participants in our CD&A working group we have created a CD&A timeline to guide issuers in planning and producing the CD&A section of the proxy statement, keeping in mind the unique timeline under which a company’s compensation committee operates.

In the end, companies and compensation committees should view this CD&A template as a flexible template, particularly because the CD&A should be a properly customized story and should not devolve into “boilerplate” language. The goal is to use the template approach to include the basic elements of the compensation narrative in a manner that best tells a company’s compensation story.

If you liked this post, consider subscribing to Market Integrity Insights.