Shadow Banking Set in Context: Unlocking Capital Markets or Migrating Risk?

The term “shadow banking” was first coined in 2007 to describe parts of the financial intermediation process conducted outside of the commercial banking system. Since then, “shadow banking” has been used in a number of different contexts and carries a variety of connotations. The concept itself generates an array of opinions, facts, perceptions, and misperceptions, all of which serve to illustrate the scope of the topic, the inadequacy of data, and the challenges facing policy makers to get their arms around the subject. So what does “shadow banking” really mean, what does it look like, and what should policy makers care about?

To answer these questions, CFA Institute has published a report titled Shadow Banking: Policy Frameworks and Investor Perspectives on Markets-Based Finance. In the report, we examine the perimeter of shadow banking — the entities, activities and components within the shadow banking system — and how they vary across different jurisdictions. The analysis covers the United States, the European Union, and Asia Pacific (focusing on China) and illustrates that the concept of shadow banking differs across regions. In developed financial markets, the term is synonymous with “markets-based finance” such as certain types of investment funds and securitisation vehicles, as well as activities such as securities financing transactions. In other jurisdictions, “shadow banking” largely comprises alternative lending channels such as peer-to-peer lending and other forms of nonbank direct loan provision.

In essence, therefore, “shadow banking” can be considered a holistic term encompassing all nonbank credit intermediation, and spans wholesale markets-based finance and alternative lending channels. Such nonbank credit intermediation typically involves short-term funding or borrowing to facilitate longer-term lending or investment in less liquid assets, resulting in maturity transformation, liquidity transformation, credit risk transfer, or leverage.

Moving Target: Difficulty Defining Size and Scope of Shadow Banking Market Tests Regulatory Response

In broadest possible terms, the Financial Stability Board (FSB) estimates the size of the shadow banking sector globally to be approximately $75 trillion as at the end of 2013 (the latest available data). A narrower estimate of shadow banking activity is also provided by the FSB that filters out entities not directly involved in credit intermediation (such as equity investment funds) and entities that are prudentially consolidated into a banking group. According to the FSB, this narrower measure reduces shadow banking assets by approximately $25 trillion. Given the range of estimates, it is clear that the shadow banking sector is hard to concretely measure, which underlines the data inadequacies facing policy makers and the associated challenges in establishing the appropriate scope and calibration of regulation.

In fact, the scope of regulation related to shadow banking entities and activities is already quite broad. In the US and EU, for example, regulation of investment funds marketed to retail investors is comprehensive, while new rules for money market funds have been established which address liquidity risk management and redemption rules as well as exposure risks via liquid assets requirements and portfolio concentration limits (among other things). In this context, the term “shadow banking” is somewhat misplaced and should not be construed with unregulated activities.

On the other hand, there are other parts of the shadow banking system that are mostly unregulated, such as peer-to-peer lending, microfinance companies, trust-based loan provision, and other alternative lending channels, and it is in this domain that risks to investor protection are most likely to emerge.

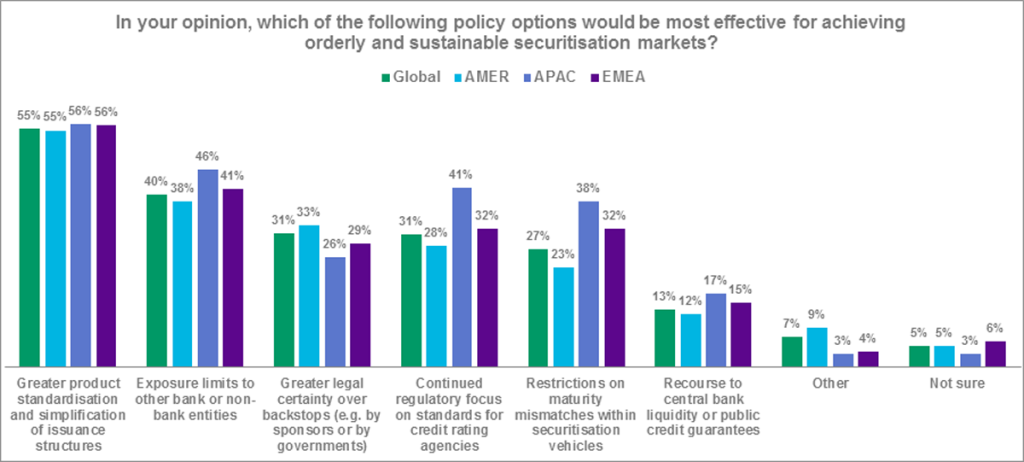

Given the current focus of securitisation and securities financing transactions within the international policy sphere, the CFA Institute report examines the perspectives of investment professionals on these (and other) issues via survey. Notably, more than half of investment professionals surveyed identified greater product standardisation and simplification of issuance structures as the most effective policy option for achieving orderly and sustainable securitisation markets.

Source: Shadow Banking: Policy Frameworks and Investor Perspectives on Markets-Based Finance

The need for greater standardisation and simplification of issuance structures (as well as greater transparency) in securitisation markets is a necessary condition to stimulate investor interest in securitisations. Currently, investors face adverse selection risks in securitisation markets because of product complexity, market fragmentation, and insufficient transparency, which lead to information asymmetries between risk sellers and risk buyers. Moreover, there are costs to monitoring exposures, in terms of both asset-level data (static) and the evolution of credit pools and flows (dynamic).

Approximately half of survey respondents also identified a need for greater transparency over securities financing transactions (such as repos and securities lending) through reporting transactions to trade repositories and to investors. These issues are the focus of a current EU regulatory proposal on securities financing transactions. The next three most popular policy options with respect to securities financing transactions include limits on rehypothecation, rules on collateral reinvestment (such as restrictions on the maturity of reinvested assets and counterparty liquidity standards), and harmonised requirements for central clearing of repo transactions — all of which signal a desire among investment professionals for a more robust collateral framework.

The report concludes with more detailed policy proposals to address the aforementioned issues from the perspective of the needs of investors. These measures, combined with appropriate supervision and enforcement of existing rules, should strengthen market integrity and contribute towards a more resilient and sustainable shadow banking ecosystem.

In subsequent blog posts, we will explore shadow banking issues specific to different regions and consider the implications for policy makers.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: Curt Merlo, 2014