Study First to Give Investor Views on Complexity in Corporate Financial Reporting

Now that standard setters know what investors want in their financial reports, can they make them truly less complex?

Here’s where things currently stand: For years, corporate managers, auditors, and accountants have complained that financial statements are too long and complex, and that this complexity increases companies’ compliance costs.

Standard setters have heard their concerns and attempted to address them, for example, by creating separate, reduced reporting requirements for nonpublic companies. The International Accounting Standards Board (IASB) did this for small- and medium-sized (SME) enterprises, and the Financial Accounting Standards Board (FASB) is currently creating alternative US private company reporting requirements.

Missing from this dialogue — until now — has been the views of investors.

According to a just-released CFA Institute study that features results of a member survey on the topic, Addressing Complexity in Financial Reporting: Investor Perspectives, the overwhelming majority of investors have apprehensions. The results show that

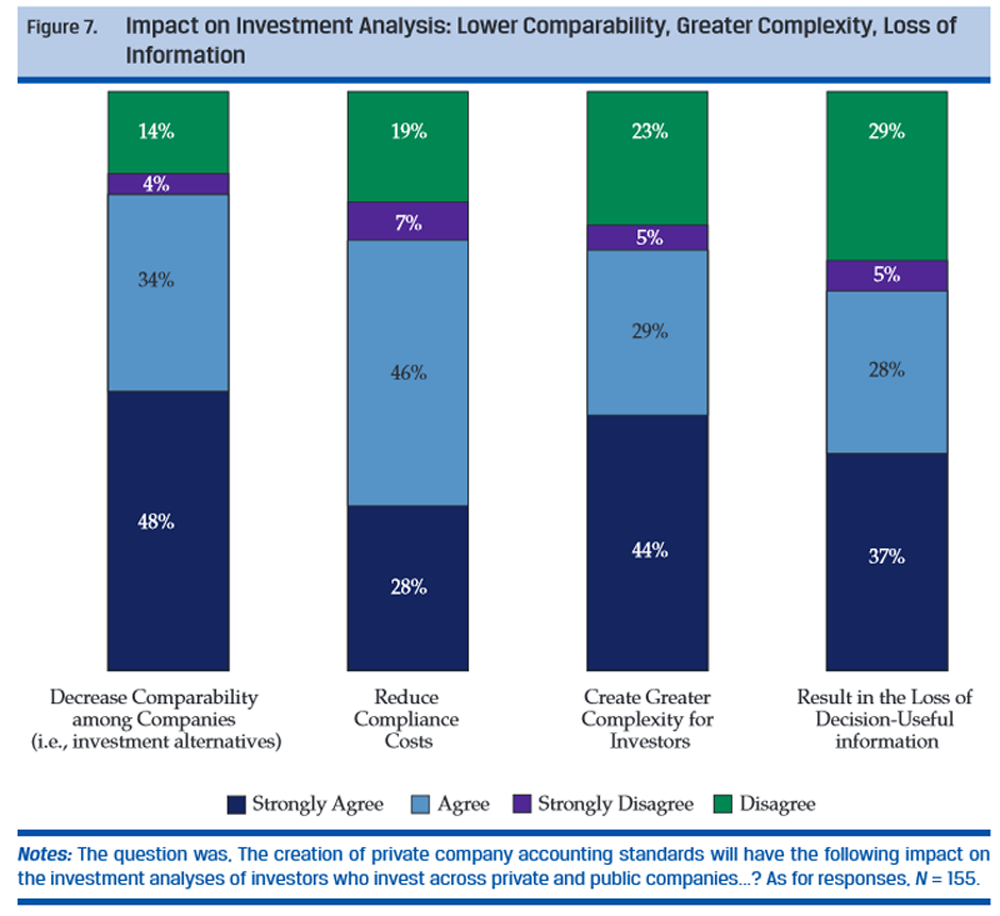

- 82% of respondents believe the creation of separate private company standards would create comparability issues for those investing across public and private companies

- 65% say it would result in the loss of information useful to their financial analyses

- 73% believe it may actually increase complexity instead of lessening it

Investors do believe the initiative will reduce companies’ compliance costs. This benefit, however, is unlikely to outweigh the costs for investors.

And, in the end, any short-term gains for companies could be overshadowed by longer-term costs. The study, whose release coincides with CFA Institute “Putting Investors First Month,” provides examples of how the loss of information from the SME and US private company standards could impede investors’ valuations of such companies. This, in turn, could prove expensive for companies because they could face higher capital costs.

While these results pertain specifically to US private company accounting, they are relevant globally. Indeed, the International Accounting Standards Board (IASB) is deliberating whether to allow individual jurisdictions to extend its current SME standard to publicly traded entities and financial institutions.

Meanwhile, the FASB is currently considering whether to extend some of these reduced private company requirements — meant to reduce compliance costs — to public companies. However, only 6% of CFA Institute survey respondents were in favor of this approach.

Added complexity in financial reporting resulting from more complex business transactions, such as complex financial instruments, is unavoidable, and a reality investors have to face. Complexity, however, is increased by accounting standards that do not reflect the underlying economics of transactions and, therefore, do not provide investors with needed transparency. This can be compounded with ineffective communication of the company’s results. Investors believe such complexity is avoidable. Standard setters, therefore, need to focus on reducing avoidable complexity for public and private companies alike.

Accounting Reforms Should Focus on Inadequate Accounting Standards and Ineffective Communication

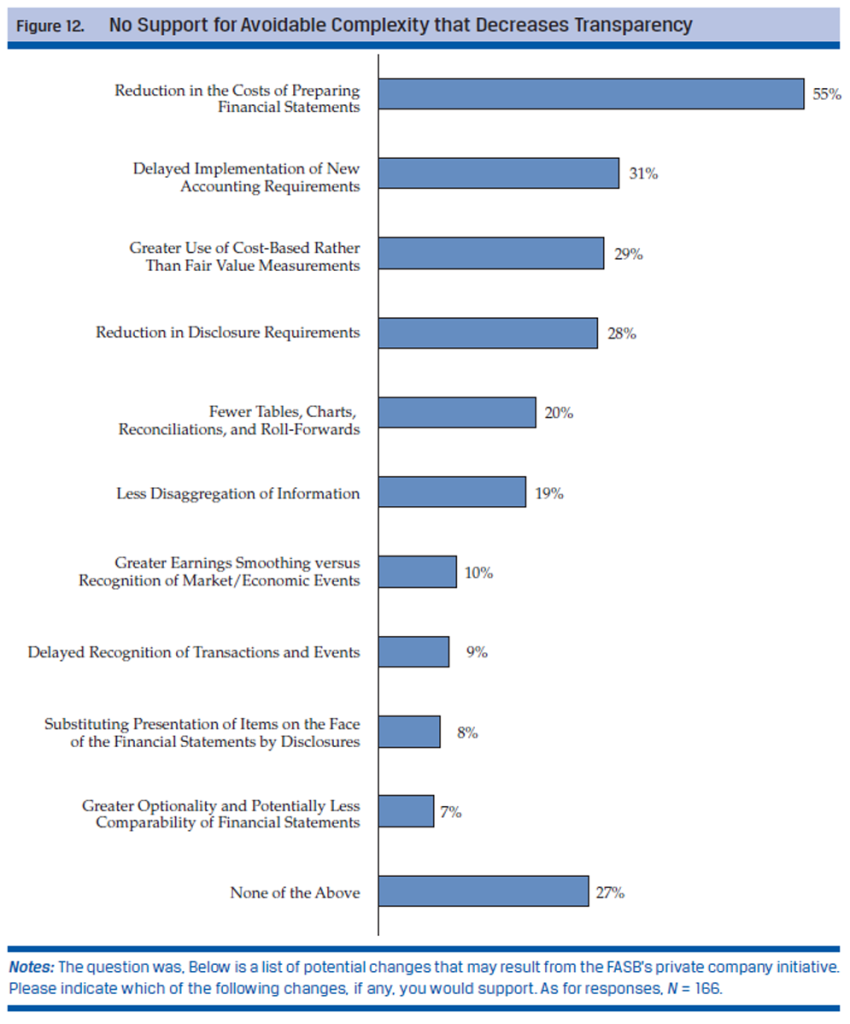

Investors do not support the following potential changes that may come about as a result of the private company initiative, which could increase, rather than reduce, avoidable complexity:

- Inadequate recognition: Delayed recognition of transaction and events

- Inadequate measurement: Greater use of cost-based rather than fair-value measures

- Accounting constructs vs. economic realities: Greater earnings smoothing versus recognition of market/economic events

- Poor presentation: Substituting presentation on the face of the financial statements with disclosure; less disaggregation of information; and fewer roll-forwards, reconciliations, tables, and charts

- Greater optionality and potentially less comparability of financial statements

- Reduced disclosure requirements

Aswath Damodaran in his paper, Information Transparency and Valuation: Can You Value What You Cannot See?, comments on the consequences of such complexity. He notes that “fuzzy” accounting standards exacerbate complexity in financial reporting by allowing discretionary power in the measurement of income and capital. Accounting can be used to report higher earnings, lower capital invested, and higher returns on capital. Investors who look at earnings stability as a measure of equity risk are misled into believing that these firms are less risky than they truly are.

The principle aim of accounting standards should be to ensure reflection of the underlying economics of transactions and events. To that end, standard setters need to work toward ensuring that all economic assets and obligations are recognized on the balance sheet; that investors receive economically relevant measures (fair value); that financial statement presentation is enhanced with a focus on disaggregation, cohesiveness, and the use of roll-forwards and the direct method cash flow statement; and that disclosures are not used as a substitute for poor presentation. Furthermore, efforts should aim to increase transparency by eliminating accounting constructs, optionality, smoothening of earnings, and exceptions to principles.

Inadequate communication can also compound transaction complexity. We urge standard setters to consider our publication Financial Reporting Disclosures: Investor Perspectives on Transparency, Trust, and Volume, which provides recommendations on how to increase communication effectiveness in financial statements.

View a 30-second video overview of the new report.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: istockphoto/Lya_Cattel