CFA Institute Survey: How Do ESG Issues Factor into Investment Decisions?

If you are a financial professional or investor, you have probably run across the term “ESG” in the past couple of years. What do these letters mean, what is behind them, and how do they play into portfolio managers’ and research analysts’ day-to-day work and investment decision-making?

ESG is the acronym for “Environmental, Social, and Governance” a set of factors used to evaluate corporate behavior. Discussion of ESG factors is increasingly becoming part of the investing landscape. They are often not directly captured on a company’s financial statements yet have the ability to materially impact a company’s future prospects. These issues often have a long-term effect on a company and have therefore increasingly been the focus of long-term institutional investors.

ESG factors will impact different companies in different ways. For example a company that operates in the oil-and-gas field will need to make sure it pays attention to environmental, health, and safety issues, an “E” factor. Clothes manufacturers need to often ensure that their supply chain and human capital policies don’t run afoul of investor sentiments, an “S” issue. Governance or “G” issues likely have been the most prominent in recent years, as poor governance at a number of firms contributed to the recent global financial crisis. It is of little surprise, therefore, that we’ve seen increased acceptance in recent years of the need for investment professionals to consider ESG factors in the investment decision-making process.

CFA Institute offers members and investors many resources on ESG issues to better educate themselves. There has also been ESG reading material in the CFA Institute curriculum for years now to ensure that the next generation of financial professionals understands current global investment practice. We believe that every financial analyst conducting investment analysis should have knowledge of the risks and opportunities of environmental, social, and governance (ESG) issues in investing.

How Do CFA Institute Members Integrate ESG into Investment Decisions?

This interest in ESG issues and ESG data led us to ask our members what they are seeing in their daily practice and how they use, or don’t use ESG data. On 26 May 2015, we invited 44,131 members who are working as portfolio managers and research analysts to participate in a survey (key findings are summarized here). The global survey closed on 5 June 2015. Seventy-three percent of members who responded to the survey said that they take ESG issues into account in their investment analysis and decisions, with governance factors taking the lead in driving investment decisions. Regionally, a higher proportion of survey respondents in the Asia-Pacific region considered ESG issues, followed closely by members in the Europe, Middle East, and Africa (EMEA) region. Respondents in the Americas region were the least likely to use ESG information in their decision-making process.

When asked to rate different ESG issues by order of importance, survey respondents ranked board accountability, human capital, and executive compensation as the issues most important to investment analysis and decision-making.

We also asked how they take ESG issues into consideration in their investment analysis and decisions; 57% of survey respondents said they integrate ESG into the whole investment analysis and decision-making process, while 38% stated that they use best-in-class positive alignment, and 36% use ESG analysis for exclusionary screening.

The main reasons survey respondents take ESG issues into consideration in their analysis are to help manage investment risks (63%), and because clients/investors demand it (44%). About 38% of those surveyed feel that ESG performance is a proxy for management quality.

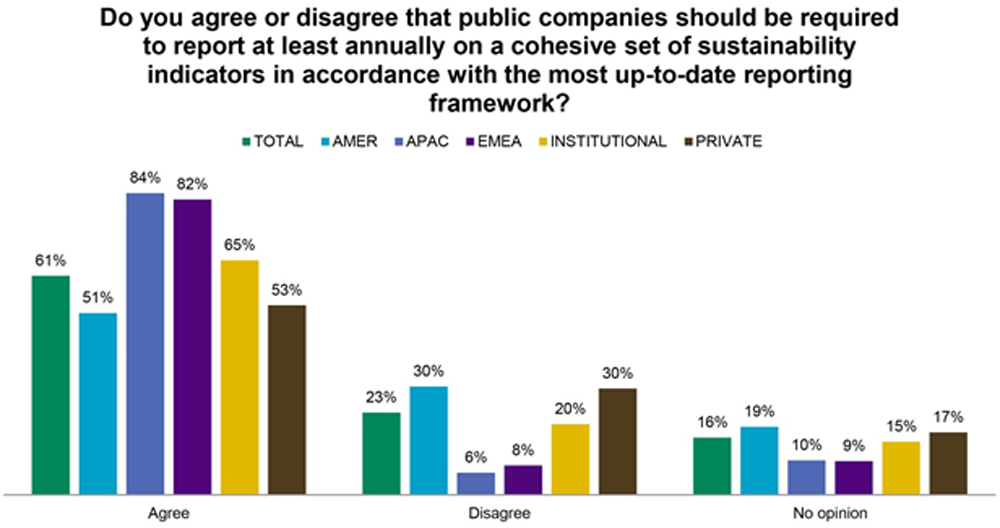

The findings show that survey respondents see value in companies providing ESG data to the marketplace; 61% agree that public companies should be required to report at least annually on a set of sustainability indicators in accordance with the most up-to-date reporting framework (51% Americas, 84% Asia-Pacific, 82% EMEA).

Survey respondents want to make sure that the ESG data they receive is useful, as 69% think it is important that ESG disclosures be subject to independent verification. When asked who is best positioned to provide independent verification of ESG disclosures, 53% said professional service firms skilled in ESG matters, while 31% felt that independent professional service firms (e.g., public accounting firms) would be the best source of verification.

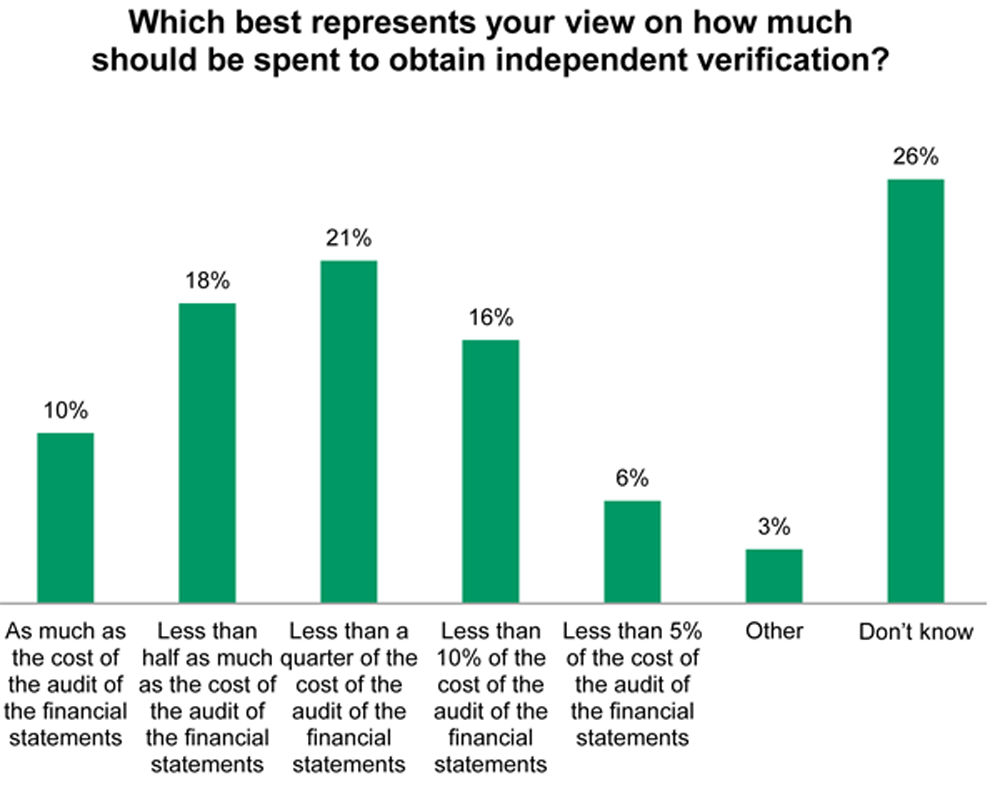

When asked how much they would be willing to pay for such independent verification, results were mixed, with the highest proportion (26%) saying they didn’t know, signaling that such thoughts are likely new to many of our members. Twenty-one percent said that they would be willing to pay less than a quarter of the cost of the audit of financial statements, while 18% said that they would be willing to pay less than half of the cost of the audit of financial statements.

Only 28% of members who responded to the survey indicated that employees at their firm receive training on consideration of ESG issues. Regionally, 40% of EMEA respondents said employees receive such training versus only 26% in the Americas and 23% in the Asia Pacific. A higher proportion of those managing institutional assets (34%) receive such training compared with those handling private assets (21%).

According to survey respondents, they mainly get ESG information through public information (75%), but plenty use third-party research as well (66%). Somewhat surprisingly, about half of member survey respondents receive ESG information through direct engagement with companies.

If history is any indication, we’ll see even greater demand for ESG information in the future. In just under a decade, the United Nations’ Principles for Responsible Investment (PRI) Initiative — which was created to increase investor engagement with companies and policymakers on ESG issues — has grown from approximately 100 signatories with $4 trillion in assets under management about a decade ago to 1,260 signatories with $45 trillion in assets under management today.

Increased demand is confirmed by financial data provider Bloomberg, which cites a substantial increase in the number of customers using ESG data in recent years (2,415 in 2009, and 17,010 in 2014).

A number of organizations are also providing resources dedicated to ESG issues. For example, the Sustainability Accounting and Standards Board (SASB) in the US is working with issuers and the investment community to help define ESG factors that are material on an industry-by-industry basis.

We are also in the process of updating our 2008 ESG manual to provide members with up-to-date resources.

Register now for a webinar (10 a.m. ET, 26 August) to review the findings.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: iStockphoto.com/sorbetto

Great article, summarized very well the current state of ESG issues

Thanks for your comment Alejandro. Stay tuned for our ESG Manual planned for release in a few months.

Extremely interesting findings and excellent review. Relative to APAC and EMEA respondents, any clear reasons/insights for why respondents in the Americas were less inclined to utilize ESG information/issues in the investment decision process? Or why less inclined to support annual ESG reporting?

Thank you for your comment Mitchell,

The results in the Americas were about what we expected, lagging behind EMEA in using ESG analysis in the investing process. In the Americas, especially the US and Canada, many may take for granted a relatively high level of governance standards and may not take governance into consideration unless there are obvious problems. In APAC the use of governance in the investing process may be more pronounced due to the perception of a relatively lower quality of corporate governance protections in many APAC markets.

And when asked why they do not take ESG issues into account, mostly survey respondents said that there was not a demand from clients. If that demand increases, so will adoption.

Matt

Interesting to see how this global ESG usage pattern also tracks the CSR-type behaviors of companies themselves globally. Since 1999, we’ve tracked this adoption trend (of what is variously called corporate responsibility, sustainability), in the same sequence. We correlate the adoption pattern to the underlying social mores of those countries and regions.

Any thoughts on that?

That is quite interesting Elsie.

We see increasing demand for ESG data from investors, which may correlate to what you are seeing.

Take care,

Matt

Matt, thanks for your response. CFA Institute is playing such an important role in the positive evolution of the investment community.

Further questions: Do you have data on the drivers of investor demand for ESG? And the segmentation of those drivers? We are very interested in how they might correlate with the personal values of the investor clusters and/or their gender/generation.

Elsie,

In this survey we did not drill down into the drivers of investor demand.

Take care,

Matt

Very insightful to learn that within ESG issues, board accountability, human capital and executive compensation are most important to investment analysis and decision-making. As Human Capital practitioners, we created a web-enabled ICE Cube Human Capital diagnostic Tool and piloted with ~1000 companies in ten countries. Data shows that the Effectiveness of the component D&I, Sustainability and CSR (which cover ESG issues) is contributed by how well an organisation performs in three areas- An outcome driven D&I, Sustainability and CSR strategy, culture of innovation and execution of CSR agenda. The tool measures 170 themes across 20 components for human capital capability and effectiveness. We are also constantly learning the power of the tool and the data.

Dear Chandrasekhar Pingali, that is a valuable tool! How can I find out more about it? Elsie