Ethical Decision-Making Skills: What Investment Managers Need to Know

When the topic of ethics arises at conferences, participants’ typical statements go something like this:

You can’t teach someone to be ethical. A person’s ethical character develops long before she or he enters the workforce. Ethics and compliance are not the same thing.

I’m not going to debate these commonalities today. However, I want you to envision a process where compliance to firm and regulatory obligations is undertaken ethically by all employees.

Now that you see it, does it still seem more like an ideal than part of an investment professional’s daily practice, despite the industry’s efforts to achieve this through a wide range of required annual training programs?

That’s likely because these programs center on meeting regulatory requirements for reinforcing the law of the land. Often there is a program that reviews the company’s code of ethics and other employee conduct expectations. The goal is to ensure everyone in the firm knows how to comply with the rules.

So how can we change these commonly voiced perceptions associated with ethics within our industry?

One answer is to modify the annual training programs from simple knowledge sharing to ones based on skills development. Focusing on the skills needed to make decisions in an ethical manner creates a process that can be applied to any code of ethics or regulatory requirements.

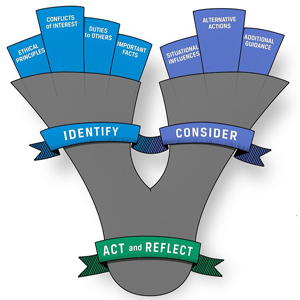

To facilitate a change in thinking around ethical programs, CFA Institute developed an Ethical Decision-Making (EDM) framework. This tool recognizes the fluid nature of ethical decisions by focusing on items that need to be identified and considered when an issue arises. This fluid nature means that the decision-making process is not linear as new information or an external bias may lead one to start the process anew. Finally, once a decision is made, it is important to reflect upon the process to learn what was beneficial and what to avoid in the future. Let’s take a deeper look at the EDM framework.

Identify

It will be important to identify the ethical principle(s) that may be in conflict in the particular situation. The EDM is agnostic as to the requirements covering an individual. There are many fundamental ethical principles covering the investment management industry such as confidentiality, fair dealing, diligence, and independence. An individual should already be aware of these through job onboarding or other professional education training.

Along with the relevant principles, the duty an individual has to one or more groups will also influence the decision-making process. Through awareness of these groups, the individual can identify the obligation to work in the interest of them appropriately. For example, trading on material, nonpublic information may benefit one’s clients, but it does so at the cost of the integrity of the capital market.

Identifying the principles and duties requires a rigorous review of the known facts. This will likely lead to questions about information that is unknown. By seeking additional information, an individual can bring clarity around the challenge.

Finally, it will be important to identify whether the situation is further compounded by conflicts of interest. An individual may have relationships or incentives that attempt to influence the decision-making process. Recognition and disclosure of these conflicts allow an individual to appropriately inform those to whom a duty is owed.

Consider

Along with identifying the relevant elements of the scenario, the EDM framework prompts one to consider a variety of factors. Situational influences are outside pressure and internal biases that might add difficulty in making a decision. These could be an individual’s desire to please the supervisor or be accepted by a group of colleagues. Through recognition, an individual can take steps to mitigate these influences.

It is also important to consider multiple options to address the situation. An individual may jump at the first solution presented. By keeping an open mind during the process, an outcome may be determined that benefits all parties involved that was not originally considered.

Finally, should time allow, an individual may want to turn to others for guidance. This may be a co-worker, supervisor, or other firm leader. Through discussions, alternative options and situational influences may be uncovered. However, time is not always available, which is why developing one’s ethical decision-making skill is important.

Act and Reflect

After an individual works through identifying and considering the relevant aspects of the situation, a decision has to be made. The specific actions required of the decision will depend on the nature of the initial concern. An individual may not be able to correct the situation alone and thus should elevate the issue to a more appropriate party, whether inside the firm or an external regulator.

No matter the actions taken, every decision provides a learning opportunity. The process taken will assist the individual in understanding his or her strengths and weaknesses in applying the EDM framework. This will be beneficial when the next challenge arises.

Applying the EDM Framework

To assist individuals in applying this new framework, CFA Institute offers two training opportunities. On a recurring monthly basis, a webinar is held for anyone to attend. Using a case-based training format, attendees are tasked with applying the EDM framework to a variety of hypothetical workplace scenarios.

The webinar contains multiple interactive elements. Along with the use of polls to collect the initial thoughts on the cases, an open chat room is used. This forum, moderated by myself and Jon Stokes, JD, director of professional standards, allows attendees to voice their support of the selections made and identify information that would benefit the decision-making process. These elements keep attendees engaged during the one-hour events.

CFA Institute recognized that some industry professional may require additional flexibility in programming to apply the EDM framework. This led to the development of an online, self-guided course, Ethical Decision-Making for Investment Professionals. This course provides a fundamental review of the EDM framework before moving into cases about a hypothetical investment firm.

To add to the interactive nature of the self-paced course, a branching format is used in the case questioning. Following a few questions identifying key EDM framework elements, participants are asked to select from the courses of actions that should be taken. The next set of facts delivered will be based on the initial choice. This allows someone that makes a less-than-optimal decision to recover the ethical path with the subsequent questions. For those with a firm ethical foundation, the path gets more difficult.

Each case provides the user with the opportunity to bring potential clients into their firm’s virtual waiting room. The better an individual is at applying the EDM framework and staying on an ethical journey, the more likely the waiting room will receive the maximum number of clients for each scenario. Those obtaining a sufficient number of clients will earn a certificate upon completion.

Having an Impact

Since we launched these programs, more than 2,400 people have participated in the webinars and over 500 have used the online course. A recent webinar attendee is promoting the skill-training session to more than 300 fellow employees. An individual working in compliance for over a decade who took our course commented: “It was a great refresher to allow me to hammer down certain crucial fundamentals. The points brought up in the case study were all so valid and the same questions do come up often in real life.”

Our goal with the framework and these programs is to strengthen an individual’s skill in recognizing ethical issues and then taking the appropriate action. Just as it takes practice and effort in applying a model to undercover profitable investment opportunities, ethical decision–making skills need to be practiced to become second nature.

If you liked this post, consider subscribing to Market Integrity Insights.