Demonstrating Ethical Conduct Is a Priority Throughout Investment Relationship

Most of us agree that we would not hire an investment manager that we did not trust. Thus, for a manager, displaying a commitment to ethical conduct is important in order to attract new clients. But how does the manager’s commitment to displaying ongoing ethical conduct rank after an advisory relationship has begun?

The level of importance of ethical actions is another of the themes uncovered in the results of the joint CFA Institute/Edelman survey From Trust to Loyalty: A Global Survey of What Investors Want. An earlier blog noted several topline findings of the report, such as fee transparency and disclosure of conflicts of interest. Although these are clearly elements in building trust, I wanted to see how retail and institutional respondents viewed a commitment to ethical conduct over the lifespan of the advisory arrangement.

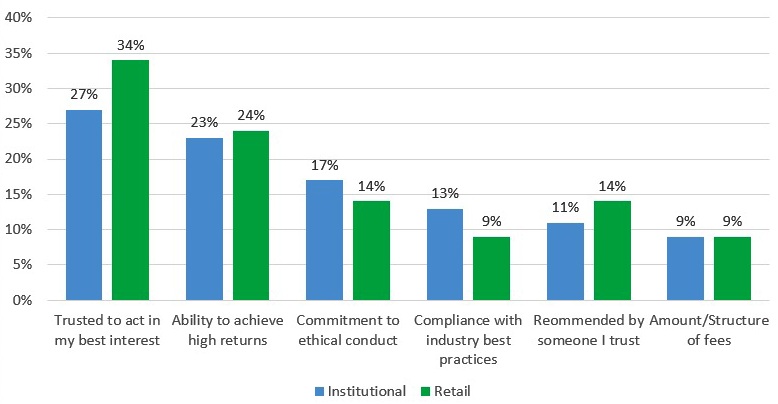

One question in the survey asked respondents to rank six attributes in importance when seeking to hire a new manager. For the institutional and retail investors responding, there is a clear need for a potential manager to demonstrate the ability to act ethically and in a manner to protect clients. As you can see in the following chart, if we combine the characteristics of “trusted to act in my best interest” and “commitment to ethical conduct,” the results show that 44% of institutional investors and 48% of retail investors want to see these attributes in a manager they are considering hiring, which significantly outpaces the importance of returns and fee structures when hiring a firm. A strong commitment to ethical actions is needed for business development.

Which of the following is most important when making a decision to hire an asset manager?

Percentage of Item Selected as Most Important

Retail Investors — Ethical Standards Are Important

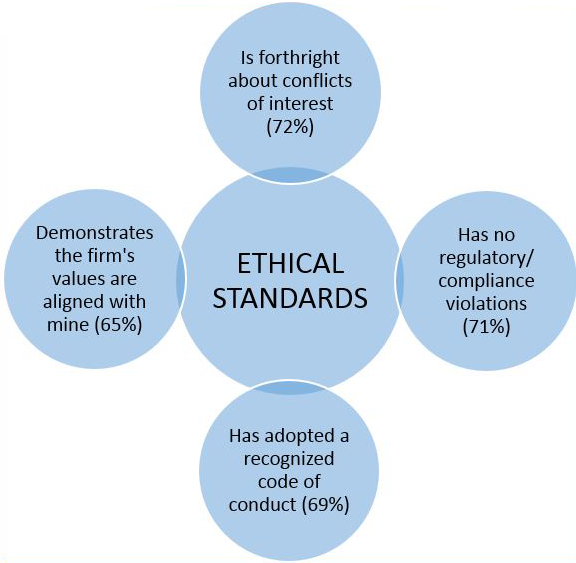

Another round of questions asked respondents to indicate the importance of 20+ attributes for managers to have in order to build client trust. During our analysis, we grouped four of the actions into a subgroup called ethical standards, which included adopting codes, avoiding regulatory violations, aligning values, and managing conflicts of interest.

The respondents indicated these four attributes were important to maintain and further strengthen their trust in managers. Although full fee disclosure ranked the highest and received an 80% importance score, all four of the ethical standards attributes were ranked as important by two-thirds or more of the respondents.

Retail Respondents: How important are the following items when it comes to working with an investment firm?

[Percentage important (scores of 9, 8, or 7)]

Institutional Investors — Ethics Tops Importance Ranking

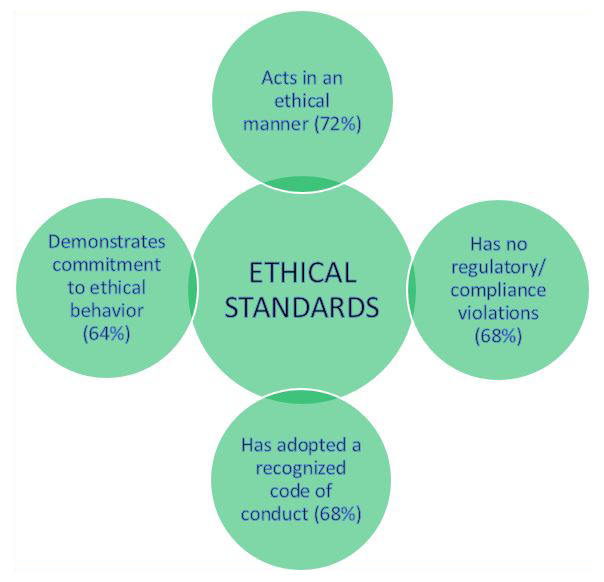

The elements provided to institutional investors differed slightly, given a greater level of perceived interactions with the managers. For this set of respondents, the four items in the ethical standards subgroup included a commitment to ethical behavior, acting ethically, adopting codes, and avoiding regulatory violations.

Institutional investors gave the highest importance score to “acting in an ethical manner.” Again, all four attributes were seen as important for managers to exhibit in order to strengthen investors’ trust in them, with each ranked in the Top 10 attributes provided in the survey.

Institutional Respondents: How important are the following items when it comes to working with an Investment Firm?

[Percentage important (scores of 9, 8, or 7)]

It is interesting that the level of importance for the ethical standard actions were consistent between retail and institutional investors, although the rank of those items differed significantly when compared with the full list of actions. Both types of investors demonstrated that consistent ethical actions are a vital part of a firm’s trust-building efforts.

Engaging Your Client

In sum, the survey results revealed areas of importance during different phases of the client relationship. In the beginning, factors of ethical conduct and commitment are important in order to earn new clients. Once the engagement commences, these attributes become baseline expectations.

Just as investment returns will ebb and flow, so will relationships with clients. Some will remain through down markets, whereas others will seek a different firm to manage their investments. Notably, 27% of retail and institutional investors said they would re-evaluate their investment firm(s) based on performance through a crisis. An unwavering commitment to ethical conduct combined with transparent and consistent communications will be keys to both building and maintaining loyal clients.

The following are some resources to help you show your commitment to advancing ethics and trust:

- Adopt the Asset Manager Code of Professional Conduct at your firm and demonstrate a dedication to placing client interests first.

- Share the Statement of Investor Rights with your clients.

- Build credibility and promote transparency by adopting the Global Investment Performance Standards (GIPS®).

- Limit reputational and regulatory risks, strengthen your company’s culture, and improve client relationships with our Ethical Decision Making for Investment Professionals online course and interactive webinars.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: CFA Institute

This is an excellent article that everyone should read. Your first chart shows that investors put 3x – 4x more emphasis on on loyalty than fees in their selection criteria when hiring a manager. That’s very nice to hear. But judging by the current “hot topic” news stories about large institutional investors, the only thing we hear about is their singular emphasis on fees, and their inclination to embrace passive management to lower investment costs. It appears that what participants say about themselves may be different from how they actually behave. Have you explored the possibility that respondents say what they believe their constituents want to hear?