Do You Know What XBRL Is? A Majority of Survey Respondents Do Not Know

Despite the fact that eXtensible Business Reporting Language (XBRL) is the global standard for exchanging business information between financial reporting systems, a recently published CFA Institute survey showed that 55% of respondents* did not know what it was.

Awareness and Use of XBRL

In the survey, we first asked members which financial reporting attributes were important to them. We asked them to rank the importance of the following attributes: comparability, timeliness, reliability, consistency, and granularity.

Not surprisingly, respondents believed that all these attributes were important, with reliability being most important.

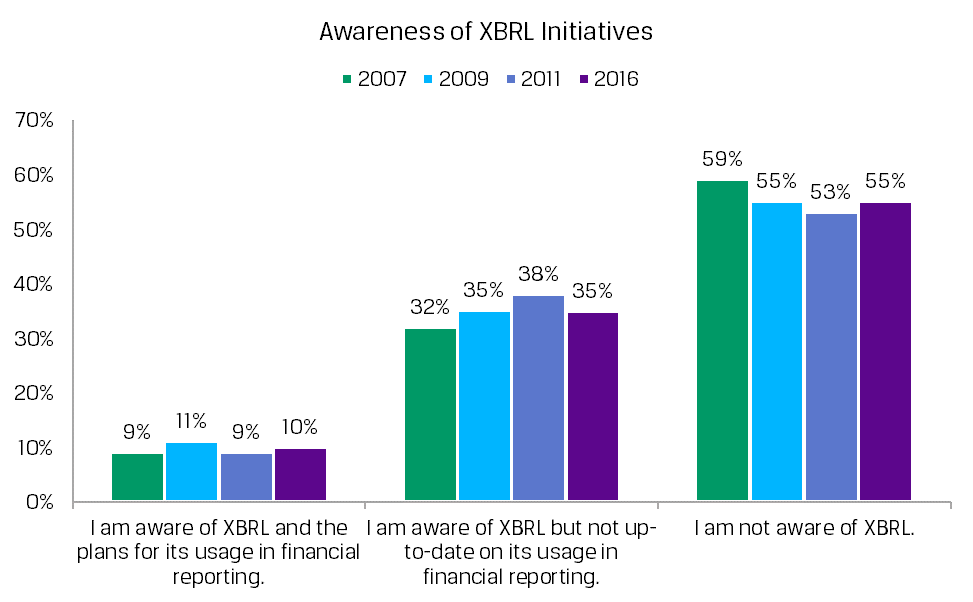

The next question was about the member’s level of awareness of XBRL. As shown in the following chart, 55% of respondents remain unaware of XBRL and 35% were aware but not up-to-date on its usage in financial reporting; together that comes to a whopping 90%.

Of those aware of XBRL, the highest proportions agree that XBRL-tagged interactive data will significantly improve their ability to increase the timeliness of the valuation process and their ability to upload company data into their financial analysis models.

More than three-quarters of respondents (77%) rated tagged information for all companies across a meaningful set of annual and interim periods as important for their use of XBRL-filed information.

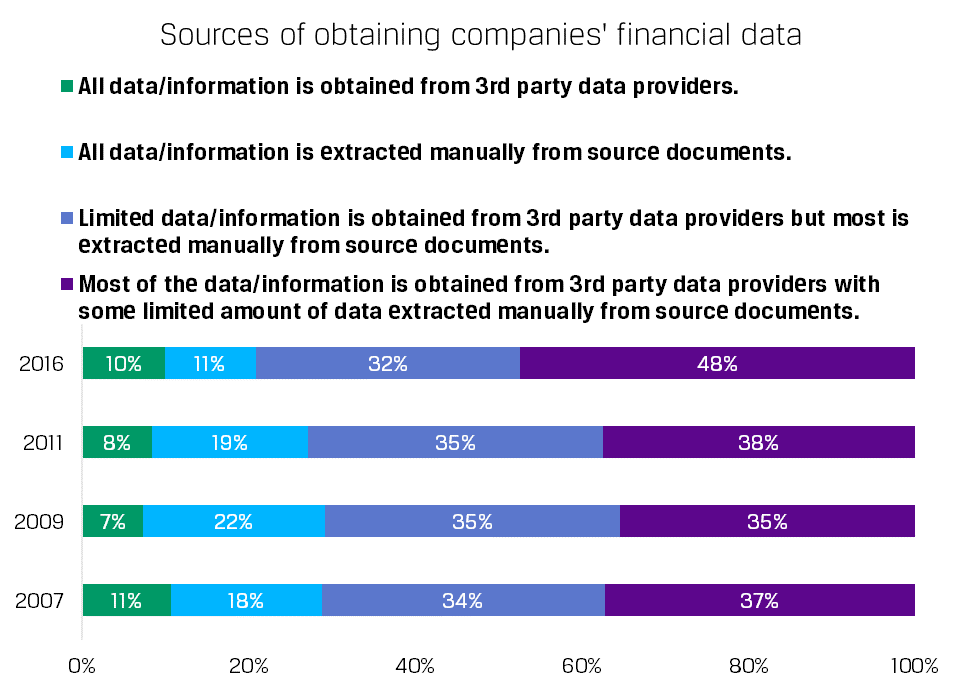

We then asked about the sources of obtaining company data, and the results were fairly consistent with previous years. As shown in the following chart, 48% of respondents obtain most of the data they use in their analysis of companies from third-party data providers, with a limited amount of data extracted manually. Ten percent obtain all data from third-party providers.

What the Results Are Telling Us

The primary story we are hearing is that companies are not using structured data as a communication platform, which is reflected in the fact that they are tagging only where they are required to and not beyond. They are tagging at the end of the financial reporting process simply to meet regulatory compliance needs. And it is also reflected in the poor quality of XBRL data that are submitted to regulators. Companies are not giving analysts a reason to embrace XBRL or to change their current practices. So, analysts continue to rely on data providers.

If companies changed their approach to the use of structured data, it could revolutionize financial reporting, as we have discussed in other posts. We will continue to work toward that end.

Read the full survey results to learn more.

*The regional distribution of the CFA Institute members who participated was as follows: 60% from the Americas region, 24% from the EMEA region, and 16% from the APAC region.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/angelhell

The result of the survey is not surprising, nor is the lack of enthusiasm for XBRL in general. From the time of its introduction, I have wondered if XBRL is the answer to an unasked question. Perhaps this reveals my inability to understand the benefits alleged by XBRL, which is entirely possible, given my use of company financials goes back to the days of the 13-columnar that we all used with pencil and a 10-key. I have advanced beyond that point, but again, no one has been able to show me the huge advancements of what XBRL is supposed to produce.

Thank you for your comment, Kevin.

I encourage you to read our blog “The Role of Data and Technology in Transforming Financial Reporting” that explains the benefits of using XBRL. The blog can be found at:

https://blogs.cfainstitute.org/marketintegrity/2016/09/01/the-role-of-data-and-technology-in-transforming-financial-reporting/

Best wishes,

Mohini

I read about XBRL back in 2011 and how it was going to revolutionize financial reporting. Perhaps it is a matter of time. Thank you for this summary.

Thank you for your interest, Ernest.

Best,

Mohini

I think a couple of factors have kept XBRL from being better understood by the analyst community.

XBRL was conceived of as a way of making it easier for everyone to consume financial statement data. That hasn’t happened. In part this is because the SEC decided not to fund the development of a basic, freely available tool for working with XBRL data in spreadsheets. The tools have been improving over the past couple of years, but in the absence of “free” there’s been less demand for XBRL tagged data than there might be. The cost of developing such a tool is a drop in the bucket compared to the agency’s annual budget.

Also, when the SEC was working through the implementation of “full disclosure” in the early 1970s, the various NYSSA analyst industry splinter groups were heavily involved in providing input to the companies in that industry and to the SEC. The NYSSA actually published a relatively comprehensive report on this topic. To my knowledge, there was limited involvement by the analyst community in the creation of the XBRL taxonomies. Had there been greater involvement, I think there would be greater awareness today.

I used XBRL for HMRC mandatory reporting in UK in 2011 and 2012. There is absolutely no awareness about it in Middle East even though XBRL experts are mentioning that it is the future of reporting and will be the hot burger in next 4 to 5 years.

Hi Mohini:

although xBRL data is has been available for a few years now, it is difficult for investors to use because third party technology is required purchase. if conventional financial statement data is widely adopted and freely available the benefits of xBRL will not reach the investor if a similar dissemination utility is not developed or made available. your effort would have been better spent on the issues in dissemination issues.

secondly, in a separate review by Martin Fridson on the the End of Accounting, the higher utility of cash flow as opposed to earnings might better explain the lesser attractiveness on relying on earnings even if the data is XBRL available.

thirdly, l believe that the Securities Commission of Malaysia has made xBRL required reporting by the Private Pension Administrator to the Securities Commission (as opposed to the PPA reporting to pension investors). apart from reporting to investor/consumer/public you might want to explore if xBRL is exploited in other reporting environments.

you might therefore want to develop CFA Institute policy positions on xBRL by taking these issues into account and work a path forward to enhance the wider adoptablility of xBRL.

The Malaysian Companies Commission (aka. SSM) is announcing the use XBRL for business reports in 2017. The taxonomy for the content of the reports have been published on SSM site. From the looks of it, XBRL is the way to go to standardize financial reporting.

Thank you for the post, Mohini Singh

As the Malaysian Business Reporting System (MBRS), built on top of XBRL, will become available for annual submissions, Formis Network Services Training is providing workshops in MBRS (Malaysian Business Reporting System) nationwide.

If you are interested in learning more you can read more here: http://formis-training.com/. The programs will be conducted jointly by SSM and Formis Training Starting August 2018.

MBRS Training will be split into two:

– Introduction to MBRS (1 Day Training)

– MBRS for Preparers: Financial Statements (2 Day Training)

I am a lecturer from Indonesia, i want to do the survey about the extent to which the lecturer in Indonesia know about XBRL….

still exploratory research in Indonesia, cause never find xbrl research here…

Thank you for the post..really help me to start my research..

Thank you. I am glad this was helpful to you.

Great content. Keep up the good work. I enjoyed every bit of your post. I can also recommend http://www.amazewriters.com, it has been serving me for the last 2 years