Solving the Conundrum Presented by Non-GAAP Financial Measures

Concerns about the sometimes misleading nature of the voluntary, company-reported, non-GAAP financial measures (NGFMs) — also referred to as alternative performance measures (APMs) — have long existed and pre-date the dot-com bubble days. These concerns have recently resurfaced because of the increasingly pervasive reporting and prominence accorded to these alternative measures, and because of the widening gap of these measures relative to GAAP and International Financial Reporting Standards (IFRS) measures.

Several studies, including a 2016 PricewaterhouseCoopers report and academic research by Black, Christensen, Ciesielski, and Whipple, show how widespread the reporting of NGFMs/APMs are across FTSE 100 Index and S&P 500 Index firms (e.g., 95% of FTSE 100 companies reported an adjusted profit number). Other studies highlight the relatively exuberant portrayal of performance by NGFMs. RG Associates reported in its Analyst’s Accounting Observer that out of a sample of 380 S&P 500 companies, 6.6% reported growth in 2015 non-GAAP profit but had an 11% decline in GAAP profit.

Correspondingly, in 2016, securities regulators upped the ante in reining in misleading NGFM reporting. The US SEC, European Securities Markets Association (ESMA), and International Organization of Securities Commission (IOSCO) have all updated their guidance on these measures.

CFA Institute Perspective on Non-GAAP Reporting

Whether and the extent to which companies should be restricted in communicating NGFMs can present something of a conundrum. On the one hand, the unchecked proliferation of NGFMs can end up undermining GAAP/IFRS performance measures. Furthermore, NGFMs can be harmful to investors, particularly retail investors, when they misleadingly characterize performance in a more positive light than the GAAP/IFRS number. On the other hand, there is a general acknowledgement that many investors apply and find these measures to be useful for analyzing companies. Furthermore, NGFMs are voluntary and supplemental in nature and are communicated by companies for various reasons, including to convey performance through the “eyes of management.” And it is usually beyond the purview of securities regulators to set standards for voluntary measures.

Several investment professionals from around the globe that are CFA Institute members have reached out to the Standards and Advocacy team expressing concerns about what they consider to be dubious and opportunistic NGFM reporting. One example is the exclusion of legitimate and recurring business expenses, such as stock option expenses and restructuring costs, in the calculation of NGFMs. These concerns mirror those that have been highlighted in the media, which has been filled with examples of egregious misreporting of these measures by companies.

To engage in the debate and provide investor perspectives on whether or how much to rein in or enhance the quality of NGFM reporting, CFA Institute recently conducted a comprehensive member survey, with responses from more than 550 members. The survey feedback helped shape our commentary on NGFMs presented in Investor Uses, Expectations and Concerns on Non-GAAP Financial Measures and Bridging the Gap: Ensuring Effective Non-GAAP and Performance Reporting. Highlights from the study were also featured in a Wall Street Journal article.

Headline Findings

The following highlights some of the key findings in the research.

Investor Demand for NGFMs

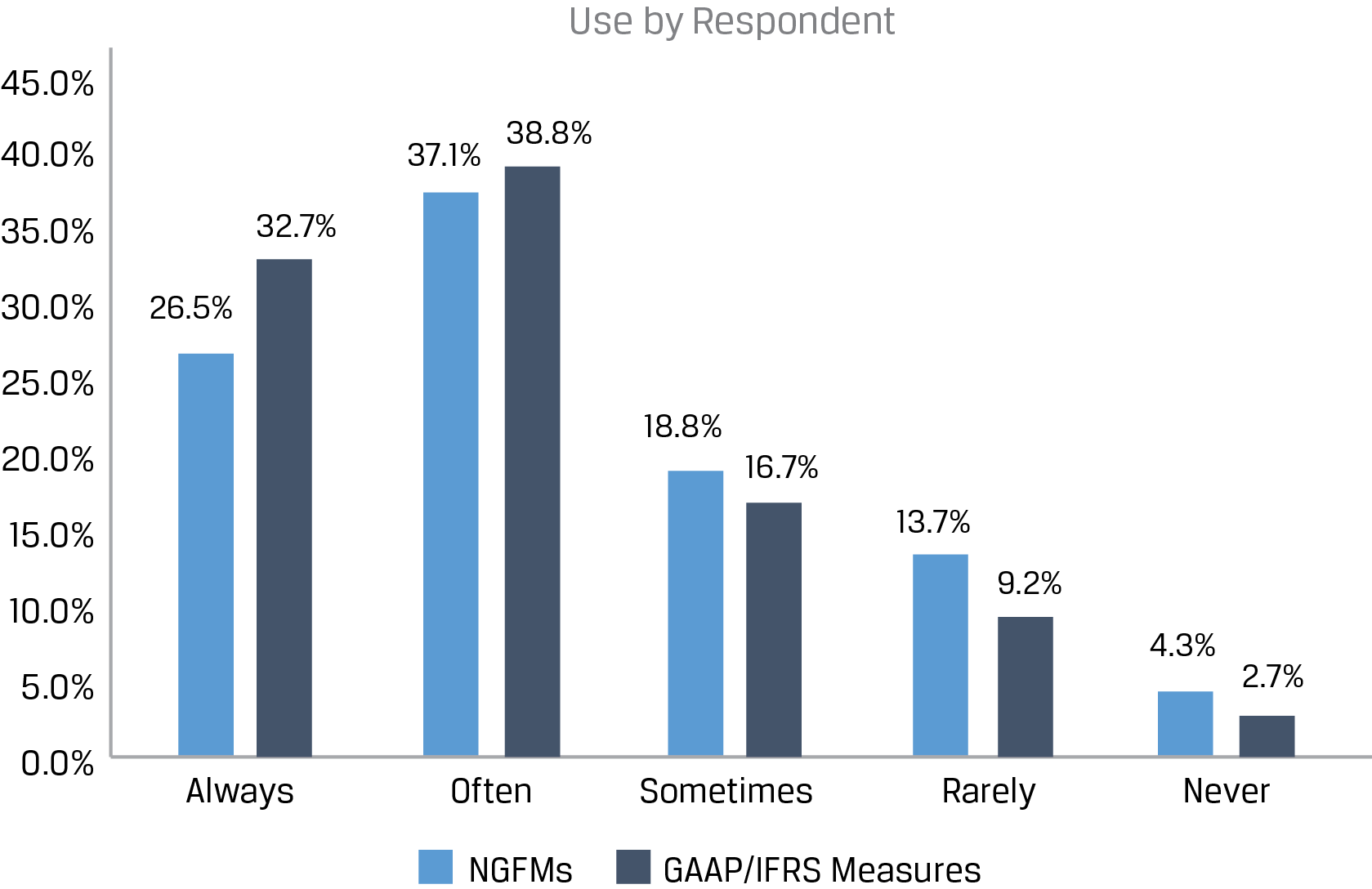

- Investors extensively use NGFMs (63.6% of respondents always or often use these measures) albeit to a lesser degree than GAAP/IFRS-based measures (71.5% always or often use these measures).

- Investors don’t just apply company reported NGFMs, rather many make adjustments to these measures by reversing line item adjustments made by companies when calculating NGFMs. Our survey results show that 60% of respondents make further adjustments to reported NGFMs.

- There are a range of reasons for investors and analysts to apply these measures, including as performance analysis and valuation inputs or an accounting quality indicator as well as to conform to industry norms, such as consensus earnings reporting requirements.

Use of NGFMs vs. GAAP/IFRS

NGFM Calculation

We reviewed investor perspectives on line items that are either frequently adjusted and/or have high magnitude of adjustments across S&P 500 and FTSE 100 firms. We found support for adjustments of truly one-off items (e.g., one-off sales) when calculating NGFM. In contrast, there was opposition to excluding or adjusting recurring business expenses (e.g., stock option expenses). Overall, our review showed that a sizeable proportion of respondents considered many of the line item adjustments as sometimes appropriate or inappropriate, revealing that the appropriateness of adjustments is likely determined on a case by case basis.

Communication and Transparency of NGFMs

The quality of communication and transparency in the reporting of NGFMs remains an area in which there is scope for ongoing improvement.

- Comparability: There is a general challenge of comparing NGFMs across firms because of the lack of standardized definitions for these measures. As an example, it can be quite daunting to compare EBITDA and adjusted EBITDA across companies. The comparability challenge is compounded by the tendency of companies to vary the line item adjustments made when calculating NGFMs across different time periods.

- Reconciliation and disclosures: Securities regulators’ guidance requires companies that report NGFMs to present a reconciliation to the most directly comparable GAAP/IFRS line items as well to provide contextualizing disclosures that explain the line item adjustments. We found that there is scope for improvement in the reporting of these reconciliations and disclosures.

Bridging the Gap: Enhancing the Quality of NGFMs

NGFMs are most likely here to stay because many investors find them to be useful. We also consider current and potentially strengthened regulatory imposed restraints on misleading NGFMs to be necessary but not sufficient for ensuring that only the highest quality performance, liquidity, and financial condition measures are communicated by companies. Our survey results reveal investors are mostly supportive of different regulatory guidelines and they expect more effective oversight on NGFM reporting.

In our reports, we recommend a multi-pronged approach involving regulators, auditors, audit committees, and investors to ensure the effective reporting of these measures and the strengthening of the overall quality of NGFMs (i.e., informative and reliable NGFMs). The survey results reveal particularly strong support (80.3%) for some form of assurance to be provided for these measures. A multiple stakeholder approach is also articulated in the recently published Center for Audit Quality (CAQ) paper: Non-GAAP Financial Measures: Continuing the Conversation

Finally, concerns about misleading NGFM reporting should serve as a catalyst for the International Accounting Standards Board (IASB) and US Financial Accounting Standards Board (FASB) to enhance their primary financial statements’ presentation and classification requirements, including defining key subtotals. The member survey results show that most investors expect and are supportive of standard setters providing guidance on the presentation of NGFMs in financial statements as well as on the improvement of the structure of both the income statement and the cash flow statement.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/peepo

After reading this, I’m not sure if enough consideration has been given to the possibility that GAAP may no longer be a fair reflection of the financial performance in many industries where so much investment is intangible, software and customer acquisition. A read of Baruch Lev’s End of Accounting book from last year was a good investment of my time.