Implications of the Widening Spectrum of Useful Corporate Information

A recent CFA Institute member survey showed that traditional financial statement information continues to play an integral role during investors’ analysis of the performance, value, and risk of companies. Investors’ heavy reliance on traditional statement information is not surprising given that such information is designed to be relatively comparable, is subject to audit, and is required to be generated in a processing environment with adequate governance, controls, and oversight.

Importance of Different Sources of Information, Years 2007-2016

All results shown in the chart above are based on those who selected 4 and 5 Very Important

Results from CFA Institute member survey on XBRL, 2016 CFA Institute

Yet, recent commentary, including in the Harvard Business Review and from the Federation of European Accountants, as well as the provocative title of Lev Baruch and Feng Gu’s book — “End of Accounting and the Path Forward for Investors and Managers” — have put forward a proposition that Generally Accepted Accounting Procedure-based (GAAP-based) information has been declining in its valuation relevance for a variety of reasons.

Baruch and Gu present empirical evidence demonstrating the decline in relevance of GAAP-based book value of equity and earnings from the 1950s to date. The authors attribute the observed pattern of declining relevance of GAAP information to the failure of existing accounting requirements to require the recognition of, and full transparency of, internally generated intangible assets (e.g., intellectual property rights, brands). Intangible assets make up a high proportion of the assets used by many modern-day businesses, and they are not covered by the International Financial Reporting Standards Foundation (IFRS) policies.

Other Information Should Complement (Not Substitute) GAAP/IFRS

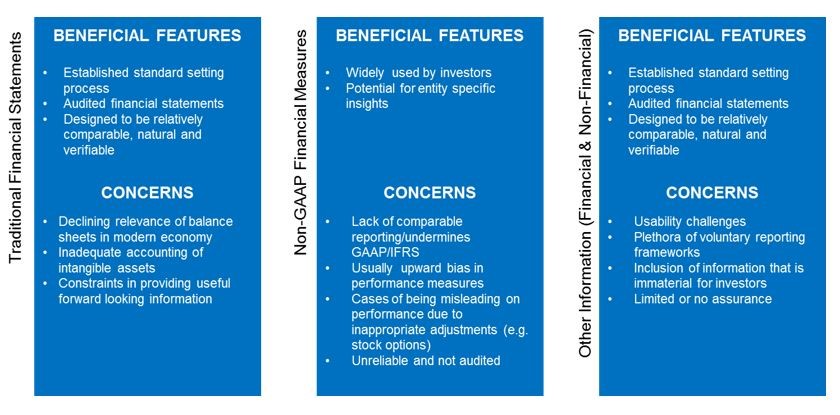

GAAP and International Financial Reporting Standards (IFRS) information remains necessary but not sufficient for investors to assess the prospects and long-term value creation ability of companies. Hence, it is not surprising that investors are clamoring for enhanced reporting of other types of information including non-GAAP financial measures (NGFMs) and Environmental, Social, and Governance (ESG) information.

However, the information outside the main financial statements should be complementary to, and not a substitute for, the insights gleaned from GAAP/IFRS information, especially as the relatively nascent other information is also not exempt from shortcomings, as outlined below. A case in point is non-GAAP financial information that is used by investors but is also rife with concerns as we discuss below.

Investor Views on NGFMs

In December last year, CFA Institute published two reports on NGFMs: Investor Uses, Expectations, and Concerns on Non-GAAP Financial Measures and Bridging the Gap: Ensuring Effective Non-GAAP and Performance Reporting.

In this two-part video series, Vincent Papa discusses standardized accounting framework and calculations companies are using surrounding non-GAAP financial measures.

Part One

Part Two

Concerns on NGFMs

As discussed in our two reports, investors widely use NGFMs, but there are many concerns about the reporting. Some of the top concerns from CFA Institute members who responded to our survey include the following:

- Inability to compare performance across companies and risk of misinterpretation of relative performance. As an example, a recent news feature highlighted top-performing stocks based on profit margins and depicted Facebook as being top of the pack. What is notable is that Facebook’s highlighted profitability measure is the non-GAAP gross margin — and unless other companies being compared have made similar adjustments to Facebook as delineated below — any comparisons of performance across companies would be potentially misleading.

Table 1 - Excerpt of Reported Top Profitability Stocks

Source:Investor's Business Daily, 15 February 2017Six Top-Rated Stocks with 50% Plus Profit Margins Annual Pre-Tax Margin Facebook 60.0%

United Therapeutics 59.3%

Phillips-66 Partners 55.7%

BPFI Holdings 53.4%

Alibaba 52.9%

Mobileye 51.8%

Table 2 - Facebook Line Item Adjustments

Facebook — USD (Millions) 2016 2015 GAAP Net Income 10,217 3,688 Equity compensation expense 3,218 2,969 Payroll taxes related to equity compensation 98 77 Amortization of intangible assets 751 730 Income tax adjustments (1,916) (946) Non-GAAP Net Income 12,368 6,518 2016 2015 Operating margin non-GAAP 60% 56% Operating margin GAAP 45% 35% - Across time-period inconsistencies in line item adjustments. Companies have flexibility in how they calculate NGFMs, which can lead to inconsistent types of adjustments across reporting trends. This undermines the ability of investors to perform either a company’s adjusted performance trend analysis or peer analysis.

- Questionable line item adjustments can mislead investors on a company’s performance. Excluding recurring items, such as restructuring costs and stock option expenses, is effectively distorting and presents a rosier view than the GAAP/IFRS measures of performance.

- Mispricing risk associated with greater prominence of NGFM-relative GAAP/IFRS measures. Investors who apply relative value methods, such as Price-to-Earnings (PE) multiples, can potentially be misled by over emphasis on adjusted earnings-per-share (EPS) and adjusted net income. Undue prominence of adjusted EPS and adjusted net income can contribute to the mispricing of equities by some of the capital market participants who apply relative valuation methods, such as PE multiples.

- Risk of unjustified performance-based executive compensation. Adjusted performance measures typically make a company look better. When compensation is linked to NGFMs, executives may be overly compensated at a time when the company could actually be underperforming.

- Inadequacies of reconciliation and disclosure of NGFM adjustments. Issues include instances of inadequate disaggregation of line item adjustments, instances where reconciliation is not prominently located, and boiler plate explanations for the communication of and line item adjustments in the NGFM determination.

- Lack of reliability and need for assurance on NGFMs. A 2014 Price Waterhouse Cooper survey of investors showed that only 22% of respondents considered NGFMs to be reliable.

Addressing NGFM Concerns

The CFA Institute report, Bridging the Gap: Ensuring Effective Non-GAAP and Performance Reporting, recommends a multi-pronged approach to addressing NGFM reporting concerns.

The first is a preemptive approach in which the International Accounting Standards Board (IASB) and US Financial Accounting Standards Board (FASB) enhance their primary financial statements’ presentation and classification requirements. These requirements include defining key subtotals and improving the structure of both the income statement and the cash flow statement.

The second is creating discipline around the reporting of NGFMs to ensure their effective reporting and strengthening their overall quality to make them more informative and reliable. These are roles to be fulfilled by securities regulators, auditors, audit committees, and investors. CFA Institute member survey results revealed particularly strong support (80.3%) for some form of assurance to be provided for these measures.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/peepo