Use of ESG Data in Investing Is Maturing, But Regional and Gender Differences Exist

In 2015, CFA Institute surveyed its members to better understand how they are integrating or not integrating environmental, social, and governance (ESG) data into the investment process. We recently repeated the survey to reveal any trends developing in the use of ESG factors, to measure the growth in ESG integration, and to offer investors a better understanding of the evolving ESG landscape.

In the latest survey, we find evidence that the ESG market is maturing, but with significant variation by region. Risk assessment and client demand dominate the reasons practitioners undertake ESG analysis, and the desire for more and improved ESG data remains strong.

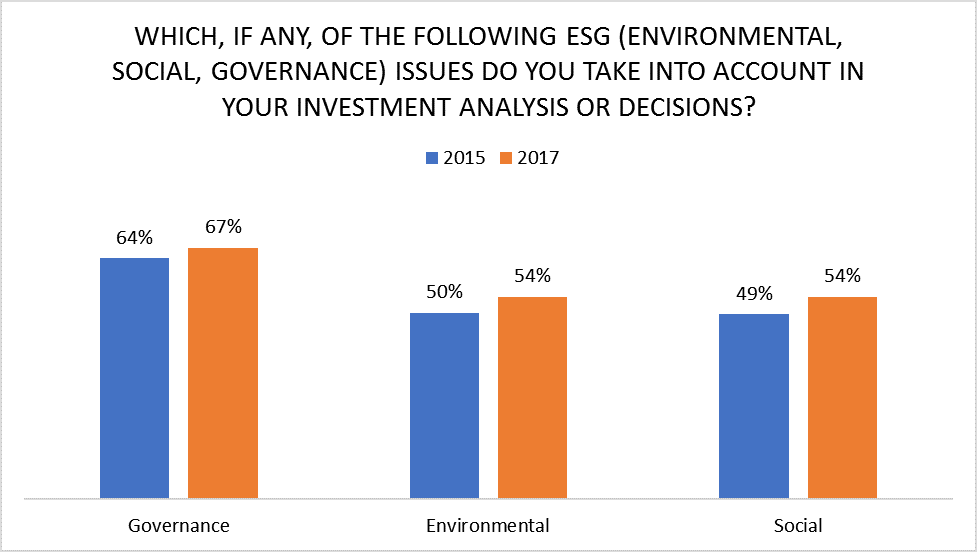

Overall level of those taking account of ESG factors is the same (73% at least consider E, S, or G), but interest in each component (E, S, and G) has increased around the globe. It remains to be seen whether these results means that interest in ESG integration has plateaued or we are in a maturing phase in which adoption of ESG integration is just growing more slowly than before.

Topline Findings in the 2017 ESG Survey

Those who say they take ESG issues into account in their investment analysis remains unchanged from 2015. But as the following chart shows, there has been growth in the use of each E, S, and G.

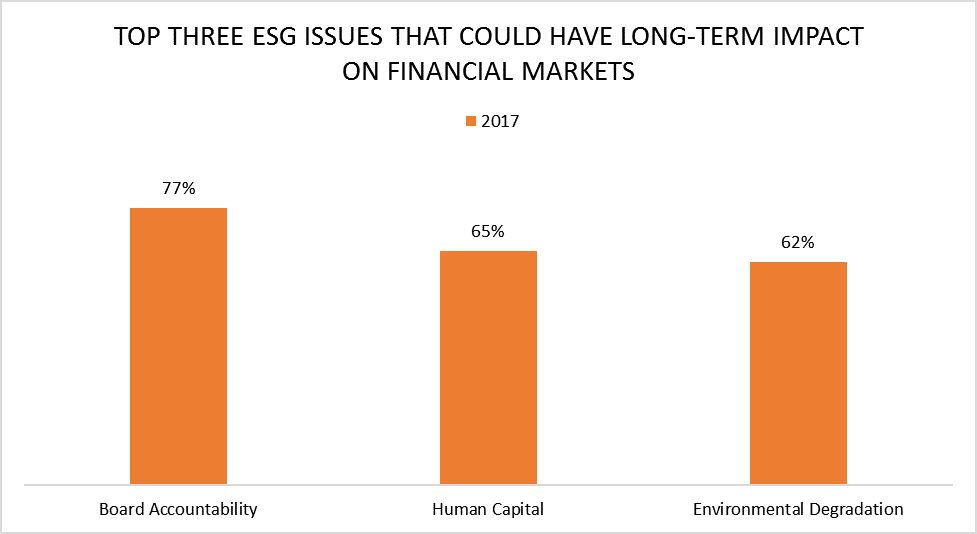

When asked to rate ESG issues from most impactful to least impactful, board accountability, human capital, and environmental degradation were ranked as top three issues that could have a significant impact on financial markets. Respondents were asked to rate issues according to what they believe their impact would be, with 1 being no impact and 5 being a significant impact. The following graph shows percentage of a rating of 4 or 5 that these issues received.

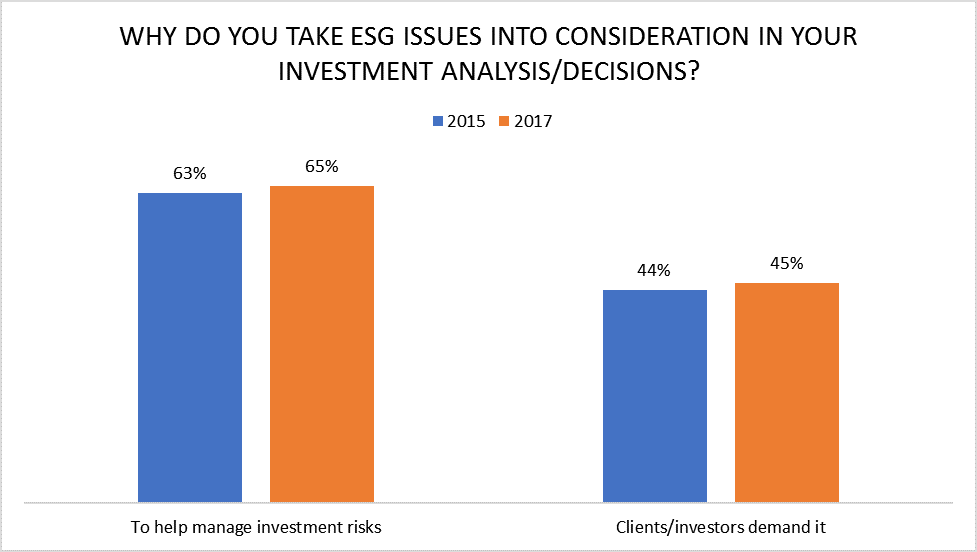

When asked why they take ESG integration into consideration in investment analysis, managing risk and client demand were the main reasons.

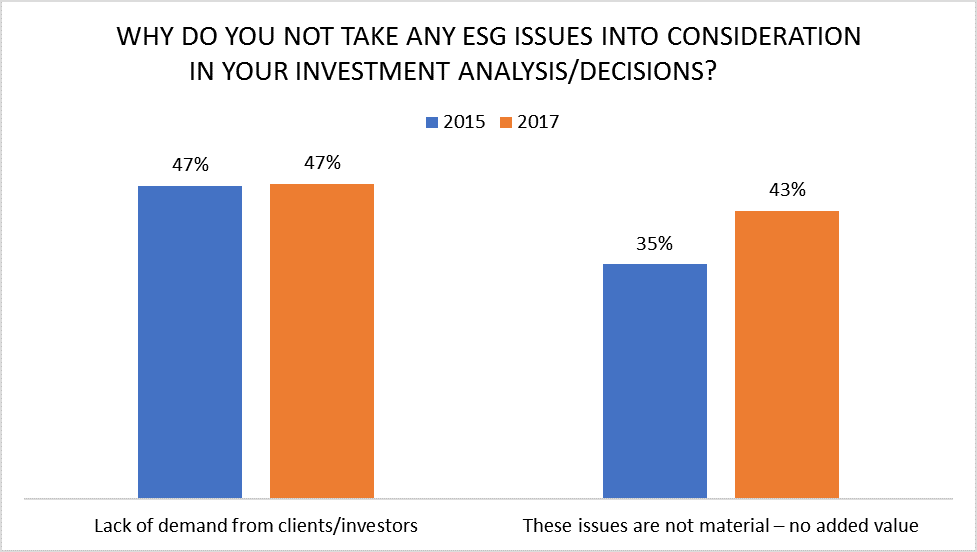

For those who do not integrate ESG into the investment process, lack of client demand was the main reason, followed by an increasing belief that ESG issues may not be material.

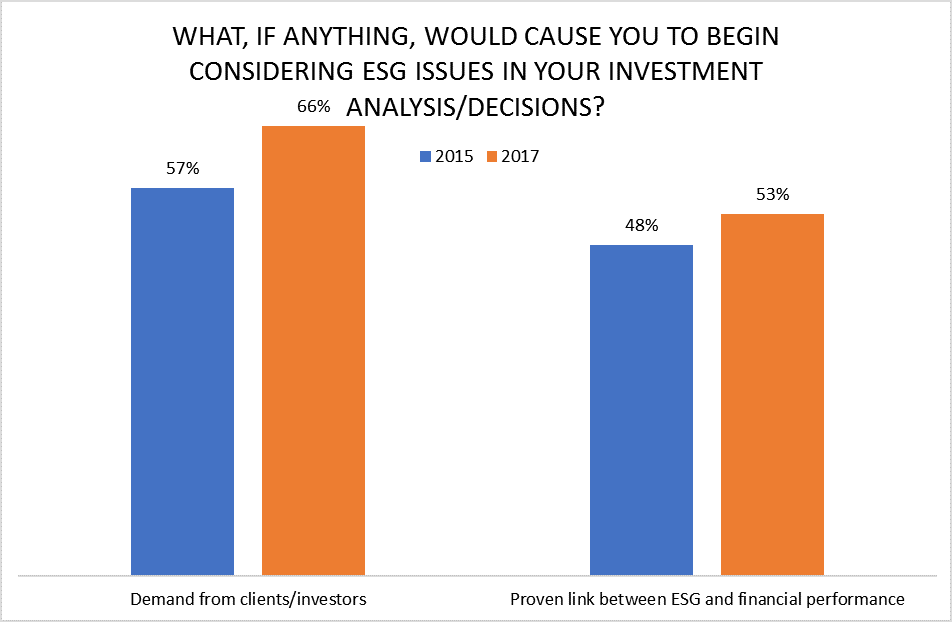

An increase in client demand followed by a proven link between ESG and performance were most likely to sway those who do not currently incorporate ESG data in their investment process.

The most common use of ESG in the investment process is still ESG integration, by a wide margin. But there was a surprise uptick in exclusionary screening at the expense of best in class investing over the past two years.

Transparency and Integrity of Data

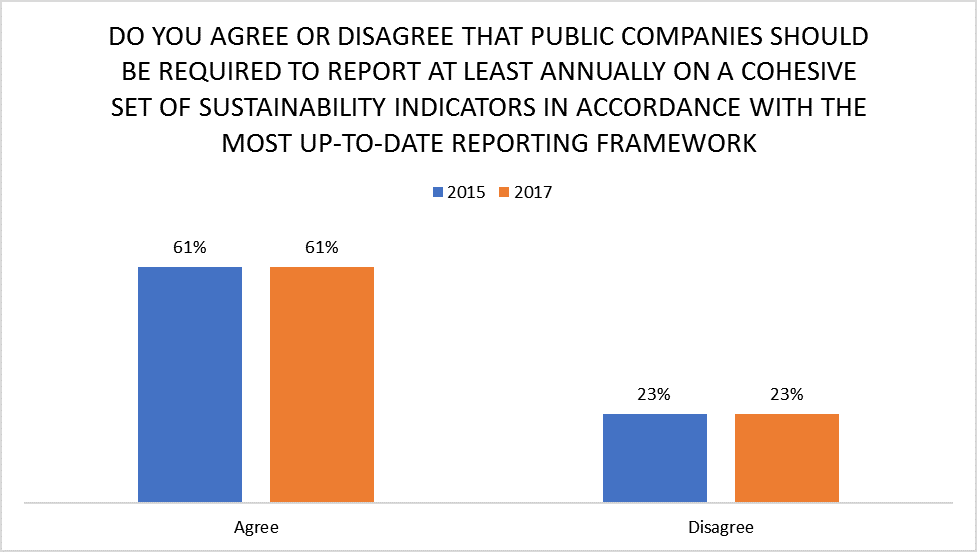

Globally, the same percentage of respondents agree that public companies should be required to report at least annually on a cohesive set of sustainability indicators.

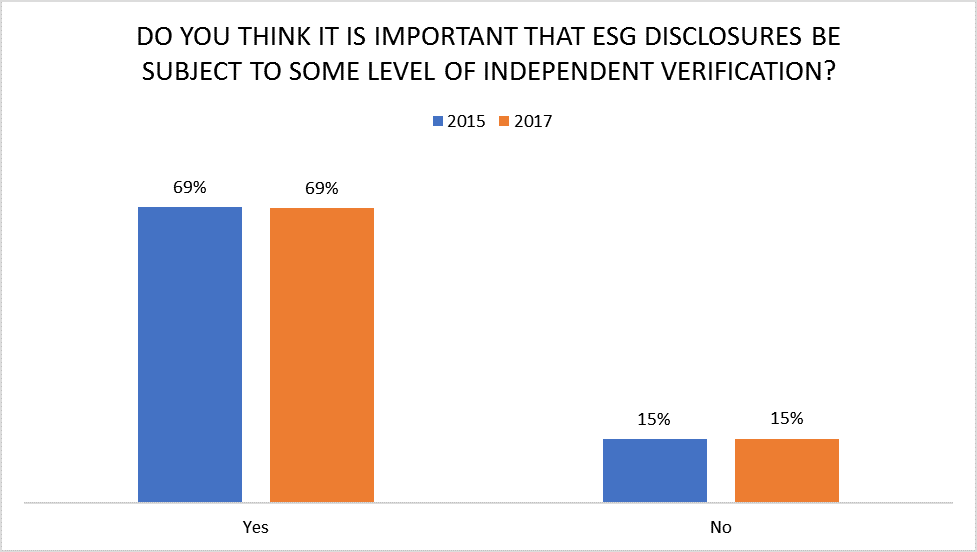

Over two-thirds of those surveyed (69%) believed it is important that ESG Disclosures be subject to some level of independent verification, which is the same as in 2015.

Regional Differences

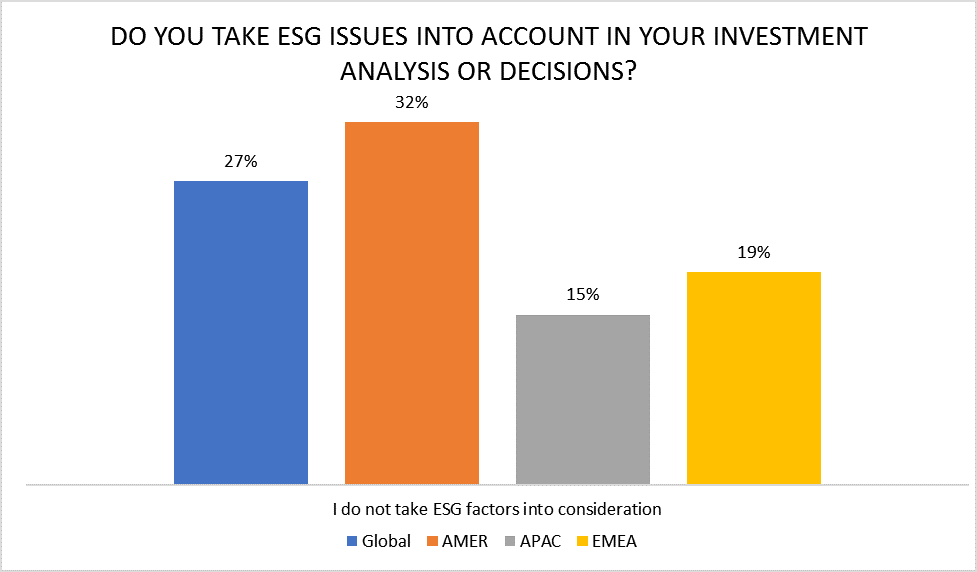

When asked if members take ESG issues into account in their investment analysis and decisions, those in the Americas are lagging behind. But a significantly higher proportion of members in the Asia-Pacific (APAC) region and Europe, Middle East, and Africa (EMEA) region do take ESG into account.

Survey respondents in EMEA were much more likely to consider ESG issues systematically in investment analysis (62%) than Americas (47%) or APAC (48%).

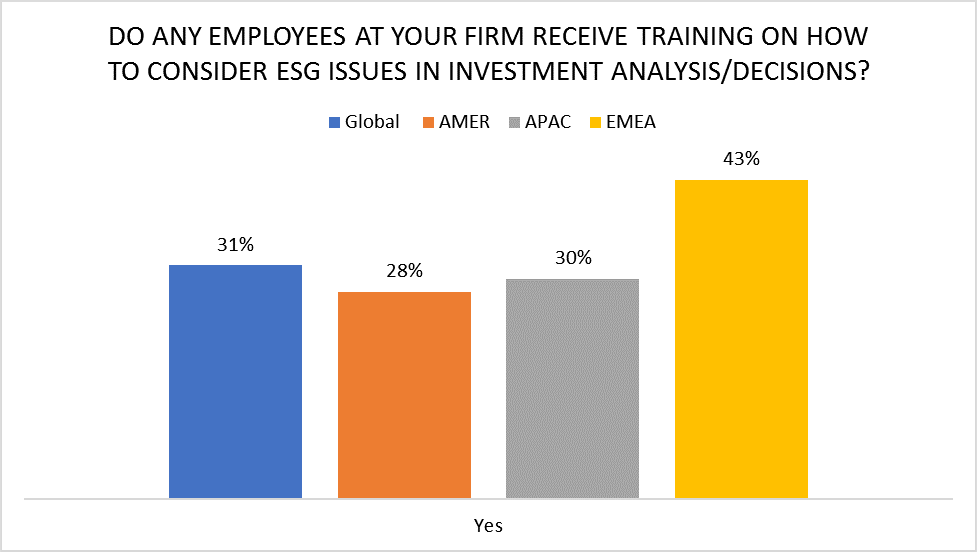

Respondents indicated that those in EMEA are much more likely to get ESG training, with 43% saying yes, employees receive training on how to consider ESG issues in their analysis. These numbers were much lower in the Americas (28%) and APAC (30%).

Men and Women Differ in Their Views of ESG’s Value

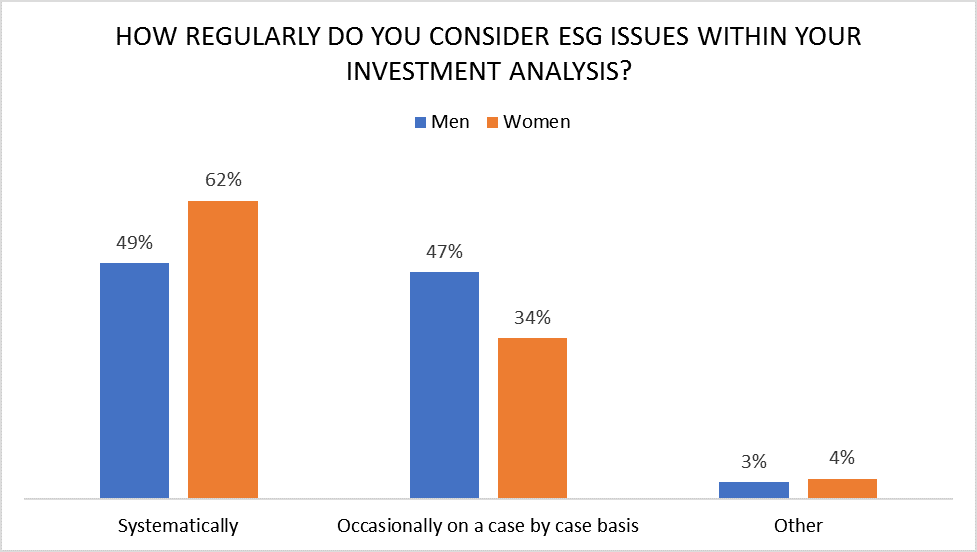

Almost half of men surveyed (46%) say ESG issues are immaterial or add no value to investment decisions compared with 18% of women. The one common reason for both men and women who do not consider ESG issues is lack of client demand. And women are much more likely to systematically consider ESG data.

Generational Differences

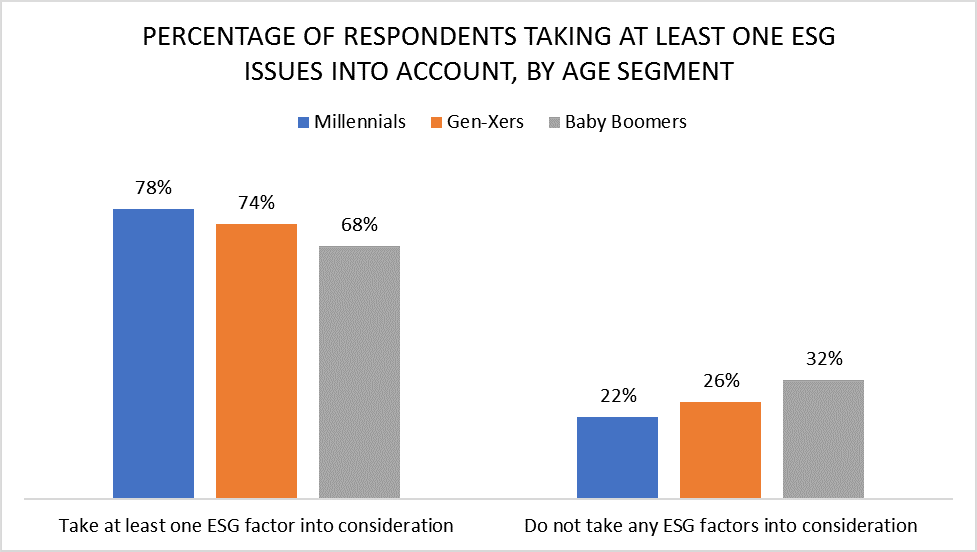

Millennials are most likely to take ESG issues into account in their investment analysis and decisions and baby boomers are least likely.

Summary

We will have to revisit this topic with our members in a few years’ time to further understand what trends are shaping ESG integration. But it is clear that ESG integration into the investment process is not a passing fad, although increased demand from clients, more and better ESG data, and training from practitioners could enhance the ability of financial investors to incorporate ESG data into the investment process.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©CFA Institute