Investors Want Audited Digital Financial Statements

Much has been written and discussed about the merits of digital financial reporting. Some concerns still need to be addressed, however, such as reviewing or validating these reports using eXtensible business reporting language (XBRL) against a set of standards. Currently, no established standards exist for review or audit of these reports. As things stand, the reviews are based on voluntary agreed-upon (AUP) procedures, which are procedures agreed upon by the auditor and the client.

Approximately 8% of US companies engage firms to carry out AUP reviews. No requirements, however, mandate this type of review.

The US SEC has required filers to submit their financial statements in both paper and digital formats since 2009. The SEC does not require an audit or on the digital format. We maintain that this is not in the interest of investors.

First, investors are reviewing and using this digital information to make investment decisions.

Second, a number of regulators around the world, including the US SEC currently and the European Securities and Markets Authority (ESMA) as of 2020, will require digitally tagged financial statements.

Third, regulators are moving toward mandating filers to submit their digital information in an inline XBRL format. This format embeds the machine-readable XBRL tags into the human-readable financial statements (i.e., into a single document). Investors would expect both the human-readable layer as well as the machine-readable layer of this single document to be audited. After the US and the EU, we expect that Japan, probably China, and some other jurisdictions in Asia will follow suit.

This increasing adoption translates to the consequential need for third-party review, which in the interim has been accomplished through AUPs. The significance of addressing this need sooner than later must be emphasized.

Furthermore, we believe data quality issues could be overcome by an audit requirement. As Lou Rohman, XBRL Services, Merrill Corporation, in his article “Should XBRL Financials Be Audited?” points out,

One significant consequence of an audit is that it would motivate those companies that are currently submitting poorly tagged XBRL to start paying attention, and do it the right way. Unfortunately, poor quality XBRL is submitted too often today, whereby the XBRL computer-readable financials don’t provide the same information as the HTML human-readable financials.

A second benefit of an audit is that the improved quality of XBRL would decrease the pain and effort of consumers of the XBRL to “fix” the data prior to using it. Much effort is put forth by consumers to correct the tagged data submitted by registrants. Better data would also increase the ability of less-sophisticated consumers to use the as-submitted data and rely on the output of their analysis.

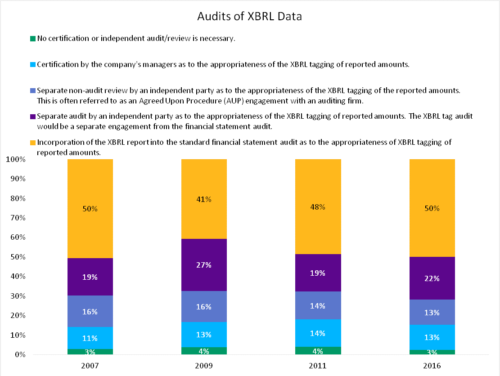

Accordingly, per a 2016 survey of CFA Institute members, 77% of respondents who are aware of XBRL want some level of assurance over the XBRL report—with 50% agreeing that the XBRL report should be incorporated into standard financial statement audit. This result is similar to that found in prior surveys.

We urge regulators and audit standard setters to take heed of what investors want.

Question: What level of assurance is necessary to ensure that the proper XBRL tags are assigned to the reported amounts in accordance with GAAP-defined tags?

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/Blend Images

Standard Business Reporting programmes in several countries do include Digital Assurance in their scheduled plans.

As an example, recent public decisions in the Ukrainian SBR “Public Interest Entities” initiative explicitly address fully tagged audited Financial Statements and Notes.

see https://www.xbrl.org/news/ukraine-moves-to-minimise-red-tape-centralise-reporting-2/