Case Studies In The Changing Use of Structured Data: Revenue Recognition

In my latest paper, Data & Technology: How Information Is Consumed In The New Age, we take a deep dive into how structured data is being consumed and refute the claim by some that structured data is not being meaningfully utilized.

The breadth of the subject matter preclude easy or useful summary, but here we draw from the paper an example of how an investor or analyst might analyze revenue recognition, which is an area of significant interest (and confusion) under the FASB’s newly promulgated Accounting Standards Codification 606.

Calcbench is representative of a number of data providers that have materialized. These data providers have advanced the usefulness of structured data by designing analytical tools around the structured data that companies offer in their regulatory filings. These providers increase user capabilities and analytical reach by orders of magnitude.

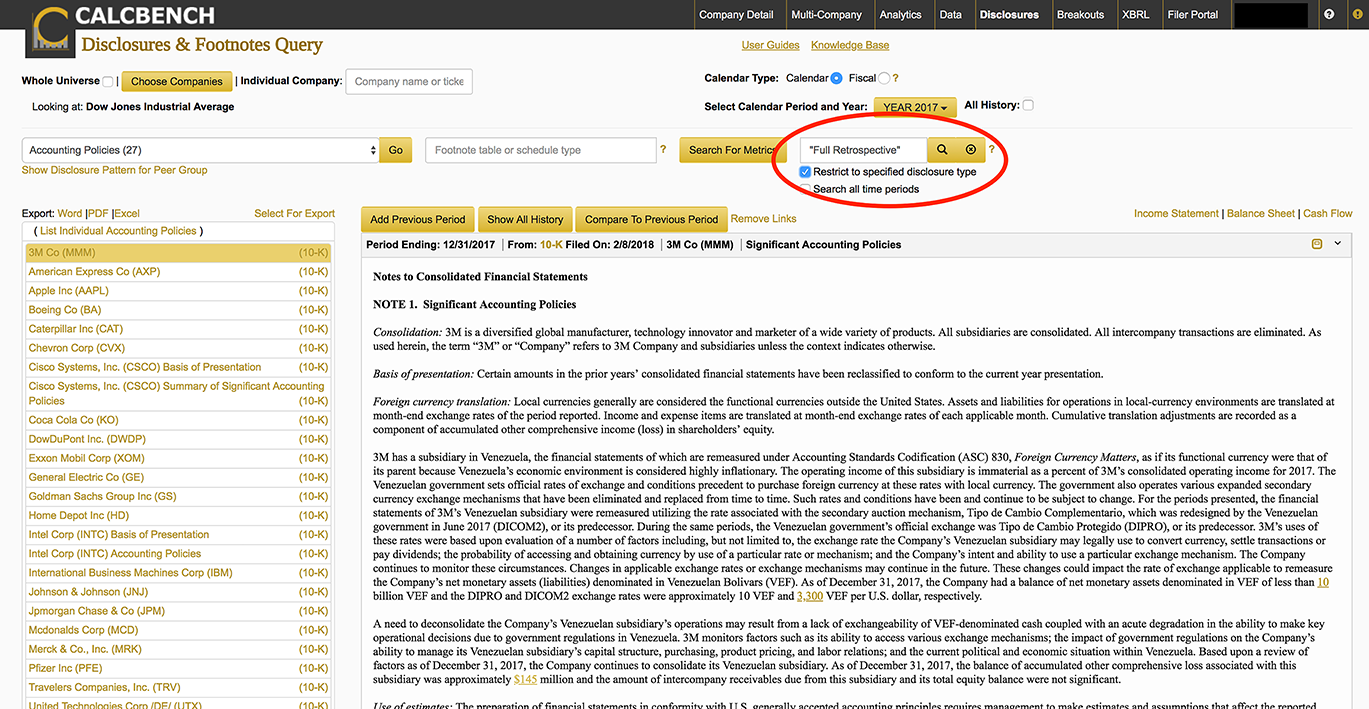

In this example we first show how the CalcBench platform allows users to systematically access accounting policies and get information with a few mouse clicks. Below, an analyst searches among accounting policies to learn which firms have referred to the “Full Retrospective” method of recognizing revenues.

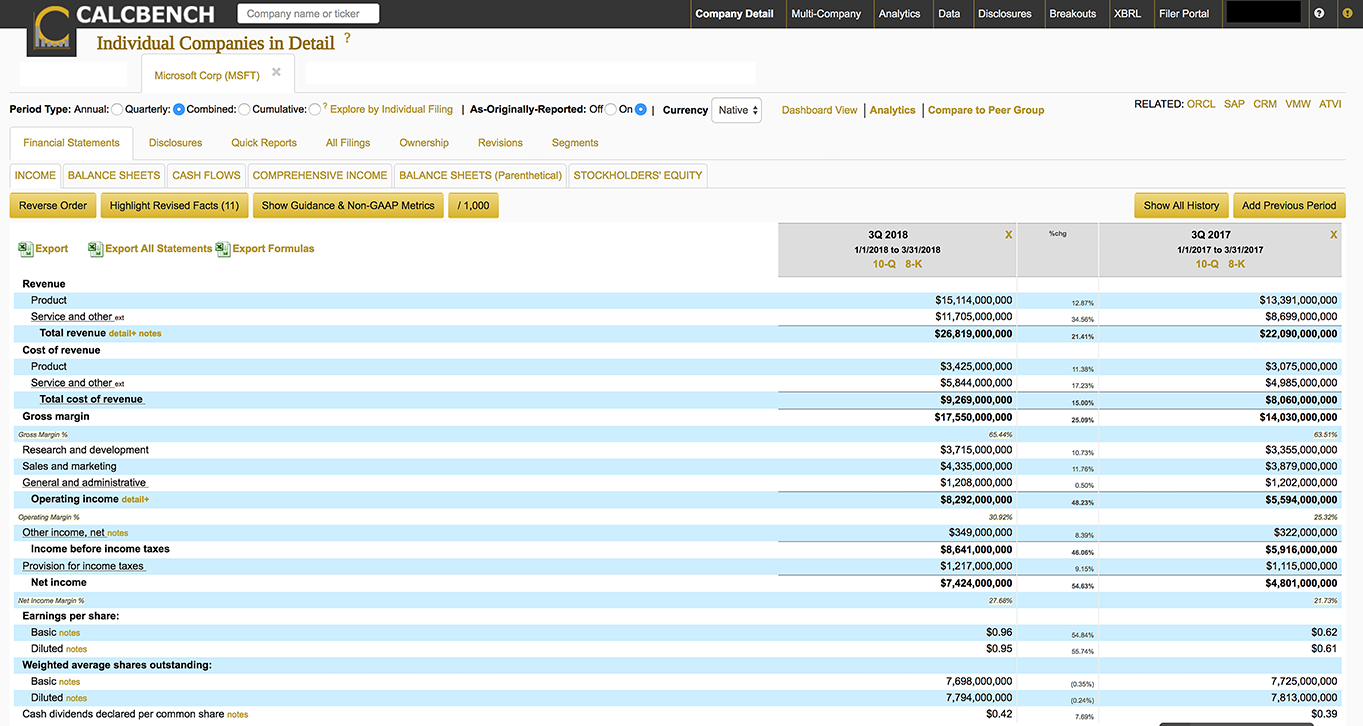

Now suppose this analyst wants to know how the numbers have been affected by a change in the revenue recognition policy among any one issuer. Consider Microsoft’s income statement from the first quarter of calendar year 2018 (fiscal 3Q for Microsoft) and compare it with the originally filed statement from the first quarter of calendar year 2017.

Note in the screenshot below, that product revenue is $13.391 billion for the 2017 period, and the service revenue is $8.699 billion. Microsoft originally filed these numbers in April 2017.

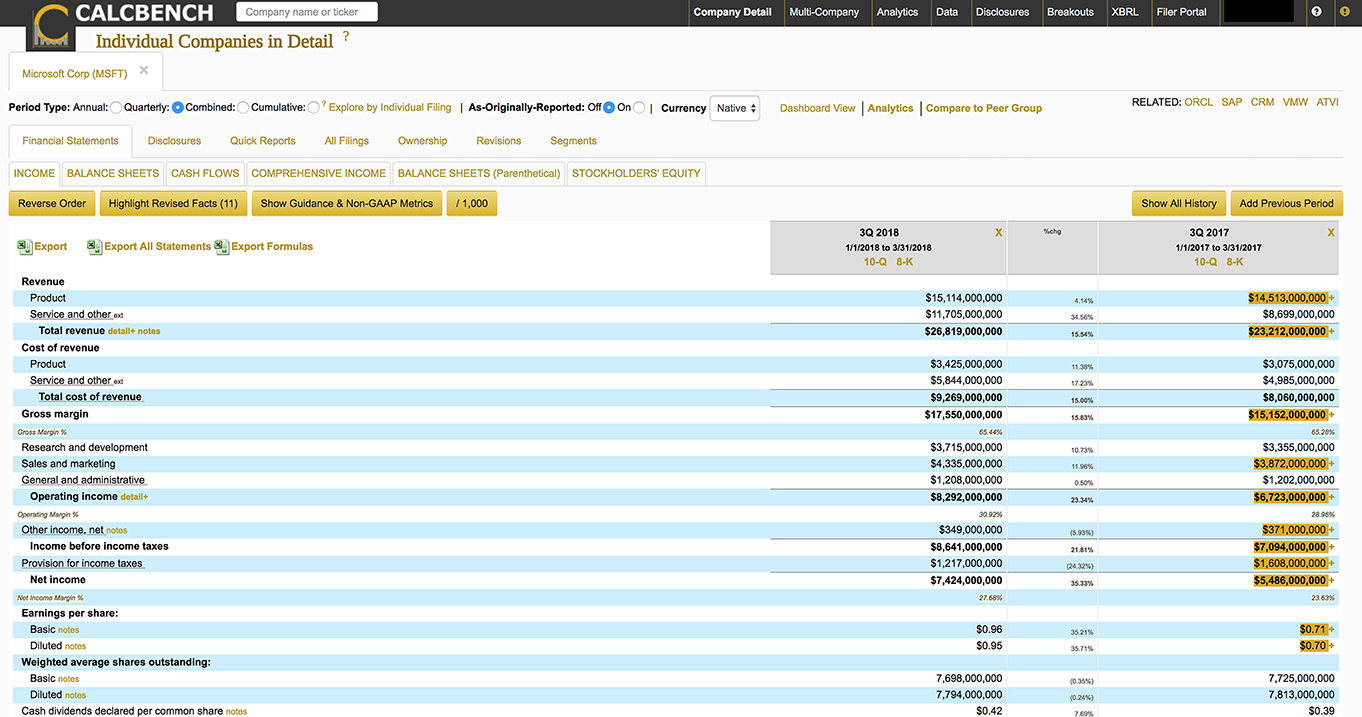

Next look at the revised numbers under the newly adopted revenue recognition rules. Notice that the Microsoft product revenue from one year ago is now $14.513 billion—a difference of $1.122 billion. The impact to diluted EPS was roughly $0.09 per share.

This case study shows the power that derives from structured data. Users save time, money and increase the power of the inferences they can make, which is the value information is designed to deliver.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/Susan Gladwell