Unlocking the Potential of Capital Markets in Central and Eastern European Countries

Owing to a number of barriers and unaddressed challenges, the capital markets in Central and Eastern European (CEE) countries lag behind the more developed Western European markets. Despite the multiplicity of factors that has dragged down the CEE region’s economy, a large unexploited potential exists. To learn more about this potential, CFA Institute conducted a member survey in early 2018, asking participants in the region what they believed were the main issues preventing growth of capital markets in their country, and seeking possible solutions to foster deeper and more integrated markets in the area.

Between 26 February and 18 March 2018, 263 investment professionals from eight CEE countries (Poland, Romania, Greece, Hungary, Czech Republic, Bulgaria, Cyprus, and Slovenia) completed the survey. Respondents were predominantly portfolio managers, senior executives, risk managers, consultants, and analysts.

Sixty-seven percent of those responding see greater supervision of European financial markets through the establishment of a common EU regulatory body (i.e., endowing more direct regulatory and supervisory powers to the European Securities Markets Authority) as a necessary approach to unlocking the potential of capital markets across Europe, and in particular, in the CEE region (Exhibit 1). A single body supervising European capital markets would provide several benefits for the development of markets in the CEE region as well as for Western European markets. A European supervisory authority could contribute to narrowing the deep differences in terms of liquidity in capital markets in Europe by directly or indirectly enforcing common rules across markets. This strategy would employ more supervision and common standards to reduce investment costs, boost foreign direct investments, and improve the level of transparency and investor protection, which is still low in some CEE countries. However, 30% of those responding did not see the harmonisation of supervision at the EU level as the best regulatory approach. They would prefer a minor level of regulation in the EU capital markets sector, believing that local markets have specific issues better understood by local regulators and supervisors.

EXHIBIT 1. Support for increased supervision of EU financial markets by a common EU regulatory body

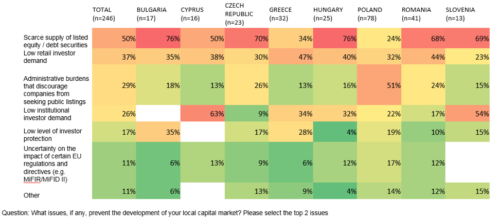

Questioned about the principal issues concerning capital markets in the CEE region, survey respondents ranked, by order of relevance, the scarce supply in listed equity/debt securities markets, low retail investor demand, and administrative burdens that discourage companies from seeking public listings (Exhibit 2). Fifty-one percent of Polish investment professionals responding viewed the latter as the main problem in Poland.

EXHIBIT 2. Issues preventing local capital market development

Another issue in the CEE region is the declining level of investor confidence in local financial markets. Only 38% of respondents have trust in their local market, likely due to the mis-selling of financial products (e.g. the case of foreign currency loans) in the region in recent years. However, this trend is not limited to CEE countries. A 2018 CFA Institute survey report, “The Next Generation of Trust,” highlights that the lack of confidence in the financial services industry is a global issue, and trust remains stubbornly low in the sector vis-à-vis other industries, such as technology, food and beverage, and law firms. In spite of their low level of trust in the CEE region’s financial markets, survey respondents indicated that their local capital markets provide higher standards of investor protection today as compared to 5 years ago. Fifty-eight percent of respondents said that the level of investor protection has improved, while 39% believe it has not changed. The majority of survey respondents also think their local capital markets provide much higher levels of transparency today as compared to 5 years ago.

The European Commission’s 2018 European Financial Stability and Integration Review report, which focused on general developments in financial markets in the EU, stresses the benefits of capital markets development and its links with increased economic growth. Improvedcross-border integration of financial markets could contribute to increasing investment and diversification opportunities for investors within the EU, facilitating access to risk capital for borrowers and boosting competition.

Based on an examination of capital markets in EU members in the CEE region, the report indicates that their equity and bond markets are relatively small compared to those in the EU’s Western European countries. To catch up with the other European regions, local capital markets in the CEE region should provide a larger array of finance sources for growth and development and improve access to finance for Small and Medium Enterprises (who account for between 55% and 78% of total production). Additionally, better regulation and a sound supervisory system would help foster the development of local capital markets in the CEE region, and would improve the level of investor trust. This, in turn, would lead to a higher retail investor demand.

CFA Institute will be conducting a similar survey (the main results will be published in late 2019), targeting the Scandinavian countries with the goal of understanding the specifics of Nordic capital markets and the main unresolved issues in the region.

Image Credit: © alashi