Towards a level playing field

Asia firms urged to be more transparent and informative on ESG disclosure

As environmental, social and governance (ESG) considerations move increasingly into the mainstream of investment, companies in Asia are waking up to the opportunities of committing to ESG-focused principles. An increasing number of investors accept that an evaluation of an investment opportunity is not complete without proper appreciation and analysis of these factors.

It has become evident that investors need easy access to high-quality, comparable, relevant ESG information. But this information is not always available. As a result, listed companies have been under increasing pressure to report more and better data. This issue has appeared on the radar of governments, regulators, and stock exchanges, which are driving changes in reporting and disclosures by listed companies through policies, regulations, and guidelines.

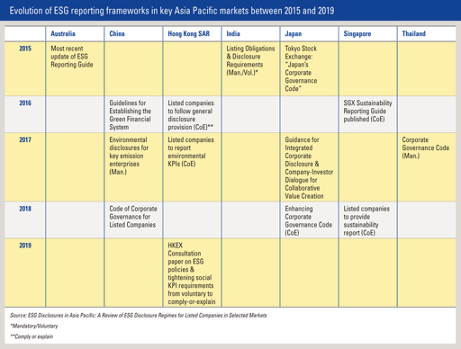

This is why CFA Institute has now published a report on ESG Disclosures in Asia Pacific: A Review of ESG Disclosure Regimes for Listed Companies in Selected Markets, designed to keep stakeholders abreast of the latest developments and regional trends in disclosure regimes. The report provides an overview of regulations in seven markets in Asia Pacific and provides an overview of the opportunities and challenges for various stakeholder groups.

We also give recommendations on how stakeholders can contribute to the development of more transparent and informative ESG disclosure practices in their markets, and create a level playing field across the region.

Disclosure in Asia Pacific

ESG reporting is a crowded space. Several global frameworks have been developed, such as the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), Integrated Reporting, and Task Force on Climate-Related Financial Disclosures (TCFD).

They differ in their approaches, philosophies, and purpose. For example, SASB primarily addresses the needs of investors, while GRI is broader, addressing the needs of all stakeholders. TCFD focuses on climate-related disclosures.

Although these frameworks are largely complementary, instead of providing clarity, their profusion has added to the confusion of companies and investors.

One of the most striking findings in the CFA Institute report is that interest in the topic has grown significantly in the region. Many Asia Pacific markets have taken steps toward mandating or encouraging disclosure in some or all aspects of ESG within the past two decades. Corporate governance, in particular, came into focus in the early 2000s, in response to the collapse of the dot-com bubble and the Enron scandal.

In the markets we reviewed, regulators and exchanges have adopted a range of approaches, from voluntary disclosures to comply-and-explain, to mandating key performance indicator (KPI) disclosures, to recommending global frameworks. They also differ in the level of the obligation imposed on reporting companies, ranging from voluntary to comply-or-explain, to mandatory.

Key findings

° Corporate governance is the most advanced of the three factors

We have found that of the three components of ESG, reporting on corporate governance is generally far more advanced than reporting on environmental and social factors. This is consistent with many investment managers’ views that thus far, the corporate governance of a listed company has the most influence on its alpha.

° Individual markets are taking different approaches

Regulators and exchanges in different markets have adopted a range of approaches, from mandating key performance indicators, to comply or explain requirements.

° Benefits of ESG reporting

Apart from keeping investors informed and regulators satisfied, the process of preparing ESG disclosures benefits a company, such as motivating directors and management to become more aware of relevant risks and opportunities and the perception of investors and stakeholders. Signaling such awareness to the market could help a company demonstrate strategic leadership on the management of such issues.

° More than box-ticking

The volume of reporting has increased substantially as regulators and stock exchanges in Asia Pacific drive changes in reporting and disclosures. But there is still room for improvement in the quality of disclosures. More importantly, the value proposition of ESG disclosures needs to be better articulated to motivate companies and boards to make improvements and not treat it as a box-ticking exercise.

Recommendations for progress

Progress is likely to occur in a phased manner. The trend of ratcheting up the level of obligation and the scope of disclosures is likely to continue, with governments, regulators, and standard setters driving these changes. Notwithstanding this, each stakeholder group has a unique role to play in maintaining momentum and improving the quality of reporting.

We see it as critical to educate the board and senior executives to more fully integrate and report on how ESG fits in with a company’s strategic outlook, risk management framework, and corporate accountability, so that they can steer the company accordingly.

We want to ensure that all relevant and material ESG information and any related KPIs are communicated to stakeholders, including employees, investors, and other capital providers, in a consistent and timely manner.

We encourage investee companies to upgrade the quality and consistency of ESG information, including more detail on what is material ESG information and how it may affect valuation and future corporate performance.

Information is a two-way street. Investors should also communicate to issuers what information they would like to see and how that would impact an issuer’s valuation. This will ensure future improvements.

There may no one-size-fits-all approach in ESG-related information, but it’s clear to us that further refinement and understanding of such disclosures will improve their quality, consistency, and comparability.

Image Credit: © Getty Images/TolikoffPhotography