Strengthening and Safeguarding the UK Crypto Market

The UK is entering a pivotal phase in the evolution of its cryptoasset regulatory framework. With the release of Discussion Paper 25/1 (DP25/1), the Financial Conduct Authority (FCA) signals its intent to move beyond narrow rules on anti-money laundering and financial promotions toward a comprehensive regime covering trading, custody, lending, staking, and more. This shift aims to strike a balance between fostering innovation and protecting market integrity.

CFA Institute welcomes this opportunity to contribute to the policy dialogue and shares here a summary of key proposals, their broader implications, and our recommendations for ensuring a robust and responsible cryptoasset ecosystem.

Released on May 2, DP25/1 represents an expansion of the FCA’s regulatory scope. Moving beyond its remit concerning anti-money laundering (AML) and financial promotions, the DP25/1 signals a clear intent to construct an all-encompassing regulatory regime for cryptoassets within the UK.

CFA Institute is monitoring the progression of the UK’s Crypto Roadmap and welcomes the opportunity to respond to the consultation process. This post summarizes the FCA’s key proposed measures, discusses their broader implications for market development and integrity, and shares our perspectives.

Crypto Regulatory Shift in the UK

- Shift from piecemeal to comprehensive regulation: Historically, the UK’s crypto regulation has been fragmented, primarily focusing on AML registrations for certain firms and applying financial promotions rules. The FCA’s roadmap and upcoming new legislations represent a move toward a holistic, comprehensive regulatory framework that brings a broad array of crypto activities like trading platforms, custody, lending, staking, stablecoin issuance firmly within the regulatory perimeter. A milestone of this regulatory evolution is the release of HM Treasury’s draft legislation, “The Financial Services and Markets Act 2000 (Regulated Activities and Miscellaneous Provisions) (Cryptoassets) Order 2025,” which was designed to create new regulated activities for qualifying cryptoassets and stablecoins. This statutory instrument formalizes regulatory oversight, mirroring the type of oversight observed in traditional finance, but tailored for the unique characteristics of digital assets.

- The UK’s “same risk, same regulatory outcome” approach: Traditionally, the crypto sector has operated with considerably less regulatory oversight than traditional financial services, leading to both product innovation and, at times, substantial risks for retail consumers. In response, the UK is now working to bring certain cryptoasset activities within the financial services regulatory scope. This fundamental shift is increasingly guided by the Financial Stability Board’s (FSB) framework, developed in 2023, which champions the principle of “same activity, same risk, same regulation.” That is, if a crypto activity carries similar risks to a traditional financial activity, it should be subject to comparable regulatory standards. This pragmatic and principle-based approach aims to foster responsible innovation while ensuring adequate investor protection.

- International reach and alignment: The new UK regulatory regime seek to extend its reach beyond domestic entities. It intends to regulate not only UK-based firms but also overseas firms that engage directly or indirectly with UK retail customers, thus requiring them to obtain UK authorization or establish a UK presence. This expands the FCA’s supervisory powers and the practical reach of UK regulation on an international level. Meanwhile, the FCA maintains a focus on key principles: maintaining UK investors’ access to international liquidity pools, aligning with the FCA’s secondary growth objective for the UK financial services sector, and ensuring coherence and alignment with international best practices.

Key Areas of Discussion

The FCA’s core objectives are ambitious: to cultivate a safe, transparent, while competitive cryptoasset sector that champions innovation and diverse offerings. Key proposals outlined in DP25/1:

| Cryptoasset Trading Platforms (CATPs) | UK-based CATPs will generally require direct UK authorization, while overseas firms serving UK retail clients will need to set up a UK branch in addition to the required authorized subsidiary. CATPs that offer retail access, algorithmic or automated trading and market making activity will be subject to additional rules. CATPs are expected to operate trading systems based on non-discretionary rules and conflict of interest management. Other requirements related to trading data and record-keeping. |

| Intermediaries | Intermediaries will be required to implement procedures for “prompt, fair and expeditious” execution of client orders, with best execution rules being considered for specific client categories. Mandatory functional separation between principal trading and client order execution operations, explicitly prohibiting Payment for Order Flow (PFOF). Other requirements related to trading data and cryptoasset admission. |

| Lending, Borrowing | Restrictions on offering lending and borrowing products to retail consumers in their current high-risk structures, while exploring measures to reduce their risk profiles to become appropriate. Restriction of the use of credit for purchasing cryptoassets – with an exception for qualifying stablecoins. |

| Staking | Firms offering staking services will be held liable for retail consumer financial losses stemming from inadequate operational resilience, requiring firms to hold sufficient capital to absorb such potential losses. Firms must obtain explicit, advance consent from retail consumers on staking terms and provide key information on staking products and associated risks. Firms must maintain separate wallets for consumers’ staked cryptoassets, distinct from the firm’s and other consumers’, along with accurate records and regular reconciliations. |

| Decentralised Finance (DeFi) | Acknowledging the complexities of DeFi, the FCA looked at how activities within this space might fit into the regulatory framework, especially where identifiable entities are involved. Introduction of industry guidance to help firms understand their obligations. |

CFA Institute Viewpoints

CFA Institute advocates for a robust, holistic regulatory framework built on the principle of “same risk, same regulatory outcome.” Our proposals aim to safeguard market integrity, protect consumers, and foster a sustainable and resilient cryptoasset ecosystem within the UK.

- Ensuring robust market structure and integrity for trading platforms: CFA Institute supports the establishment of clear and stringent operational standards for CATPs. Overseas CATPs engaging with UK retail clients must establish a UK legal entity to mitigate jurisdictional and resolution risks in a bid to ensure full accountability within the UK regulatory regime. Furthermore, controls are essential for all CATPs to manage risks from direct retail access and automated trading strategies. The platforms should assume primary responsibility for investor protection, supported by non-discretionary trading rules only. We generally oppose matched principal trading (MPT) or other principal dealing by CATP operators or their affiliates on central order books, asserting that CATPs should remain neutral, non-discretionary venues. Any exceptions demand rigorous legal and operational separation, strong governance, significant capital, and heightened regulatory scrutiny to prevent conflicts of interest and maintain a level playing field.

- Safeguarding Retail Investors from High-Risk Crypto Products: We concur with the FCA’s comprehensive identification of risks associated with various crypto products, and we wish to highlight additional concerns pertaining to regulatory arbitrage and the systemic risk posed by excessive re-hypothecation within the sector. Our view is that retail access to crypto lending and borrowing products in their current high-risk forms should be restricted, including a direct restriction on the use of credit for purchasing non-qualifying cryptoassets.

- Pragmatic Oversight for Decentralized Finance (DeFi): We appreciate the FCA’s focus on decentralised finance (DeFi). And we embrace the “same risk, same regulatory outcome” approach, which is essential for minimising regulatory arbitrage, recognizing its essential role in minimizing regulatory arbitrage and fostering consistent oversight. While acknowledging the dynamic, complex nature and the diverse decentralisation spectrum of DeFi, we assert that any identifiable entities operating within the DeFi ecosystem performing regulated activities should fall within the regulatory perimeter.

We also support the FCA’s intention to introduce industry guidance for DeFi and we have put forth suggestions for supplementary measures. These include targeted retail education initiatives to enhance understanding of DeFi’s intricacies, mandatory due diligence on identifiable protocols, and the implementation of risk-calibrated access mechanisms to mitigate potential harms to investors while still allowing for innovation.

The Road to Implementation

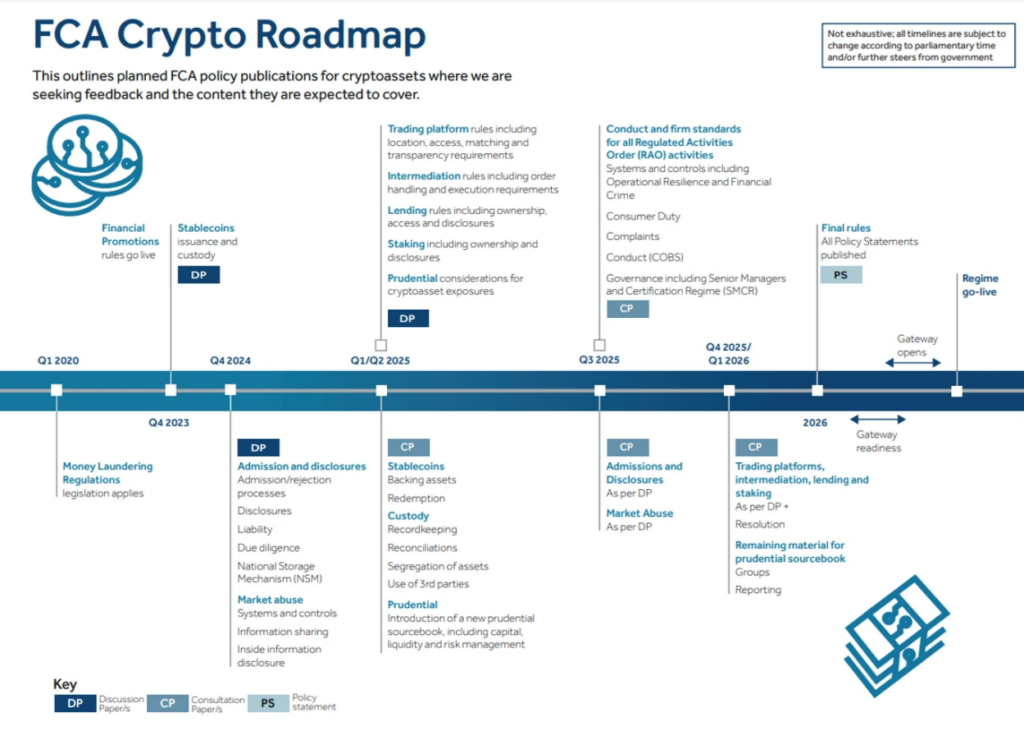

With the feedback period for DP25/1 now closed, the stakeholder input collected will inform the next phase: the publication of subsequent consultation papers (CPs), which will outline specific draft rules and guidance. The ultimate goal? An enhanced cryptoassets regime expected to go live in 2026.

The Roadmap for Consultation Papers

- Stablecoin issuance and cryptoasset custody: Q2 2025.

- Prudential framework for cryptoasset firms: Q2 2025.

- Conduct and firm standards: Anticipated Q3 2025.

- Trading platforms, intermediation, lending, and staking: Anticipated Q4 2025/Q1 2026.

Exhibit 1: FCA Crypto Roadmap (Source: Financial Conduct Authority)

Preparing for the Future Digital Markets

The UK’s effort to accelerate cryptoasset regulation reflects its recognition of digital finance as a strategic pillar of its financial services sector. CFA Institute welcomes the opportunity to engage constructively in this process — through our response to DP25/1 and ongoing input on the stablecoin consultation — and remains committed to promoting sound, principle-based policy that protects investors and fosters resilient market development.

Importantly, the UK’s proactive approach aligns with a broader international shift. Major jurisdictions are advancing their own regulatory frameworks such as the EU’s Markets in Crypto-Assets Regulation (MiCA), the US Senate’s GENIUS Act, Hong Kong’s Stablecoins Ordinance (Cap. 656), and Japan’s amendments to its Payment Services Act. Together, these developments mark a decisive global movement toward comprehensive oversight of digital assets.

As digital finance continues to evolve, regulatory convergence will be essential. Addressing challenges such as legal ownership, custody safeguards, supervisory clarity, and technical interoperability will require cross-border cooperation. For firms and investors alike, staying attuned to these changes and adapting early will be critical to maintaining compliance, mitigating risk, and building lasting confidence in the future of digital markets.