India’s Derivatives Market and Retail Investors

Highlights

- Retail investor activity in India’s derivatives market has increased significantly. According to official data released by regulators, the number of individual traders has grown by over 120% between FY22 and FY25 to almost 10 million.

- However, data show that 90% of retail investors incurred losses by investing in derivatives markets in aggregate over the last four years. Many retail investors apparently do not fully understand the risks involved.

- There are thousands of finfluencers on social media who recommend trading in futures and options to retail investors, often without adequate disclosures on associated risks and any conflicts of interest.

- The capital markets regulator, SEBI (Securities and Exchange Board of India), suggested that certain institutional investors may have engaged in market manipulation and unfair market practices. The regulator is also concerned that many finfluencers’ inappropriate advice to small retail investors is also part of the problem.

- CFA Institute remains supportive of enhanced scrutiny to detect unethical market behaviour, greater efforts to improve financial awareness among retail investors, further strengthening of the derivatives framework (which SEBI has already undertaken), and stricter checks and controls on content shared by finfluencers.

Introduction

India is the world’s fifth largest economy and the world’s most populous nation, with nearly 1.4 billion people and a median age of 29 years.[1] While the country is classified as lower-middle income[2] based on per capita income, the distribution is skewed. For example, 57.7% of income is in the hands of the top 10% of people and 65% of wealth lies with them. In contrast, only 15% of income and 6.4% of the country’s wealth are within the bottom 50% of people. In other words, the top 10% of the earning population still earns over USD15,000 annually.[3] Adjusted for purchasing power parity, this figure may easily come to around USD50,000.[4] This segment of approximately 90 million people,[5] who belong to the top layer of the society by income, possess an investable surplus traditionally allocated to bank deposits, real estate, and gold. For many of them, investment preferences are also evolving rapidly.

Over the past decade, even more so since the COVID-19 pandemic, retail participation in equities — specifically in the derivatives market — has risen sharply. Limited financial awareness and susceptibility of retail investors to misleading advice and exaggerated claims pose a significant challenge for regulators and policymakers. The situation is grim, with official data suggesting that over 90% of retail investors have consistently incurred losses in derivatives over the last four years. For regulators, market integrity and investor trust are imperative to ensure greater transparency and a level playing field. In this context, we examine the key issues and offer recommendations to ensure ethical market behaviour and investor protection.

Retail Investors in the Equity Markets

Retail investors’ interest in equity markets has substantially increased over the last decade in India. The data from the National Stock Exchange (NSE) suggest that the total number of unique registered investors was below 20 million in May 2015 and has now reached close to 119 million as of August 2025.[6] The pre-COVID-19 pandemic and post-pandemic growth rates are significantly different; the number of investors participating in the market increased by almost four times between March 2020 and August 2025.[7]

While we see an increased activity in the cash market, there are even higher levels of interest in derivatives trading. The data from the NSE on average daily turnover (ADT) across different market segments suggests that over the last ten years, the growth in ADT for equity options is significantly higher relative to the growth in the ADT for cash markets.

More than 90% of Retail Investors in the Derivatives Segment Lose Money

Derivatives trading (futures and options) represents one of the riskiest avenues for retail investors, and the experience in India has been no exception. As retail participation in derivatives increased, many investors appeared to engage primarily for purely speculative purposes. According to SEBI, more than nine out of ten retail investors in India have lost money in FY25 trading on futures and options.[8] This rate is significantly higher than in many other markets, notwithstanding the different timeframes being compared. For instance, in the United States, approximately 60% of retail futures traders lose money trading in futures.[9] In the United Kingdom, 70-80% of retail clients’ trading contracts for difference (CFDs) reported losses,[10] while in France the figure stands at 89%.[11] Australia[12] and Ireland[13] report loss rates of 72% and 74%, respectively, for retail CFD traders. These data underscore the severity not only in the Indian markets but in this segment across the world.

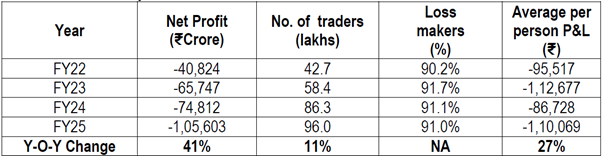

Based on SEBI data, Table 1 highlights key trends: a steady increase in the number of traders, a widening of aggregate net losses, and a persistently high proportion of loss-making participants, with over 90% incurring losses each year.

Table 1: Annual Profits of Individual Traders in the Equity Derivatives Segment

Source: SEBI.

The SEBI data shown in Table 1 indicate that the net losses of individual traders widened by 41% to INR1.05 trillion (approximately USD12.5 billion) in FY25 (1 April 2024 to 31 March 2025). The percentage of traders making losses in the equity derivatives segment remained broadly unchanged at 91% from an earlier study done by SEBI for FY24.

There was also concern that institutional investors are gaining at the expense of retail investors. If investors can broadly be divided into two categories, retail and institutional, consistent losses for one imply profits for the other. It is important to note that institutional investors benefit from access to sophisticated algorithmic trading systems capable of executing trades in milliseconds, significantly reducing slippage. As AI-driven tools continue to evolve, this technological edge could further widen, with institutions often being early adopters due to their scale and resources. They also employ advanced risk management frameworks — such as value at risk (VaR), stress testing, and scenario analysis — to anticipate and mitigate potential losses. These capabilities are generally not readily available to retail investors, creating a capability gap for many retail participants and thus underscoring the need for investor education.

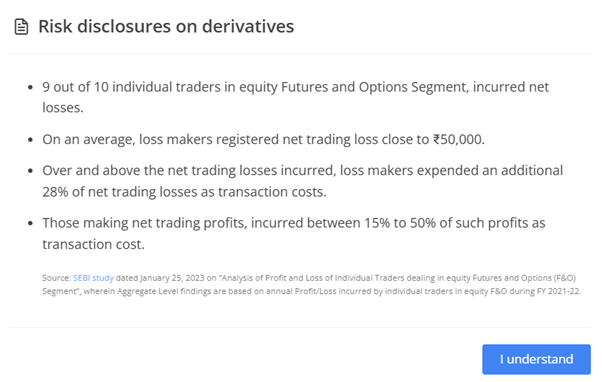

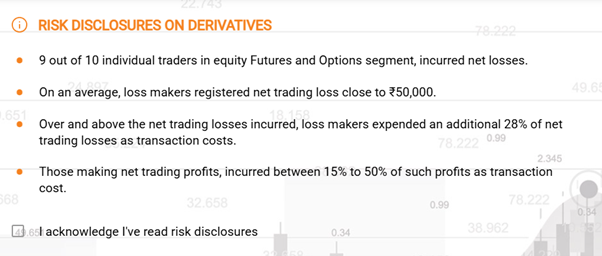

During this time, SEBI has been cautioning retail investors. For example, when investors log in on a trading app, they must mandatorily view and click on a message, such as those shown in Exhibits 1 and 2. These notifications are part of an investor education initiative mandated by SEBI, and all the trading platforms are required to display one before a user can execute any trades.

Exhibit 1: Example from Zerodha (online brokerage platform)

Exhibit 2: Example from Mirae Asset Sharekhan

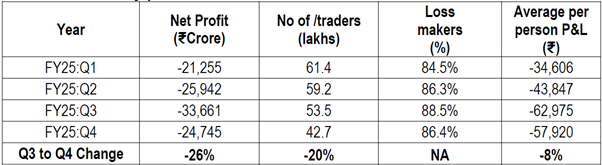

The good news is that some of the recent measures adopted by SEBI have helped bring down activity levels in this market. These measures have included the recalibration of contract size for equity derivatives, rationalization of weekly index derivatives products, and increases in tail risk coverage on the day of options expiry.[14] With lower trading activity, the losses of individual investors also have declined, as seen in Table 2.

Table 2 shows how the numbers of individual traders and the collective losses they have undertaken declined in 4Q FY25 (1 January to 31 March 2025). Nevertheless, the average losses per person have not reduced by much.

Table 2: Quarterly Profits and Losses of Individual Traders in Equity Derivatives

Source: SEBI.

In financial markets, it is expected that some investors will profit while others will incur losses. However, when the integrity of markets is under scrutiny, the challenge for regulators becomes much more complex. The recent case involving Jane Street Capital underscores the fact that maintaining market integrity is a continuous process. Box 1 summarizes the Jane Street case as of the writing of this article.[15]

| Box 1: Jane Street and Allegations of Market Manipulation During the first week of July 2025, SEBI banned the New York-based proprietary trading firm Jane Street Capital for alleged market manipulation to make major illicit gains in the markets. This surprised the markets, especially in the derivatives segment where the trading volumes are already under pressure after SEBI’s clamp down measures. While Jane Street has refuted the allegations about unlawful trading practices, it has decided that the firm will be cooperating during further investigation. As required, Jane Street deposited more than INR48 billion (approximately USD600 million) in an escrow account in compliance with the requirements of the interim order passed by SEBI on 3 July 2025. The interim order also stated that Jane Street and associated entities are restrained from accessing the securities market and are prohibited from buying, selling, or otherwise dealing in securities, directly or indirectly. Jane Street also requested access back to its trading activities in India. In an update released on 14 July, SEBI said it is in the process of examining the company’s request. A further update released on 21 July by SEBI stated that they have lifted the ban on trading activities by Jane Street. However, the entities have been directed to cease and desist from directly or indirectly engaging in any fraudulent, manipulative, or unfair trade practice or undertaking any activity, either directly or indirectly, that may be in breach of extant regulations (please refer to Source A, mentioned at the bottom of this page). In a news article published on 30 July, Mr. Tuhin Kanta Pandey, SEBI chair, in an interview with BusinessWorld (as mentioned in a Business Standard article) stated that Jane Street has not resumed trading in futures and options since SEBI lifted the ban imposed on 3 July (please refer to Source B). On 3 September 2025, Jane Street filed a case against SEBI claiming that the regulators denied it access to key documents needed to defend against the allegations. The courtroom battle began on 9 September, and a three-member appeals court bench is hearing the matter at the Securities Appellate Tribunal or SAT (please refer to Source C). SAT has directed SEBI to file its reply within three weeks, and the final verdict was still awaited as of this writing (please refer to Source D). SEBI has said that on 17 January 2024, Jane Street made INR7.35 bn profit (around USD85 mn) in a single day by implementing algorithms that allowed them to manipulate NIFTY and Bank NIFTY index prices. This was not the only incident: Between January 2023 and March 2025, Jane Street is accused of making unlawful net profits of more than INR365 bn (more than USD4 bn). Interestingly, SEBI initiated investigating Jane Street’s operations more closely in April 2024 after a legal dispute in the United States between Jane Street and Millennium, which eventually got settled by the end of 2024 (please refer to Source E). The core issue was that Millennium had hired two employees from Jane Street, who the firm said had stolen its confidential trading algorithms. The suspicion is that Jane Street’s algorithm-based strategy was based on Intraday Index Manipulation and Expiry Day Manipulation. It is suspected that early in the day, Jane Street would rapidly buy major banking stocks that were dominant components of the Bank NIFTY index. This would artificially drive the price of the index up. Sensing this as a genuine move, many retail investors would start buying call options and selling puts. However, the rise was allegedly orchestrated by Jane Street, which was buying put options and selling calls. It is then alleged that on contract expiry days, Jane Street’s algorithm would sell its index futures and holdings, resulting in a sudden decline of the share price. This led to massive losses for retail investors, while Jane Street generated huge profits from their put options. SEBI has said that this amounts to market manipulation, with Jane Street profiting at the expense of retail investors. Source A: https://www.sebi.gov.in/media-and-notifications/press-releases/jul-2025/update-on-the-jane-street-interim-order_95491.html Source B: https://www.business-standard.com/markets/news/jane-street-yet-to-resume-fo-trading-as-sebi-tightens-surveillance-125073000690_1.html Source C: https://www.indiatoday.in/business/market/story/jane-street-sebi-legal-battle-begin-today-derivative-trading-stock-manipulation-report-2784158-2025-09-09 Source D: https://www.livemint.com/market/stock-market-news/sebi-jane-street-index-manipulation-case-sat-appeal-11757403618622.html Source E: https://www.moneycontrol.com/news/business/markets/jane-street-millennium-trade-secrets-fight-ends-in-settlement-12885643.html |

While the Jane Street matter is still under review by SAT — thus it will take more time before clarity emerges — there are some relevant issues to consider:

- Retail investors and their participation in equity derivatives – Indiscriminate interest in speculative activities appears to be the guiding force behind retail investments in the derivatives market. This presents a complex challenge for regulators and legislators, especially as the government seeks to promote broader retail participation in capital markets. It raises the question: How can capital markets be developed in an orderly fashion while protecting retail investors? It requires a multi-pronged approach, including:

- more effort in raising financial awareness among retail investors about the risks associated with derivatives trading;

- stringent scrutiny and strengthening surveillance to detect market manipulation, including the use of AI for early warning signals;

- engaging brokers in targeted investor education campaigns; and

- further reinforcement of the equity index derivatives framework.

SEBI has already introduced several measures, such as rationalizing weekly index derivatives, increasing tail risk coverage on expiry days, and raising contract sizes for index derivatives.

- Role of finfluencers and how to make them accountable – Many finfluencers have pushed derivatives as an easy way to make money, and a large community of retail investors may have fallen for their advice. Today’s digital-first world undoubtedly offers retail investors unprecedented access to information, but these trends also raise pressing and important questions about investor awareness, trust, accountability, and education. In our March 2025 report “Clicks and Credibility: Understanding Finfluencers’ Role in Investment Decisions,”[16] we found that only 2% of influencers are SEBI-registered to offer investment advice, yet 33% provide explicit stock recommendations. Additionally, 63% of influencers fail to adequately disclose sponsorships or financial affiliations. SEBI has responded proactively, including initiating bans from the capital markets and hefty penalties on finfluencers misguiding investors, which should go a long way in making them accountable.[17]

- Role of quant trading in markets and risks associated – The role of algorithmic and quantitative trading in markets is growing, but it also introduces new risks. In the case of Jane Street (see Box 1), it is evident that the firm’s advanced, custom-built algorithms enabled rapid, targeted trades within milliseconds, which was a key factor in how the regulator viewed this case. The way computing power is expanding and as Artificial Intelligence (AI)-based tools get more powerful, there is a risk that instances such as coordinated selling could lead to the materialisation of systemic risk events for markets in general, particularly for retail investors. The need for more careful assessment and real-time monitoring is clear. Regulators and policymakers will need to be on top of technological developments and their market impact.

CFA Institute Policy Recommendations

We recommend the following:

- Stringent scrutiny to detect unethical market behaviour: SEBI has already adopted technology-driven surveillance; deploying more advanced tools will further improve detection and enforcement.

- Improved financial awareness: Campaigns by AMFI (Association of Mutual Funds in India), the umbrella body of asset management companies in India, have been very successful in making mutual funds more popular in India. Similar activities should be organised to make retail investors more aware of risks associated with derivatives.

- Stricter oversight of finfluencer content: Tighter controls on finfluencer content and collaboration with social media platforms are essential to ensure accountability and prevent misinformation.

Conclusion

India’s capital markets regulator, SEBI, has taken a proactive approach in response to evolving market dynamics. Its efforts in ensuring investor protection and stringent actions against market manipulation are commendable, especially given the rapid expansion in market size and investor participation. Notably, SEBI’s regulatory actions against misleading claims and fraudulent advice by finfluencers are also significant and timely, contributing to making the markets safer for investors.

However, it is also the responsibility of retail investors to exercise caution and avoid speculative trading when not fully understanding the associated risks. India’s financial landscape is evolving rapidly, driven by strong economic growth above the global average and rising disposable incomes leading to an investable surplus. The growing popularity of equities as an asset class along with advancements in technology and social media are significantly influencing investor behaviour, particularly among younger participants. While digital access to financial advice presents opportunities, it also introduces challenges. It is imperative for all stakeholders to focus on the evolving relationship between digital influence in different market domains, the evolution of investment behaviour, and the need to uphold market integrity.

CFA Institute believes a combination of measures are necessary to tame the negative effects of excessive speculation while ensuring a continued positive engagement of retail investors in capital markets. These measures not only include a recommendation for regulators to conduct stringent scrutiny towards unethical behaviour but also involve improving investor financial awareness and tightening controls over finfluencer social media activity.

[1] https://www.worldometers.info/demographics/india-demographics/.

[2] https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups.

[3] India Today, “Budget 2025: How India’s Wealth Shifted to the Pockets of Top 1%” (January 2025). https://www.indiatoday.in/business/story/budget-2025-how-indias-wealth-shifted-to-the-pockets-of-top-1-per-cent-2662386-2025-01-09.

[4] BW Businessworld, “Decoding PPP Paradox” (14 November 2024). https://www.businessworld.in/article/decoding-ppp-paradox-539181.

[5] Sabrang, “The Growing Divide: A Deep Dive into India’s Inequality Crisis” (28 May 2024). https://sabrangindia.in/the-growing-divide-a-deep-dive-into-indias-inequality-crisis/.

[6] NSE, “A Monthly Review of Indian Economy and Markets,” Market Pulse 7 (June 2025). https://nsearchives.nseindia.com/web/sites/default/files/inline-files/Market%20Pulse_June%202025.pdf.

[7] NSE, “Corporate Performance and Macroeconomic Signals,” Market Pulse 7 (September 2025). https://nsearchives.nseindia.com/web/sites/default/files/inline-files/Market%20Pulse_Sep%202025_1.pdf.

[8] SEBI, “Comparative Study of Growth in Equity Derivatives Segment vis-à- vis Cash Market after Recent Measures” (7 July 2025). https://www.sebi.gov.in/reports-and-statistics/research/jul-2025/comparative-study-of-growth-in-equity-derivatives-segment-vis-vis-cash-market-after-recent-measures_95105.html.

[9] Commodity Futures Trading Commission, “Retail Traders in Futures Markets” (February 2024). https://www.cftc.gov/sites/default/files/2024-11/Retail_Traders_Futures_V2_new_ada.pdf.

[10] Financial Conduct Authority (FCA), “Restricting Contract for Difference Products Sold to Retail Clients and a Discussion of Other Retail Derivative Products” (December 2018). https://www.fca.org.uk/publication/consultation/cp18-38.pdf.

[11] Autorité des marchés financiers (AMF), “Study of Investment Performance of Individuals Trading in CFDs and Forex in France” (13 October 2014).

[12] Australian Securities & Investments Commission (ASIC), “Report 724: Response to Submissions on CP 348 Extension of the CFD Product Intervention Order” (April 2022).

[13] Central Bank of Ireland, “Central Bank CFD Intervention Measure” (2019).

[14] SEBI, “Measures to Strengthen Equity Index Derivatives Framework for Increased Investor Protection and Market Stability” (1 October 2024). https://www.sebi.gov.in/legal/circulars/oct-2024/measures-to-strengthen-equity-index-derivatives-framework-for-increased-investor-protection-and-market-stability_87208.html. The Indian Express, “Sebi Announces Measures to Strengthen Risk Monitoring in Equity Derivatives” (30 May 2025). https://indianexpress.com/article/business/sebi-risk-monitoring-equity-derivatives-10037208/.

[15] This article was completed on 29 September 2025, and the investigation on market manipulation allegations against Jane Street had yet to be completed. As a result, we are not commenting on the merits of the case. The matter is under judicial review, and nothing we have written here should be construed or interpreted as an official position of CFA Institute on this matter.

[16] CFA Institute, “Clicks and Credibility: Understanding Finfluencers’ Role in Investment Decisions” (March 2025). https://rpc.cfainstitute.org/sites/default/files/docs/surveys/clicks-and-credibility.pdf.

[17] The Hindu, “SEBI Bans Financial Influencer Asmita Patel, Five Others from Market, Impound Illegal Gains of More Than ₹53 Crore”(8 February 2025). https://www.thehindu.com/business/markets/sebi-bans-financial-influencer-asmita-patel-five-others-from-market-impound-illegal-gains-of-more-than-53-crore/article69195471.ece; GoodReturns, “SEBI Cracks Down on Finfluencers, ‘Baap of Chart’ & 7 Others Banned For 1 Year, Directs 17.2 Crore Refund” (3 December 2024).

https://www.goodreturns.in/news/sebi-cracks-down-on-finfluencers-baap-of-chart-7-others-banned-for-1-year-directs-17-2-crore-refund-1391507.html; The Times of India, “Ravindra Balu Bharti, Nasiruddin Ansari, and 9 Other Influencers Banned by SEBI in 2024 for Giving ‘Misleading’ Stock Investment Tips” (28 December 2024). https://timesofindia.indiatimes.com/technology/tech-news/ravindra-balu-bharti-nasiruddin-ansari-and-9-other-influencers-banned-by-sebi-in-2024-for-giving-misleading-stock-investment-tips/articleshow/116734484.cms.