Two Things about High-Yield Bonds Investors Must Understand Today

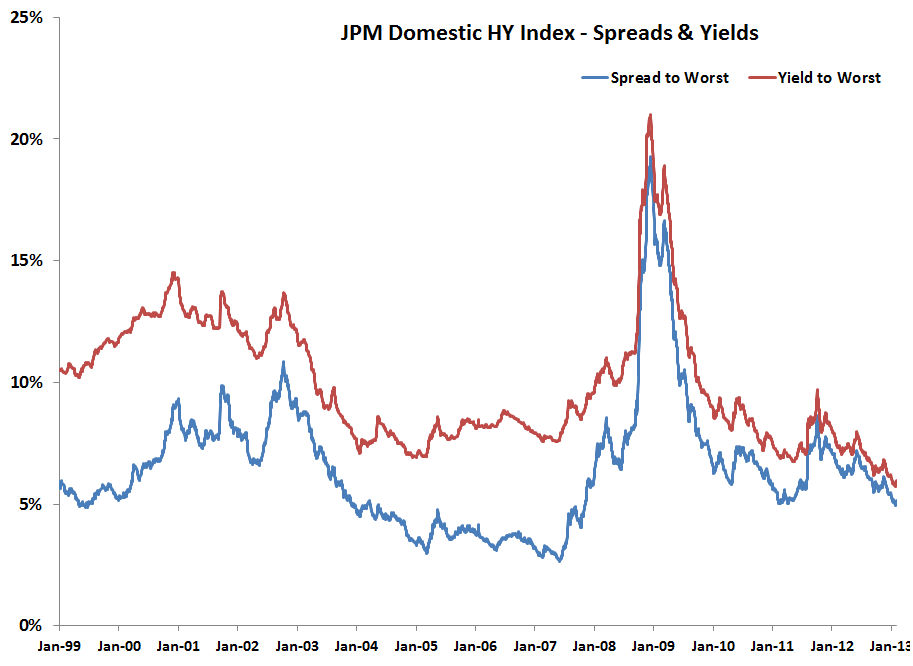

We are just one month into 2013, and investors have already seen the relentless run in high-yield (HY) bonds continue. Despite a backup in the last week of January, HY has notched a total return of 1.39% so far this year using the JPM US HY Index data.

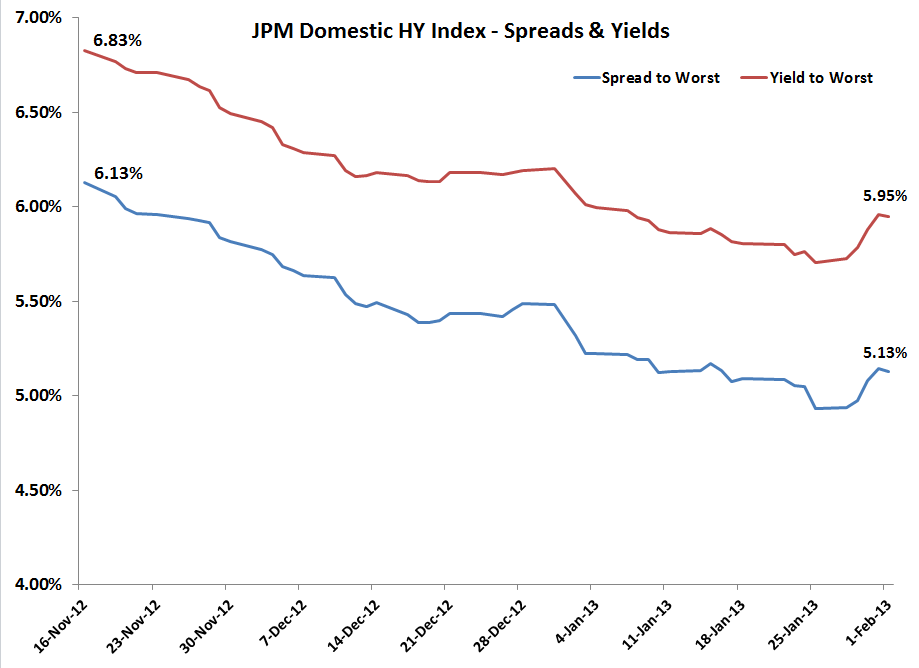

This has been a rally in terms of both spread and absolute price. HY spreads have contracted from 613 bps in mid-November to 513 bps on 1 February. Loomis Sayles’s Dan Fuss, CFA, held little back in his recent comments to Barron’s: “High yield is as overbought as I have ever seen it,” Fuss said. “This is absolutely, from a valuation point, ridiculous.”

When a person like Fuss makes comments that strong, it’s usually worth digging a little deeper. In this post, I look at two characteristics of the high-yield market that have changed over the past few years without many investors realizing it.

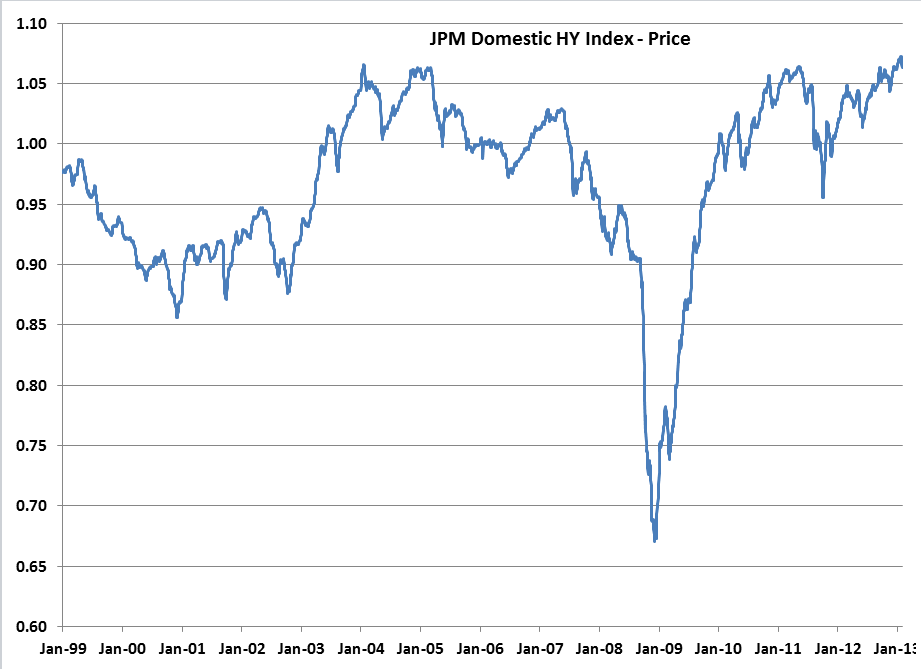

Price appreciation has largely run its course: As we see from the chart, high-yield bonds are starting to exhibit negative convexity, with prices exceeding 105 cents on the dollar.

In other words, future price appreciation is capped because of the callability of the bonds. As Loomis Sayles’s Matt Eagan, CFA, said in an interview last month, HY bonds don’t typically trade at higher than par plus half their coupon. Well, guess what? We are at that place today.

Looking back at the previous few years of performance in the HY market is dangerous and unrealistic for investors attempting to project potential future returns. This is not a financial writer giving you predictions but, rather, pointing out indisputable features of bond math.

Greater price risk now exists: The devil is always in the details, and price is an important risk that most corporate bond investors, in my opinion, are overlooking. Bond investors typically measure price sensitivity by duration — that is, the percentage price change for a given change in rates.

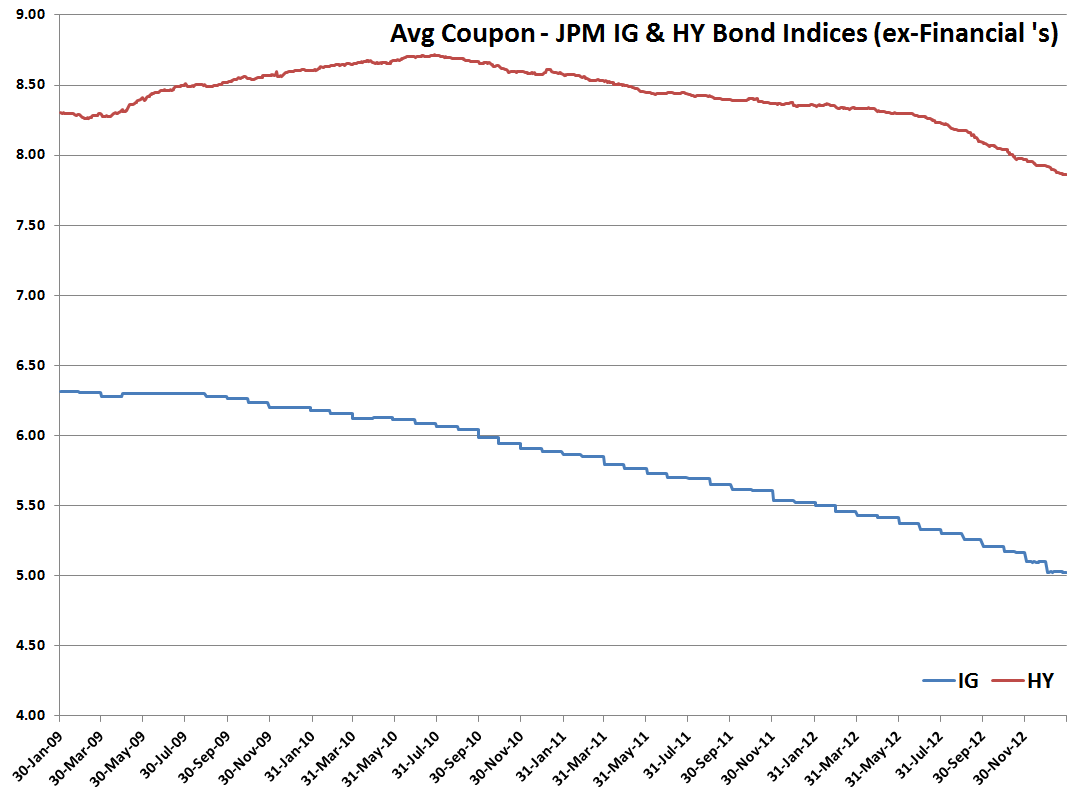

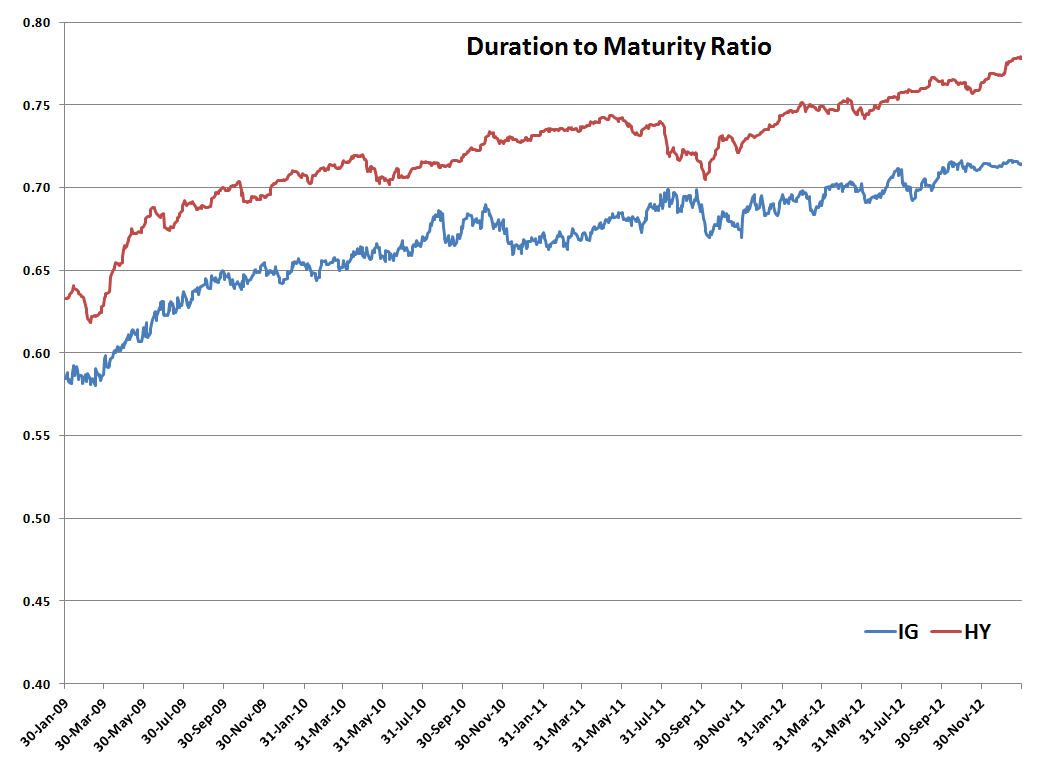

All else being equal, a bond with a higher coupon has a lower duration than a similar bond with a lower coupon. The reason for this relationship is straightforward: a bond with a higher coupon receives a greater cash flow in interim periods, whereas a bond with a lower coupon receives a greater percentage of cash flows at maturity. Why are these details important for investors? As interest rates and spreads have fallen, the coupons on investment-grade (IG) and HY bonds have also fallen. As shown in the following charts, the average coupon on IG and HY bonds fell from 6.31% and 8.30%, respectively, three years ago to 5.02% and 7.86% today. To the investor, this means greater duration (price sensitivity) per unit of maturity. Do investors realize that duration has drifted and they now hold bonds that have greater price sensitivity than they did a few years ago? The duration/maturity ratio (adjusted for calls), which is meant to show the amount of price volatility per year of maturity, shows a steady increase, reflecting greater inherent price sensitivity as time has gone on. Professional investors recognize this change, but market participants who are chasing yield and have adopted HY as their new favorite asset class may not realize what’s under the covers.

I am not calling for a top in HY or saying that it can’t have a place in an investor’s portfolio today, but the characteristics of these assets have changed. Investors who are not aware of these changes are likely to meet with a reality that differs greatly from their expectations.

(Editor’s note: Thanks for reading! You may enjoy hearing about how Equities may not deserve their bad rap)

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Source for charts: JP Morgan

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Photo credit: Istockphoto/sirBS

Does this “duration situation” exist in munis and BABs also?

Thx!

It’s pure yield chasing. The $$ has to go somewhere since the US Gov’t bond market is offering next to nothing.